Another month, and another delayed post while I juggle life. These numbers are mostly based on last Wednesday’s market close. I had big intentions of writing this on Thursday last week.

RENTALS

Our rental that we purchased a month ago is still vacant. It’s a commercial loan, so the first payment was just made on it yesterday. It always hurts to pay those bills without income. I’ve spent some time cleaning it. It looked fine if you just did a quick glance. But the details were terrible. I wiped down all the walls in the house and all the outlets and switch plates, which were extremely necessary. I wiped the baseboards with their first clean using the mop, but I’ll need to go back and do a wipe with something that gets directly on it. We were excited that the house didn’t need painted, but the closets are a bit of a mess. If I decide to make the time, I’ll throw some fresh paint on some parts. The bathrooms were pretty bad, and they’re about 70% done being cleaned. Maintenance wise, we just needed to replace a missing cabinet door pull, clean out the air return vent, and do a few random small fixes with caulk and screws. I’ve shown in several times. I even had a lease drawn up for one person, but it fell through.

We’ve had issues with our two new tenants getting their utilities in their name. We had one in Virginia who claimed she tried to get the water bill in her name and it just wasn’t happening. She always paid the day I sent the bill to her, so I just let it go. This past month was terrible. It took her over a month to get it paid, and I threatened to turn it off so that it would force her to get it in her name and keep me (and my property manager) out of it. One in Lexington was annoying that she didn’t get it done, and she’s not very communicative. Then the other in Winchester had to go in person to get the water in her name, so that wasn’t surprising that it took a while.

PERSONAL

Our 3rd kid got off the waitlist for preschool! Our beloved preschool closed down last year. Everyone flocked to this other preschool. I followed the “rules” and did things “ethically,” but we got waitlisted. Long story. I wasn’t pushing for him to be in preschool in the 2s year (he’ll be 3 next week, but our age cut off here is August 1st). I figured I’d push really hard in the next couple of months to make sure he got a spot for next year. This place I want him to go to has a lot more spots for 3 year olds than 2 year olds, so I had high expectations we’d get a spot next year. Well, we got the email a couple of weeks ago that there was room available for him! It’s a longer day than we’re used to, but he’s so excited to go to school. He asks to go to the playground daily, so that’s going to be nice that he’ll have TWO playground times twice a week. I can’t wait to hear all his stories.

My work schedule has me in the office for half a day on Monday, Tuesday, and Thursday. We’re going to look into adjusting that in January to account for the days he’s in school so that I can actually enjoy some kid free (guilt free…no strict schedules and babysitter availability) time since 2018.

We paid off the 0% interest card that was sitting at $14,000. It didn’t bother me to have that balance sitting there because it was for a good reason, but it sure does feel good to have that off our plate. Our spending has been relatively low the last few months. This month will see a small spike because I have’t preemptively bought any Christmas gifts, so that will likely be a large purchase amount later this week. We’re also in the market for camping gear since we took the kids camping this past weekend and noted a few gaps in our equipment.

SUMMARY

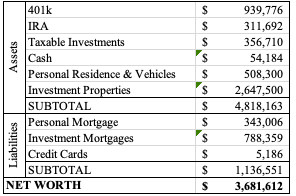

We’re up $1.5 million from 2 years ago, which is a cool number to see. Considering we paid off large credit card balances, I’m surprised our net worth only went up about $5k since last month. I updated the value of the houses in the past few weeks, so that’s where the hit is. Home values are expected to go down in the Fall, so I like to capture that adjustment from the higher values that appear in the Spring. Our cash value obviously went down since it went towards credit card payments and a down payment on a house (except it only decreased by $11k).