I feel like I have a lot of balls in the air right now, but looking at our finances, they don’t say that there have been a lot of charges. However, this post sure says that I’ve been juggling a good amount of things over this last month, and most of the issues are related to insurance in some way (and I despise insurance!).

Last month, I mentioned that we had two large charges hit our credit card. One that I purposely held off until the new credit card cycle (an insurance charge) so that the previous month’s credit card was lower than average (psychological play for myself). Then we had the electrical work completed on our deck rebuild, and that was another significant balance that needed to be paid. After that, we just had a a few medium-sized, if you will, charges that hit. I paid an extra payment to keep the balance closer to the $3000-3500 range. Well, it didn’t work. Another two service calls to rental properties and the dog’s annual vet appointment, and we were back up to $6k. We have the cash to pay it off every month; it’s just not something I want to see!

When we have a large purchase, we open a new credit card. The new credit card gives us some sort of bonus, and we get 0% interest for 12-15 months, typically. Last Fall, we replaced the carpet on the first and second floor of the house for over $10k. I paid $500 per month up until last month’s payment. The balance wasn’t a round number, so I went ahead and paid that little bit while also upping the payment to $1000. That balance is at $7,000 now and will need to be paid by December 13th. The new credit card will be used to purchase a hot tub and pay for the electric work associated with that (as well as an electrical panel upgrade).

INSURANCE CLAIM

Since our deck work is now complete, we submitted a request for additional funds. The concrete replacement was controversial in the claims process. They eventually agreed to pay for it, but they held back a significant amount of depreciation on it. We submitted the final work order showing the concrete costs and that the job was complete, and they sent us a check for about $6,550. Additionally, the electrical work was projected to cost about $1,700, but it actually was about $3,500. Luckily, we submitted the invoice and, with no questions asked, they cut us a check for the difference.

Just for the record, the job was never fully completed. Mr. ODA pulled up deck boards and retrofitted the waterproofing. We never paid out the final payment. The City’s inspector came out and started asking a bunch of questions, and the foreman finally acknowledged that they hadn’t completed the waterproofing. We didn’t tell them we fixed it, but we have no intention of being in touch with them again. Outside of the waterproofing and concrete subcontractor issues, the contractor was great at the work he does – but they should stick to simple deck construction.

PERSONAL CHARGES

We actually had a low number of transactions over this past month. We took a trip, which I covered in my last post. Mr. ODA negotiated a refund of some of the cabin charge since we booked it with a hot tub and discovered at 8 pm that there was no water in the hot tub. They refunded 10%! We had our typical charges that occur monthly, and I paid several health insurance bills for various reasons.

RENTALS

Luckily, everyone has paid their rent this month. We have $750 outstanding, but it’s not technically due until the 19th with how I’ve structured their lease. One person did pay half her rent late (on the 15th), but I didn’t charge a late fee since she actually paid when she said she would this month (always a gamble). We had a few smaller maintenance issues come up in the last month, as well as a range replacement at a property that will be installed this Saturday.

- INSURANCE

Due to a claim on one of our properties, that insurance found a reason to drop us. They notified us that we have a couple of months to find new insurance. I’ve been working on that for the last 3 weeks. It hasn’t been easy. They want pictures and then want all different angles, as if it’s my home and I can just take these pictures on a whim. Then for some reason, the agent I found through a local real estate group is great about answering questions on one property, but won’t answer questions on the other. It’s pretty frustrating. As of 10 minutes ago, I at least got the policy executed on the one he hadn’t been responding on. I started this process on September 23rd and got this run-of-the-mill policy executed today – ugh. So that’s over $900 going on the credit card today.

We have a roof replacement occurring on a property in VA tomorrow. I found out that our partner switched insurance companies without us knowing. That seems fine, except that I discovered our policy went from $600 to $1400. It turns out, he switched because that original insurance company was requiring a roof replacement. Conceptually, that’s annoying because they find some action for us every year with no warning or previous mention of something being on a watch list. However, it turns out that the roof was bad enough that no one would insure us. Again, I’m finding all this out after the fact. Our agent found someone to cover us for short term, and we’re paying a hefty premium on that. As soon as I found out, I requested quotes from roofers. I signed a contract 3 weeks ago, and that’s finally under way with materials dropped off this morning. As soon as the roof is done, I plan on sending documentation to our agent to get us switched to a “regular” insurance company and hopefully reduce that premium substantially.

We had issues with our Commercial Liability Umbrella Policy issuance this year. It was all due to the company’s poor communication. They asked for a new document to be completed, which I did in less than a day. Then I heard nothing from them until a cancellation notice for not providing supporting documentation. I had to scramble to gather all the documents, only for them to not even review my information timely and cancel the policy. They reissued with no lapse in coverage, but goodness that’s so frustrating that they can do whatever they want with no repercussions. In that process, we learned that one of our houses isn’t included in the CLUP because that insurance company’s rating fell below a reasonable threshold. So now I’m shopping for insurance for that house.

I had to pay one property’s insurance of $270 (it’s a townhouse with HOA insurance also). I also had to contact one of my escrow accounts to find out why they didn’t pay on time, which is so much fun (and I still don’t have that resolved).

- TAXES

It’s that time of year again where I have to pay out on KY taxes. Relatively, they’re low amounts, but they add up to a decent amount when you have 4 to pay at once. I’ve issued payment on these, but they haven’t cashed the checks yet (it would be nice if businesses would allow electronic payments without exorbitant fees!).

NET WORTH

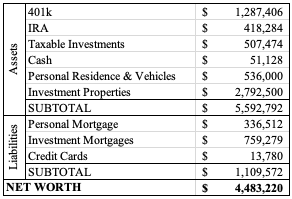

We’re over $800k over this time last year. It’s crazy to see that number because I don’t feel comfortable with our finances. I can’t put my finger on it, but I just don’t like how often I need to transfer money out of a savings account to cover obligations in the checking account. It’s just a psychological thing for me. I can’t figure out why I can’t get past it, when I know for sure that we have 18 safety nets out there if we were in a bind.

Last year’s update mentioned that our finances took a big hit between September and October, but this year, we’ve recovered a good bit and increased over $115k from last month. It appears last year I paid off a large credit card balance this month, whereas the large credit card balance pay-off will be December this year. I’ll also have additional charges when the hot tub gets delivered in a few weeks, which will increase our debt.