Our church had a series about “taking significant steps toward financial freedom.” In their terms, financial freedom doesn’t mean FIRE (Financial Independence, Retire Early), which is usually what we’re referring to here. They mean that they want people to be free of financial burdens and not “bound up” by finances. Mr. ODA and I have been in control of our finances for a long time now, so this isn’t teaching us much about what to do differently. However, I’ve enjoyed learning their perspective and have several take aways to share.

Many have heard of Dave Ramsey when it comes to christian-based financial teachings. Dave tells you to pay off all your debt and pay cash for everything. We disagree with that approach. Debt is not bad when it’s used responsibly and you’re being a good steward with your finances, and that’s what our church’s lesson is too.

People seem to think it’s ‘cool’ to talk about how ‘broke’ you are. And yet, it’s taboo to mention if you’re in a good position with your money. What if we made it so that you’re taught that when you find someone in a better financial position than you, you ask questions and learn what decisions got them to that position?

The lesson is how to manage your mentality with money. It’s not about restricting your spending or making you feel guilty for buying your coffee, but it is about how you make informed decisions day-to-day that grow you towards a position where money isn’t controlling every aspect and decision of your life in a stressful manner. If you take control of your money, instead of your money controlling you, you’ll work towards eliminating that stress.

THE WHY

The workbook starts by asking you to determine your net worth. Money-in minus money-out is your cash flow, while assets minus liabilities are your net worth. The goal here is the gauge the current status of your money and where you should probably plan to be. There’s also an exercise where you determine your motivation. Are you motivated by freedom from financial burden, having a feeling of security, having power, or through love and giving? When you determine your “why” behind making money, you know what direction to go.

Making more money isn’t always the right answer. To make more money, you may need to take on a second job or more hours at your current job. Is putting that time in worth the extra money that you’ll bring in? Will putting those extra hours in make you more happy? If not, perhaps decreasing expenses is that way to go to make ends meet. If you don’t have the ability to take time for yourself or do things that bring you joy or have “down time,” then it’s not worth taking more time from your week.

I quit working in May 2019. Since then, I’ve done odd jobs just out of excitement, not financial need. I learned different industries and only had to commit part time. I was recently feeling the pull to find another part time job. There’s a consignment sale that comes into town twice per year, and they were hiring. They said they pay $8 per hour with at least a 4 hour per shift commitment. The consignment sale is being held 30 minutes from my house. That means that a 4 hour shift requires me being out of the house for 5 hours. The gas to get there and back would cost me about $7 per day. That means I’m out of the house for 5 hours (away from nursing my baby and being with my kids) for $25 before taxes. That cost/benefit ratio was not worth it to me.

THE PLAN

My favorite analogy given was to a plumber. A plumber doesn’t just start laying pipes in walls and hope it works out. He will have a plan of how to get water from the source to the faucet. Without that plan, how would you know that the water will get to where you want it to go? Same with money. If you don’t have a plan for your money, how will you know that it’s going to the right places with minimal effort? Without a plan, that’s where the stress comes in.

If you’re worried that you’ll be able to pay your electricity bill, then money is controlling your life. Sit down and make the plan. Allocate funding to the necessities first. It’s ok to eat at a restaurant or buy a coffee, but is putting your money towards those expenses creating financial freedom or causing more stress?

Mr. ODA and I have a money-spending mentality, rather than a budget. In my opinion, when you create a budget, you’re either looking to spend everything you’ve set aside in that ‘envelope,’ you’re willing to move money around without discipline, or you think of left over money in that ‘envelope’ as a bonus and you spend frivolously. If you put $500 for the month’s groceries in an envelope, but you only spend $450, what are you doing with that $50? I’ve seen it happen plenty of times that someone splurges. Instead, Mr. ODA and I weigh every single purchase. Literally every purchase, I swear. I told the story about my weighted tape dispenser.

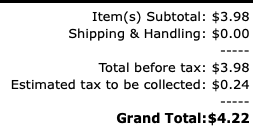

Every single year, I sit on the floor and wrap Christmas gifts. I don’t seem to notice during the year when I’m doing birthday gift wrapping (or perhaps I’m quick to grab a bag instead of wrapping paper for those instances), but at Christmas it’s apparent. I need a weighted tape dispenser. Having to find the tape on the floor in a mess, then having to use two hands to get a piece of tape off the little plastic dispenser, is just so much stress. It was YEARS of thinking “I need a weighted tape dispenser. Nah, I don’t need it for just this one week every year.” I finally bought one. It was $4.22. I agonized over this purchase because I didn’t feel it was truly a necessity and it turned out to be less than $5.

Grab your bank account statements and credit card statements. How much money did you spend? In what categories did you spend that money? Was it for necessities or was it spending that creates a strain on your ability to pay the necessities?

This is an exercise worth doing if you feel you’re drowning. I see posts daily in my mom groups that people say they make “good money,” but they can’t seem to pay the bills. I want to intervene. “Did you stop at the gas station on the way home from work to get a gatorade?” You could buy a 16 pack of gatorade, put it in your refrigerator, and have it waiting for you when you get home, which is probably about the same amount of time for not stopping at the gas station to make that inflated purchase.

So many people don’t seem to realize how fast those daily, small expenses add up. Ask yourself if there’s a better way to get such gratification, but in a way that furthers your dollar earned. Create the habit of weighing each purchase, determining if it brings you joy, and then either walking away or purchasing it. Know that if you purchase it, that will have ripple effects. So if you’re worried about paying that electric bill, then that instant joy gratification wasn’t a step towards financial freedom, where money isn’t controlling you.