I was chatting with a financially savvy friend of mine, and she asked about filing our Limited Liability Corporation (LLC). I had no idea what she was talking about. Mr. ODA had no idea what she was talking about. I sent a text to 3 of my investor Realtor buddies (in two different states), and none of them heard about it. So I started digging.

Sure enough, if you have an LLC, you’re required to file with FinCen this year.

So here’s my attempt to let a few more people know of this legal requirement that carries fines, yet no one decided an email or mailing to LLC owners (which are filed with the State governments and are required to have physical mailing addresses) would be worth their time and cost of a stamp.

THE CORPORATE TRANSPARENCY ACT

On October 23, 2019, Congress passed this Act. The purpose being “to ensure that persons who form corporations or limited liability companies in the United States disclose the beneficial owners of those corporations or limited liability companies.” Essentially, they’re trying to ‘crack down’ on companies using LLCs as a shell game to move or hide money, or pay into criminal behavior.

It states, “Criminals have exploited State formation procedures to conceal their identities when forming corporations or limited liability companies in the United States.” In 2006, an international body determined that the United States fails to comply with beneficial owner information reporting, and gave a July 2008 deadline to fix it. The United States Federal level had urged State laws to comply, but didn’t follow up, and was cited again for failure in 2016. Since the States didn’t make progress, Congress issued this ruling.

The Act states that nearly 2 million LLCs are formed each year, with few States requiring beneficial owner information. A beneficial owner is generally someone who exercises control over the company, owns 25% or more, or receives substantial economic benefits; there are exceptions listed in the law.

While this was passed in late 2019, they then needed to establish a way to securely collect and retain the information reported. FinCEN established a Beneficial Ownership Information (BOI) website, in which you’re required to enter the pertinent information. It opened January 1, 2024.

Because this is the age where there are scams around every corner, note that this is a ‘.gov’ website, and their logo is below (i.e., don’t enter your personal information into a third party website).

REPORTING COMPANY

A reporting company is those that qualify based on the law’s detail. There are either domestic (registered here, doing business here) or foreign (registered in another country, doing business in the United States) reporting companies.

There are 23 ways a company may be exempt from reporting. The general gist of the exemptions are based on whether you’re already reporting to the government in another form (e.g., banks and accounting firms). “These entities include publicly traded companies meeting specified requirements, many nonprofits, and certain large operating companies.” Don’t assume you’re exempt; be sure to check the list on the official website.

BOI REPORTING

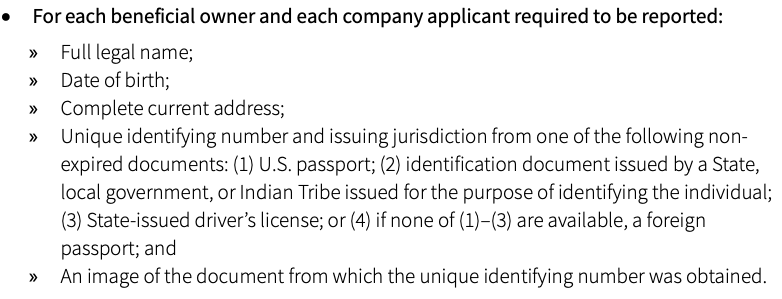

The reporting is straightforward. You will need a legal identification card image uploaded for each person entered in the system.

From the main page, I selected the icon that said prepare a BOI Report. I chose to prepare and submit, so it’s a form within the website. There’s another option that appears to allow you to fill it out in PDF form and submit the form. I preferred the prompts along the way.

Below is a snapshot of the information that’s needed in the initial filing.

When we set up our LLC, our drivers licenses were copied, so this request isn’t for anything more than we’ve already provided to our State. For us, establishing an LLC was solely a way for Mr. ODA and I to create an ownership stake in two properties that we purchased with a partner. Though there are 3 of us listed in the LLC, Mr. ODA and I are 50% partners together, and this other guy is a 50% partner. I pay him out at 50% each month after I collect rent.

It’s very simple; I’m sure there are LLCs with employees and more paperwork. However, I didn’t need a social security number for the beneficial owner(s) or any dollar amounts paid. We did establish a EIN for the LLC several years ago, so I submitted that EIN for the reporting company. Otherwise, I would have submitted my social security number as the company’s identifier.

There are more details associated with the reporting; for instance, you can update your report through their website. However, I’ll leave it to you to dig deeper on all those instances, as I’m just trying to build awareness.

DEADLINES

As with all new systems, there’s a phased approach to the requirements.

If you were already registered before this year, then you have until January 1, 2025 to file the initial BOI report. If you create an LLC during 2024, then you have 90 calendar days from the registration effective date to report. For all LLCs created on or after January 1, 2025, you have only 30 calendar days to report.