As an intro for newbies: I write a monthly finance post. These posts started out as a way to manage our dollars spent per category. It evolved to show insight into my monthly money management and thought process. It’s also meant as a way to remind people that they should be looking at their money regularly.

Every month, I’m looking back at my spending, looking at trends on the higher level (e.g., why is my credit card higher than I expected), and sharing the rental property expenses and activities that I’ve accomplished.

I typically post on Thursdays. Unfortunately, life got in the way. I had 98% of this written, but I hadn’t updated our accounts until 10 pm, so this is now posting off-schedule, on Friday morning. Sorry about that!

RENTALS

I suppose with 13 houses, it’s inevitable that I’ll have to keep track of one.. or a few.. to collect their rent. One tenant is set up to pay twice per month (they pay a premium for this). They paid both parts of December late, and the first part of January late. They pay a late fee with that. I had two other tenants pay late by a few days, but they communicated this up front, and I didn’t collect late fees.

I’ve been sharing that I have a tenant who has been behind on rent since October 1 and has communicated very poorly. By the end of December, she was caught up with rent due, but no late fees. We’re now 11 days into January without any payment. My frustration with her was that she didn’t communicate at all for the first two months, and didn’t keep her word on anything that she said she was going to do, but didn’t tell us that something would change. I always say that I’m willing to help and work with you, but you have to talk to me. If I have to beg you to tell me what the plan is, I can’t help.

I paid a carpet cleaner $250 and paid a painter $2000 for a house that we’re turning over. The carpet was new before the last tenant, but they were there for over 3 years, so it had to be done. They didn’t damage the walls, but my property manager said that all the walls looked like different colors, and I didn’t trust “touching up” 4 year old paint. The paint looks amazing, so I’m happy I went for the whole house.

I paid just over $1000 as a deposit on 3 new windows for a house, which are scheduled to be replaced on Monday (a couple of weeks for new windows far exceeded my expectations!). We had replaced the majority of windows when we bought the house. However, at the time, the kitchen and bathroom windows were considered an irregular size, and we were told they were going to be $2000 just themselves, when we were paying $2000 for all the other windows. I don’t know what pricing scheme changed in 5 years, but now all sizes are the same price, and the 3 of them are $2000 now.

We had a tenant ask to be released from his lease, which we concurred to. We had terms associated with that, which I’ll share in a separate post. We were able to get a couple into that house with no loss of rent, which has been appreciated.

We’re under contract with our handyman to do work on a house, so that’s over $5,000 of cost that is waiting to rear its head out there.

PERSONAL

This was a month of spending in activities. I signed up for a 5k in August with “early bird” pricing, our daughter’s acro class had semester tuition due, and the kids’ monthly school tuition was paid as usual. Mr. ODA bought a new battery for his car and installed that. On somewhat of a whim, we replaced our back door, which was over $1100 added to Mr. ODA’s credit card.

Just before Christmas, we took a trip. It was just to Cincinnati, which we regularly do as a day-trip. However, we wanted to accomplish a few things this time around. We went to Top Golf for 90 minutes and lunch, let the baby nap at the AirBnB, went to Zoo Lights, spent the night, and then went skiing the next morning (the kids’ first time!). We already purchased season passes (and equipment) for skiing for 4 of us, and had already purchased the zoo annual membership. Without the cost of those two things, our trip cost $330 for Top Golf, lodging, parking (we stayed in the city), a ski lesson for our 5 year old, and food. Our lodging for 1 night was nearly $200 and was significantly more than we’d typically spend on lodging. However, we’re still in a phase of life where the baby needs the be in a space by himself so he sleeps for a nap and through the night. That means we look for a place with at least 2 bedrooms and 2 bathrooms, or 3 bedrooms and 1 bathroom (bonus points for master-sized closets or an extra bathroom with no windows for me to black out). We then made 2 day trips since then, and the kids are doing awesome on skis.

NET WORTH

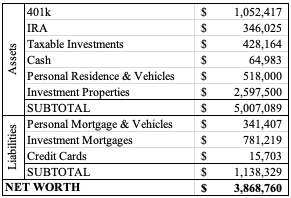

Our cash has decreased, but that was offset to taxable investments because of our Treasury Direct accounts. Even with our extra spending, our credit card balances are comparable to last month’s. The increase in net worth from last month is mostly due to increases in our investment accounts.

This year’s goal is to hit $4 million net worth. Mr. ODA said that to our financial advisor via Instagram, and he didn’t share that publicly because it wasn’t relatable. The point in sharing here is that, well it’s January and people set goals, and to note that even if this goal specifically isn’t attainable to you in the short term, know that we also once had an account balance well below where we’re currently at. Consistent investing in the market (maxing out the 401k, maxing out the Roth IRAs, and establishing regular investing and watching the market) is a large contributing factor to where we are 10 years later. If I take the investment properties out of the equation, we’re still over $2 million net worth. That doesn’t happen overnight, and it’s something you can start working towards today.