There was a time where we liked the idea of purchasing a new car, but we’ve since come around to buying a 2-3 year old car. We don’t eat that initial drop in value by driving it off the lot, and we can find a car that has mostly what we want for the right value. The point I want to make in this post is how we paid for the car and why, but the entire history of the purchase and thought process is detailed beyond that section, if you’re interested.

FINANCIAL DECISION

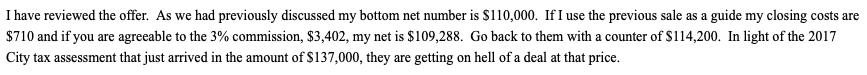

Once we decided on the van, we needed to figure out the price (more details are below). They offered $1,000 off the price if you financed, so we agreed to that. With our trade in value, taxes and fees adjusted, and the negotiation of work to be done, the net came to $9,000. The minimum to finance was $7,500. So instead of throwing the full $9,000 into the loan, we asked to put $1,500 on the credit card and finance the $7,500. By putting the $1,500 on the credit card, we made $30 in rewards.

The financing was 6.99% and we chose the option that allowed pay off after 4 payments. There was an origination fee of $175, which is rolled into the principle. Our payment is $151.94. The first 4 payments hold $175.07 worth of interest. So we will pay $175.07 of interest and the $175 origination fee as a means of taking $1,000 off the list price. That nets us, including the $30 of credit card rewards, $679.96 less on the list price. After the 4th payment is made in May, we’ll make a lump sum payment of about $7,134 to pay off the loan.

MINIVAN HISTORY

In 2020, we purchased a 2017 Chrysler Pacifica. It met so many of my wishlist items, and a dear friend of mine put a lot of effort into finding just what we wanted. Well, there were some things wrong with the sliding door, the steering wheel would get sticky at “10” and “2,” and there were a couple of small defects with the stow and go seating. The sticky steering wheel was a known issue, but we didn’t want to pay to fix it because they wouldn’t create a recall (for the record, it was pretty sticky… where I’d have to jerk the wheel to get it to move again).

In February 2023, with a 2 month old child in tow, we went to Ohio to look at another van. It was a red 2020 Pacifica. I didn’t love the red, but it came with an 8th seat and had a bunch of upgrades (heated seat) we didn’t have in the 2017 version. I have a clear memory of the car doing a little skip as we got on the highway multiple years ago, and ever since then, we’ve been watching some things with the engine. The car never had the ‘check engine’ light come on, but something wasn’t working smoothly in there. Mr. ODA mentioned a desire to get a new van, so we went looking.

He found several options nearby and we went out for test drives. Actually, we planned to do a lot of test drives, but it was a Sunday. Apparently car dealerships are closed on Sundays, and I had no idea.

First we tried driving other makes and models, but it’s hard to beat the value of the Pacifica. The other vans seem to be trying really hard to be fancy to compensate the stigma of being a minivan, but I’m not here for that. A van is extremely spacious and practical. I’m in a completely functional phase of life with 3 little kids and a dog.

PACIFICA TEST DRIVE #1

The first thing to note is that we went to two places and both places had the salesman drive with us in the van. I really thought covid killed that for us!

We went to the first one right in town. It was a silver van, and I don’t love that color. I thought I could live with that red van, but for 3 years it drove me crazy. When we got to it, it wasn’t so bad. It’s a really light silver. There were some broken things, and right off the bat, the salesman was gaslighting me that it wasn’t broken. Over the drive, I came to learn that he was proudly divorced with no kids. What a great job that the dealership assigned our online inquiry to this guy! He was super condescending about vans and kept cracking jokes about his awesome sports car and how we need one (or that we need a second Tesla). Mr. ODA shared a philosophy on debt, and he assumed he understood our position and wouldn’t let the wise-cracks go. Then to top it off, he handed our 3 year old a noise-making key chain. It took them 20 minutes to get us a quote on the van and our trade in, and I was on the verge of just walking out. The only thing keeping me there was knowing that our next stop was likely going to be a solid van, and I wanted this data point on what they were offering.

They have a required $1500-1800 certified pre-owned fee that’s on the car, and they weren’t willing to remove it. Their value for my car was low, and when I asked why the ‘good’ rating, he gave me some answer on what perfect meant and how no one is perfect. I tried to say, “so there’s nothing between good and perfect?” but people were too busy interrupting me, and I just shut down at that point. For the record, very good is in there, and my van was kept in great shape (outside of a possible transmission concern). They also tried to sell extras all over the quote, and our net was over what I wanted to pay. We got there at 10:40, and I was trying my hardest to run out of there by 11:45. Nothing about that experience should have had us there for over an hour.

PACIFICA TEST DRIVE #2

This vehicle was just under an hour from home. Ironically, this small town dealership was way nicer and the people were easier to deal with. A weird tidbit of us, but we prefer cloth seats over leather seats. The Tesla doesn’t even have a cloth option, so we have been living with the leather for over a year and it’s not so bad. I still would have preferred cloth seats, but there weren’t any on the market this week. After living without heated seats on that first van, that’s been a deal breaker for me. We also couldn’t find any vans with the 8th seat option. The 8th seat doesn’t make a difference to us as a family, but we did use it for guests visiting us fairly often. The possible transmission issue trumped our ability to serve others though.

Mr. ODA didn’t care to drive the first couple we drove, but he must have liked this one because he asked to be the one to drive it back to the dealership. That put me in the passenger seat, where I noted the visor’s clasp was missing. The visors were also swapped with each other (how does someone go about doing that with all the electric in there for the mirrors), and there was a clasp missing for the rear window shades. The outside has a dent on the side and couple of paint chips, so we asked for a paint pen also.

It was listed on their own website for higher than edmunds, but he pointed out that if we finance the vehicle, the final price was lower than edmunds by a little. They were offering $1000 off the list price for financing. We learned that concept on the drive out there. I thought saying, “I’ll hand you cash today” was better all this time. They take the financing because they make money off it. We learned they use a few banks, and one allows it to be paid off after 4 payments and the others require 6 payments before it can be paid off.

The salesman went to the ‘tower’ and got a quote. He didn’t show us. Instead, he pointed out what he purchased the car for, what they listed it at, and that they were already at a $651 loss. Um, I call BS. There’s no way your group made that type of business decision. He went back for the quote. He didn’t push the ‘loss’ concept, but he did keep mentioning it once in a while. I hope he noted we were seeing through the crap there. He was claiming they wouldn’t fix the things wrong because they’re already taking a loss. I said that was fine and we’d leave because I wasn’t about to put the time and effort into replacing a completely broken visor on a new-to-me vehicle. He went to get maintenance to look at the car and provide a quote. To their detriment, the tech put the quote on the salesman’s desk with just us in the room so we saw that the 3 things we asked for would cost under $100. Honestly, I’m wondering why they wouldn’t just go ahead and repair the visor. That’s a glaring thing that a drive would see daily, so why not just fix it so it doesn’t become a negotiation point of me, the potential buyer?

He came back with a net cost to us around $9,500. He said they’d take $200 off to fix those things. Mr. ODA said, “make the net $9,000, and we’ll take it.” And so, that happened. We walked in the dealership at 12:38 and had an agreed upon price at 2:30. We didn’t leave until 5:04. I was livid. The salesman said he could have us out of there in 45 minutes, which was a point to us taking the car off the lot that day because they’d have enough time to detail it. The car was detailed and I asked to look at it. It was not cleaned. All they did was vacuum and wipe down the leather seats. The cup holders and down the side of the walls were dirty and sticky, so I sent it back for more cleaning.

At about 4:30, I made a scene that I would have paid the $1000 to get out of there without waiting on financing for over 2 hours. At 4:40, we were taken into the financing office where he flew threw signatures and paperwork, apologized that there were 4 closings at the same time, and we were handed our key at 4:52. Since we hadn’t planned on actually finalizing a deal, we then had to throw all our stuff from our van into the new van while it was about 30 degrees and 25 mph winds (we had arrived in the sun and 50s!).

SUMMARY

We’ve learned over the years that our needs in vehicles change. Adding kids changed how things move. We drive to NY multiple times a year, plus all the driving we do for trips we take. We put one seat down so there’s room for the dog’s dog bed for trips. All 3 kids are in some sort of car seat or high back booster still. The youngest is annoyingly not independent on his car seat buckling and unbuckling (the other two were absolutely independent by this age). So for now, a van is still our need. By not investing in a brand new car, we don’t feel the need to keep it forever to protect an investment. This allows us the flexibility to switch what we have if we decide we don’t need something anymore (the dog is 13, there will be less car seat needs in a few years). Our trade-in net has been about the same each time, so I’m happy to pay about $3000 per year to own the car (in concept) without paying interest or a dealer for a lease agreement (along with the stress of issues when it’s a lease).