I recently posted “Lease Break Agreement,” where I went into the concepts we used to determine a lease break clause in our renewal with a tenant. The purpose of our fee structure was directly correlated to the time of year and probability of turning over the unit quickly. As I suspected, it took us an entire month to find a tenant. The lease break fee was one month’s rent, so we didn’t go without income during that time, but we also didn’t net a positive.

The tenant gave us notice on November 24th. Our property manager listed the property on November 26th at $1700. The higher price points are worrying me. While the market may claim that this is a fair rate, it doesn’t mean that we have a large pool of qualified candidates for this amount per month.

TURNOVER WORK

The house was painted before the current tenant moved in a few years prior. Unfortunately, some of the rooms were addressed, but not all of them. And the ware of time hit the walls all differently, so it looked like different colors of paint. I asked our property manager to get her painter over there and give all the walls a fresh coat. It looks great. That was $2,000.

I had a carpet cleaner come out and a cleaning company come out. The cleaners forgot about the refrigerator and had to come back. But otherwise everything looked great for less than $500 together.

The front porch was starting to sink. So while this wasn’t an activity done before someone moved in, we do have our handyman working on replacing the back deck, the trim around the back door, and the front porch (he jacked up the supports and is replacing the railing and stairs). I don’t even know what this final cost is yet, but it’s a lot.

APPLICANT #1

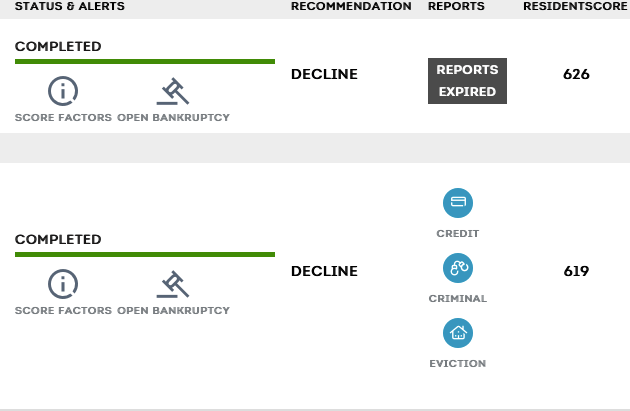

We had a lot of interest; hardly anyone qualified. After getting through some of the weeds, we did have a couple interested that appeared to be a good fit. They viewed the property twice over a week to be sure it was a good fit. The application was received on December 13, but it only listed one of the two adults who would be living there. We require all residents 18 years and older to complete a background check. We didn’t expect an issue with that since she works at a school, but it didn’t go well. Due to the holidays, their applications weren’t received until December 26th. She had several collections on her history. However, since he qualified on his own without her income, we agreed to overlook her lower credit score and collections history. I set up the lease with their names and sent them over.

We were excited because they wanted a January 1st rental, which meant we wouldn’t have any loss of income and would be able to put the lease break fee back into the house easily. They asked us if we would clean the carpets and clean the outside of the house. We agreed to the carpets and said that they outside of the house (mildew) would have to wait until warmer weather, but that we would address it.

Technically, all my tenants are supposed to clean the carpets and provide a receipt upon departure. However, I don’t hold this to anyone unless they were a real pain. A couple of hundred dollars out of my pocket and a happy ex-tenant is how I’d prefer to keep it (you’d be surprised at how many ex-tenant referrals we’ve had).

Suspiciously, they then withdrew their interest. I wish I knew why. I don’t know if their circumstances changed, if they were hiding information we hadn’t found on our own that caught up to them, or if something in the lease spooked them. If it was the lease, I wish they would have asked questions because we’re so easy going. I could have either explained why it’s there to protect them/us, or changed it.

So while we were a month ahead of schedule with being able to list the house, we now have a vacant house with no prospects. The goal is always to have the house ready to re-rent with little down time.

LISTING CHANGE

The market for the area called for $1600-1800 in rent. We originally listed it at $1700. It made me nervous. When the initial applicant backed out, I immediately adjusted the rent to $1650. We had plenty of interest at the $1700 amount, but it wasn’t worth weeding a few people out because they didn’t want to go that high. I decided to risk it with only a $50 decrease, since people would be able to see the decrease (and I try really hard to list it at the right price so I don’t have to do a price adjustment, but a December listing is hard to nail on the head). Again, we had a lot of interest, but few qualified.

APPLICANT #2

Two twenty-something men saw the property and asked to apply on January 11th. Neither of them had a job. Seriously. Neither had a single dime of true income, but wanted to commit to $1650/month in rent. Noteworthy was that they wanted us to consider that he had the potential to make $40k per year day trading stocks. We asked a few questions. They said they thought it better to find housing and then find a job. We suggested they try to find work and then live where they find a job (they had just moved ‘home’ from about an hour away).

APPLICANT #3

A woman showed interest who appeared to qualify on the surface. My broken record is to tell me things up front and be open with communication. I can’t help you if you don’t help me. Her information on paper looked fine. I’ve learned over the years to check the local jurisdiction court records myself, instead of relying on the background check. I’ve also tried to look things up before they submit their application; this way if there’s anything out there, they haven’t given us money for the application to not be used. During my search, I found several garnishment cases. Like a lot. An unreasonable amount of court records for a single person. We denied her interest form and did not pursue an application.

But on January 16, she asked for us to reconsider and explained the garnishment. There was one point deducted because the woman’s email asked if “he” as the landlord would reconsider her application (why can’t a friendly, reasonable woman be the landlord? 🙂 ). I didn’t appreciate that the garnishment wasn’t disclosed up front. However, she did explain what happened. It sounded like she was told that there was nothing due, made no payments, and then this debt showed up that she didn’t know she owed, but she’s been working a second job to pay it off. Honestly, the documentation didn’t clearly support the story, but my gut reaction was to believe her.

She also had three evictions recorded on top of this garnishment. The evictions appeared to be filed immediately upon unpaid rent by an apartment complex management company, and then the rent paid before the court date, thereby clearing the debt. I expect to have future issues with rent payments, but I suspect it won’t be anything more than I’m used to handling (e.g., where a tenant needs an extra week or so to make rent).

Our property manager appreciated the in-person interaction with this person, she was well written and well spoken when making her case to be accepted to apply, and overall it seemed worth giving her a chance. I’m also a sucker for giving borderline qualified individuals a chance. I think I’m 50/50 on it working out for me.

The lease was signed on January 18th. We agreed that she would pay the security deposit, first month’s rent, and last month’s rent. The last month’s rent was an additional way for us to hedge our bets with her unqualified application background. This is a “compensating factor.” Since she did not qualify according to our list of requirements, we’re taking an extra fee as insurance to our business interests in this property. We typically will work with someone on compensating factors so that they get a place to rent and we don’t lose out on too much in case our olive branch doesn’t work out.

She paid the security deposit with the lease agreement signature and paid first month’s rent on February 1st. We agreed to give her until February 17th for the last month’s rent. She was asking for a later move in date because she didn’t have all the money up front, but I didn’t want to cause extra stress on her moving plan/date over that.

FINAL THOUGHTS

I don’t even know how many people actually saw the property, since my property manager handled that. However, I know it was a good amount. I typically handle it where I set up an “open house” style visit window for people to come through (so many people claim they’ll show up to a scheduled appointment, and they don’t). I believe she tried to do this at the beginning, but it was taking so long to find a qualified applicant, that she ended up having to do one-on-one meetings.

She has them fill out an “initial interest” form after the showing. For the most part, I do that after the showings as well. However, it does help if you’re scheduling individual appointments to have people fill this out before hand. You want to know ahead of time if there’s even a chance of them qualifying. You don’t want to take time driving to/from an appointment and letting them looking around the house, only to find out they have a criminal background and/or less than favorable credit history.

THERE IS NO CHARGE FOR AN INTEREST FORM. If you are a tenant looking for a place to live, do not pay anyone anything until you’ve seen the property. There are a lot of scams out there where “landlords” are claiming they need an application before allowing you to see the property. They’re listing places “for rent,” that they have no vested interest in. People who recently sold their house, so pictures are available to use, are the ones finding out that people are driving by and looking around their house because someone claiming to be a landlord collected an “application fee,” with no intention of showing you the house or renting it to you.

So while this person didn’t expressly qualify based on our list of requirements to rent one of our properties, I felt like she deserved the chance. I feel bad when someone’s previous life choices immediately disqualify them, and I enjoy giving people a moment to voice their side of the story. Sometimes, their story is enough to solidify a denial from us. But sometimes, it appears worth giving them this opportunity to right their wrongs. I also feel good that I didn’t feel pressured into making a decision just to recoup vacant days on market, but that I made a logical decision. Now let’s see where we end up with this property in 18 months, and whether I still think it was a good decision!