I had an “ah-ha” moment the other day about this word. There’s a difference between being able to afford something and wanting to afford it. So many times, we focus heavily on what people see on the outside. I hear it at work lately – I work with agents, and there are comments made about how people spend their money. Now, I agree with the “I just handed you a check for $20,000, what do you mean you have no money?” However, there’s a flip side. Just because someone pulls up in a Tesla doesn’t mean they want to throw money around.

TRADE OFFS

Mr. ODA and I have money. We can go out to dinner, go on a vacation and stay in a fancy hotel, pay for flights across the country for all 5 of us, buy another house, splurge on a vacation house and a boat. If we wanted to. We don’t.

Instead, we want to look into the future. We decided that the ability to spend time as a family, being there for the kids’ activities, and going on different kinds of trips throughout the year to give the kids experiences is more valuable.

I talk about this concept often in this blog. Every dollar spent has an opportunity cost. Every dollar spent should cause the question, “is this the best use of this dollar?” We joke about how we hesitate to buy a $30 pair of shorts, which you wear for years, yet we’ll spend $30 to eat one meal. Of course, we do have those instances where we go out to eat, but they’re not a constant staple of our household. We know that the instant gratification of that one meal isn’t going to get us to our long term goals. It’s the same concept with the $5/day coffee purchase. It’s not about the literal $5 that’s going to get you on your way to financial freedom; it’s the mentality that comes with making better financial decisions.

HOUSE POOR

When we were shopping for our first house in 2012, the bank pre-approved us for $750,000. We set our limit at $350,000. Why? Because we felt we could scrape together 20% down payment and closing costs for a $350,000 home. If we were under a $750,000 mortgage, we’d have to pay a higher monthly payment and private mortgage insurance (PMI) as a penalty for not having 20% down. At $350,000, our mortgage payment was about $2,000. At $750,000, the mortgage payment with PMI would have been about $3,500. That’s an extra $18,000 per year we would have been spending on a house instead of investments, trips, a new car, etc.

If I said to you, “pay $2000 to your mortgage, and at the very same time, put $1500 into a savings account that you can’t touch,” what would your reaction be? You’d find every excuse not to do that. You may do it for a month or two, but there would be an emergency or large purchase that comes up and you’d justify using that money for that instead.

CAR DECISIONS

While we can “afford” the Tesla, we didn’t buy it to be showy. We bought it to serve a purpose. Unfortunately, the concept of Tesla comes with pre-conceived notions for people. We didn’t pay for an extra color. We bought the base model because we weighed our expectations of using it versus the cost of extra charging needed and such. With the tax credit, our net was $38,000. I’d venture to say your car was about that price or more if you bought it new. So while we can afford the Tesla, that’s what we chose for our family because it met our needs. We didn’t buy an $80,000 BMW just for the name when a $40,000 car meets our needs.

GADGETS & TRINKETS

Maybe your spending is at the hundreds of thousands level. Maybe you’re buying the new Nintendo Switch that just came out. Maybe you’re buying each new game for your gaming system. Maybe you have bought into the influencers that are constantly jamming the latest mop and vacuum down your throat. Do you need 4 mops? Do you realize that you probably just need to actually use the one you already have and that this new gadget isn’t a miracle worker?

Everyone has their thing. There’s something that brings you joy and you’re going to be drawn to purchasing new iterations of it. I get that. But have you stopped and really considered the purchase?

This is where I don’t like the “envelope” method. People who use this concept, whether it’s literal envelopes or separate accounts, tend to overspend. They see there’s money left in an envelope and it goes into “extra” immediately in your head. “I saved this month, so I can buy myself something fun!”

This month, I replaced my favorite earrings because the originals were worn out ($12), bought a pair of black shorts because I had none ($14), bought a dress because Mr. ODA needed free shipping 😉 ($20), and two books I really want to read and aren’t available at the library ($20). Before this month’s Amazon order, my previous one was for kids summer pajamas in April. I buy filters for my vacuum instead of replacing it (although I’ll admit that I’ve had my eye on a new vacuum cleaner for about a year, but it’s been sitting at $80 and I know I’ve seen it for less than that). My mom bought me my steam cleaner mop several years ago, and I have a Bona that I bought for myself in 2016. The point here being that I’m stopping and thinking before making decisions, regardless of the amount of money I have available to me.

EDUCATION

It comes down to being an informed consumer. While you can rely on the experts, understand your own goals. When that relationship banker ran our numbers for a house purchase, all he did was ask us our fixed monthly expenses and income (debt to income ratio). Note that our approval was after the changes on how mortgages were approved from the 2008 crisis. It’s a flawed system. But we knew our limits and what our goals were. He didn’t ask us our goals outside of “so you want to buy a house.” At the same time, we were paying towards a wedding. So on top of needing to come to the table with about $80,000, we also needed $12,000 to go towards that wedding. We closed on our house on July 17th and were married on August 4.

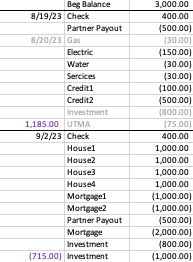

We have money in many locations. Currently, in our main checking account, I’m projected to fall below $0 if I don’t have any income before the end of the week. I have a bank account with more than enough money in it, but it just pains me to move money out of that account. I don’t want to set the precedent. I bet if I had kept my business money separate from my personal money, it wouldn’t be as obvious. But we don’t keep things separate because the business income is our family income. So when I had to pay out over $3000 for a repair on a rental house, that ate into my personal checking account balance, so I’ll need to make that transfer.

I listened to the young receptionist at work bark about people spending their money and how someone showed up in a Tesla but can’t pay their $75 office bill. However, I’m observant. I saw that she complained to me that the money in her account showed up on the wrong day so her card was declined at Hobby Lobby. I saw that she regularly came in with a new outfit from TJ Maxx. I’m sure she got a deal, but is a new outfit twice a week a necessity? When she was let go from the job, she turned to “retail therapy.” It’s hard for me to help walk you through the loss of income while you are actively spending.

Personally, I worry, “what if the ability to transfer from our special savings account isn’t there one day?” That’s because I’m looking at the big, big, big picture of our lives, and not what happens today, this week, or this month when it comes to our finances. So that’s why I don’t buy the kids all the cute outfits I see and I don’t buy myself the latest gadget. I’d rather have the ability to go on a trip and do activities with the kids that build memories.