*This post was started in November 2022, but our son was born 3 weeks early (and on Thanksgiving), so it fell off my radar for a long time while I caught back up. Let’s dive in now.

We sold our primary home at the beginning of November to move a half hour away and closer to family. It was a new construction home, and we purposely sold when we did to avoid capital gains taxes. If you call it your primary residence for 2 of the last 5 years, you’re exempt from capital gains. Considering the market over the last two years (2020-2022), we were slated to owe a hefty penny if we sold before that 2 year mark.

Had we sold earlier or perhaps waited for the spring, we could have made more. Instead, we opted to be rid of the home, not try to rent, and be able to have that behind us. We were extremely fortunate that we were under contract by the end of the first weekend we listed. The market had cooled significantly from the multi-bid, exorbitant pricing, with appraisal waiving language days.

We only had 2 showings. The first politely let us know they wanted a walk-out basement. We had an amazing basement with 9′ ceilings and no soffits, but it didn’t have a door due to the floodplain. We don’t really understand why, but the backyard was definitely low enough for it to have been a walk out basement. It was one of the red flags that made me uncomfortable living there, along with a long delay for construction on our lot and a few around us due to extensive sink hole surveying. The second showing made us an offer 10k below asking. We sort of split the difference at $495k, and they accepted.

There were several houses listed in that neighborhood for weeks after we closed, that were listed the same weekend as us, so I am eternally grateful that the stars aligned for what we wanted/needed.

PROCEEDS CALCULATION

We purchased the home for $346,793 in November 2020. The contracted purchase price when we sold was $495,000, which was completed in November 2022. That’s a difference of $148,207, but that’s not “take away” money.

As the seller, you’re typically responsible for paying out the Realtor commissions. They’re typically 6%. We asked our Realtor if she would drop it to 5% (buyers agent gets 3%, sellers agent gets 2%) since we had drawn up our purchase contract sight unseen and this was the 4th commission based transaction she had from us in less than 2 years. She agreed. I truly don’t like asking someone to take a lower commission, but due to there being several transactions in a short period of time, many not even needing much effort (showings, phone calls, etc.), I accepted Mr. ODA’s plea to ask. That comes to $24,750 paid in Realtor commissions.

We then have to pay off any loans that used that property as collateral. We had a mortgage and a Home Equity Line of Credit (HELOC). We had put 20% down on the purchase, so the mortgage had about $266k left as the balance. The HELOC had been used for a couple of other things than just the down payment on a new home, and it didn’t require principal payments on it while we had it, so that balance was about $86k.

We walked away from the closing table with about $117,000 after tax offsets and such.

PAST DETERMINATIONS FOR WHAT TO DO WITH THE PROCEEDS

In July 2012, we purchased our first home for $380,000. We put 20% down; it was a foreclosure, but the only work we had to do was on the main floor bathroom. When we sold that home Fairfax, VA for $442,500 in October 2015, we paid off a car loan and bought our second two rental properties in Richmond, VA. The car loan was only at 0.9% interest, so it didn’t meet Mr. ODA’s requirements to pay down loans with higher interest rates, but it did alleviate one monthly payment I had to manage. The irony of that statement, now that I manage 14 houses worth of payments all year. We also used those proceeds to put 20% down on the purchase of a new primary home outside of Richmond, which had a purchase price of $359,743. We paid off House1’s mortgage because the loan had a balloon payment that we needed to be ahead of.

When we sold that Richmond home for $399,000 in September 2020, we took about $109k away. We used those proceeds to put 20% down on the purchase of our new home, at $346,793, outside of Lexington, KY. We paid off House4, House6, and House13. Since paying towards a mortgage and not paying it off doesn’t change your monthly cash flow, we focused on where we could eliminate a mortgage payment. We’ve since paid off House11 and House12. House12 had a high interest rate, so we were interested in eliminating that as fast as possible, even though we were paying for it with a partner.

WHERE DID THE MONEY GO THIS TIME

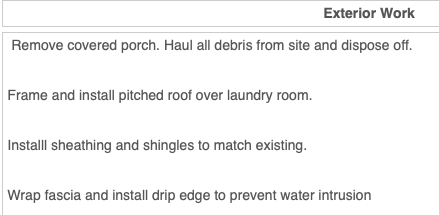

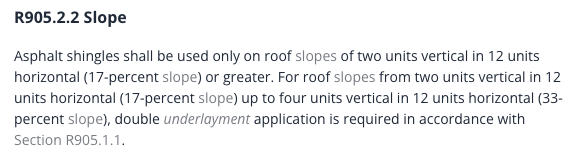

We purchased our current primary home last summer and put work into it. Since we purchased it before selling our house, we used a HELOC to pay for the down payment. That meant that when we walked away from the closing table, the money we were putting in our bank account had no distinct purpose (like in the previous cases where we had to use some of the sale proceeds to buy another primary house).

The first thing we did was open a high yield savings account. At the time, it was necessary because our savings account wasn’t paying market rate. I remember Mr. ODA complaining that interest rates on loans were increasing, but it wasn’t being shown on savings interest side. He found a high yield savings account that gave a sign on bonus (we like that ‘free’ money!). We put $50,000 into that account, earning over 4% interest. The money in that account was removed and put into our regular savings account, which is now earning over 4%.

Since the money didn’t have a purpose, we needed to get it into the market. If we put it all in the market at once, then we’re subject to a lot more fluctuation. To hedge our volatility, we planned to schedule regular investments. It seemed crazy to me, but our financial advisor and Mr. ODA decided on $5,000 per week. That would take 20 weeks to accomplish. To my chagrin, this was set up as an auto transfer. Even with a large balance sitting in the account, it didn’t hurt any less watching $5,000 every week be taken out. This plan didn’t last long though because Mr. ODA found Treasury accounts that act as short term certificates of deposit. My next post will go into this in more detail.

Not an immediate need, and we didn’t rush to buy something for the sake of buying it, but we earmarked about $20k for the purchase of a new van. I love the van we bought in 2019 (which was a used 2017), but it had a few kinks in it. I also felt pretty good about the deal I got on it. However, I didn’t put the time into test driving and looking at this van that I really should have because one of us had to stay in the show room with the kids while the other went for a drive. I also know what I’m looking for in a used car now (that was our first used car experience), versus buying a brand new car that hadn’t been driven by others. It helped that I was looking to buy the same exact van, just newer, so I know how it’s supposed to work and what to test. We ended up finding a van about 2 hours away from us in early 2023. We’re almost a year into this van, and I absolutely love it.

In the back of our minds, we’re still looking for another rental property. There’s an area in town near us that would work for short term rentals, which I’d like to dabble in. We have seriously considered a few, but interest rates have shot it down. A 1500 square foot house, with a $200,000 mortgage, comes to a monthly payment (of just principal and interest) of about $1,400. That’s just not good margins with such high interest on it. We’ll keep an open mind, but so far it isn’t panning out.

SUMMARY

Our savings account is currently earning 4.22%. Mr. ODA is also managing that balance by using the short-term Treasury bills. Since we started with the Treasury bills, we’ve made about $500, which is on top of the interest we’ve earned to date on the savings account, which is over $1600.

We started off with paying the mortgage that had a balloon payment. It was a commercial type loan, so it was amortized over 30 years, but was really only a 5 year loan. We decided to pay it off instead of re-mortgaging it at the end of the 5 years. After we took care of the balloon payment approaching, we started paying off mortgages where we could eliminate a payment (we had multiple houses with $30-60k worth of a balance), and then moved onto paying off high interest rate mortgages (for reference, a high interest rate was 5% … which is much different than today’s mortgage rates being “good” at 7.5%). We went through the process to refinance several mortgages, so we’re at a point where we’re happy with the mortgages that are left. If we wanted 100% cash flow, we’d start paying towards principal balances. However, we don’t feel that’s necessary for our current situation. We have 6 mortgages left (including our personal residence) out of 14 houses.

We definitely are more hands on with our money management than most people are going to be interested in. Now that we’re happy with our mortgage situation, we are focused on the interest side of our money working for us. With multiple Treasury bills that are reinvested for short periods of time (4 week and 8 week bills), then we’re able to earn quick interest while we don’t have a purpose for that money.

One of our houses has a balloon payment again (commercial loan). That will come due in about 3.5 years. Considering what current interest rates are, it doesn’t appear that refinancing is as enticing as just paying off the balance or selling the house. We’ll have to keep that in mind as we work on investments and having enough liquid cash over the coming years, because that loan’s balance is going to be about $173k at the end of the 5 year term.

For now, we’re in a good money management state with several short term bills and a savings account rate over 4%.