These days, you’re probably not immune to being asked to join or buy from a multi-level-marketing (MLM) business. Also known as network marketing, it a way for companies to sell their product through individuals who market product(s) to their sphere of influence. It gets a bad reputation with “pyramid scheme” and the like, but it’s legitimate and makes sense if you take the time to step back and learn about it instead of repeating the rhetoric you’ve heard from your parents.

Our experience with an MLM led to being open to buying rental properties, which eventually led to me quitting my job and being happy outside of a career. Here’s what I learned by keeping an open mind to an MLM, even though we make $0 from that business today.

This is my experience with our time in an MLM. Mr. ODA would probably have something different to say. 🙂

AMWAY

BACKGROUND

By now, you may have seen the documentary on LulaRoe. Our experience was with Amway, and it was different from how LulaRoe operates. Now, Amway is the black sheep of the MLM world if you go just based on name. They’re one of the original MLMs. But they sell good products in the health, beauty, and home cleaning genres. As a “consultant,” you’re called an “independent business owner” or IBO. I thought the best part was that there’s no inventory you need to hold. If you want to do “parties,” then you need products on hand. However, it’s much different than how LulaRoe would have hundreds of leggings on hand and makes direct sales out of their on-hand inventory. To earn money, you can recruit more business owners, or you can have customers who just order directly from the Amway website each month. You make money off of what your customers buy, as well as the income that your IBOs below you generate.

TEAM SUPPORT

There are multiple “teams” associated with Amway. It’s the education arm of the business. Our team met once a week, and you were expected to be there if you really wanted to be in-the-know and considered serious about growing. They helped you structure your business to take advantages of bonuses offered by Amway, and they taught a lot about having the right mentality. Their goal was to foster personal and business growth, provide mentoring and coaching, and provide the tools to grow your business through conferences and seminars.

This is where we got our start. I know it’s hard to believe, but we both were exposed to a lot of growth through this team. The things we learned through the meetings and books we read during these couple of years gave us the courage to make the big decisions we did, getting us to currently having 13 rental properties.

THE CASHFLOW QUADRANT

Our introduction to the business was started by being given Rich Dad, Poor Dad by Robert Kiyosaki. The book references an earlier book of his, the Cashflow Quadrant. Each quadrant has its strengths and weaknesses.

– The upper left corner of the quadrant is for those who have Employee mentality. This is someone who is trading time for money. You work an hour and earn $20. If you’re not working, you’re not earning. You’re making money in someone else’s system, and there are people over you who are making more than you (e.g., a supervisor is making more than a secretary).

– The upper right corner is for Business Owners. You own a system that works for you. You have passive income in this quadrant. You may have an employee that is generating income that you earn.

– The lower left corner is for Self-employed people. Here you’re still trading time for money, but you have control over how much you earn based on how much effort and time you put in. This is a risky area because you don’t have security and may not have an established system to rely on and project your income.

– The lower right corner is for Investing. Your money makes money for you. This can also be risky because you’re not guaranteed positive returns on your investments. If you want to make a lot of money, you need to take on more risk.

The point here, according to the team we were on, was that you want to be a business owner. You want to generate passive income so that you’re not trading time for dollars. While someone else is selling to a new customer, you’re earning a percentage of that sale while not doing anything. As you grow your Amway business, you have more and more people generating income through these sales, which you get a percentage of. The kicker is that you need to hit a certain level within your own business before you earn. We set up recurring purchases to use the products we were selling, and had customers set up with recurring orders, so that we could hit that threshold to be eligible for the passive income.

OUR MOVE FROM MLM TO REAL ESTATE

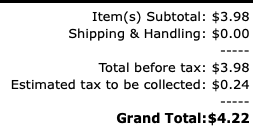

The biggest hurdle to our success was the price of the products. We aren’t someone who values a better quality to be able to justify the higher price. There are people out there that value this, but it’s not our passion. A peanut butter meal bar comes to $3.14 per bar as a customer order (as an IBO, you get the product at cost, which would be $2.82 per bar). The peanut butter granola bars we buy are $0.50 per bar. Clearly, this isn’t a marginal difference in our expenses. The products were good, but not good enough for our finances to take such a hit. I tried to focus on the beauty side of the business and held parties where I recommend products and let women try it. I had passion behind it, but I wasn’t someone who washed my face regularly and put lotion on. I could see the benefits, but I wasn’t practicing what I preached, and I lost my drive.

The next hurdle was location. Our original meeting was with our specific team within the larger team (based on your “pin level,” you had a meeting with the people who were your “downline.”). We moved down to Richmond, and our closest meeting was Fredericksburg. It wasn’t insurmountable, but it was a 40 minute drive there and back once a week. The larger team would all come together in DC every quarter for a conference. We felt like time started moving faster, and we weren’t close enough to make these our friends between conferences, and so we stopped attending the big conferences. Then we stopped attending the weekly meetings. Then we cancelled our team membership. We still maintain our Amway IBO number, since it’s just $62 per year to do that.

The thought process that we learned from their weekly teachings and reading books we probably wouldn’t have read otherwise led to our desire to generate passive income. Mr. ODA had already been interested in the concept, and then when we were talking about venturing down that path with our Realtor selling our Northern Virginia home, he really got the urge to pursue it.

When we sold our Northern Virginia home, we had about $120,000 in our bank account. About $70k of that went to the downpayment and closing costs of our new house. The remaining went to finding a rental property… or two.

REAL ESTATE, PASSIVE INCOME, AND NO JOB

Real estate is in the business quadrant, but it’s not completely passive income. Truly, the Amway business wasn’t completely passive because you still needed to have the sales (either through your purchases or customer purchases) to be eligible to earn all the passive income available to you in the business. Most months with real estate, I take the rent money, pay out our mortgages, and that’s it. Sometimes I need to make some phone calls to contractors. However, we have to do very little to maintain our business of investment properties. We can also decide that we don’t want to field the phone calls and hand off the rest our properties to a property manager for 10% of rent. If we don’t have a new property or a property to turn over, then we probably put about 100 hours per year into managing the houses.

We knew we didn’t want to be in the employee mentality for the rest of our lives. Funny, because my goal when I was in college was to work for a “big 4” accounting firm and spend 80s hour per week at work. Then I started working for the government, and my goal was to be CFO in my 30s. Then I got to the headquarters office in my late 20s and hated the environment, so I decided I wanted to be no more than a state office’s financial manager. Then we had kids, and I decided I wanted to be home with them to see all the little moments. Things sure did evolve.

I believe that the time we spent with our Amway team changed my heart. I believe that time was important for me to see a different lifestyle and a different mentality. I don’t know that I would have seen the benefits of pushing ourselves to buy more rental properties had I not seen a lifestyle of entertainment.

I started to realize it would be nice to spend time with my family while the kids were little. Who wants to wait until retirement to spend time at home, when your kids are grown and moved out of your house? Why not spend the quality time in their early years? Let’s travel more and experience more in life. Let’s have more time with the kids than the hellish hours of 5 pm to bed time.

Our cash flow each month is about $7k, just based on the rental properties. That doesn’t include expenses that come up, and every once in a while we get hit with a major system that needs replacement, but most of the charges are a couple of hundred dollars here and there. Some days, I wish I could still do what I loved to do in the transportation world, but I don’t miss the office politics and the moderately strict work schedule.

I’m happy for all the experiences that have led me to this point in life. Perhaps you can read Rich Dad, Poor Dad or Cashflow Quadrant and learn a little bit more about all the options out there. Perhaps you just didn’t know that there are opportunities out there where you’re not trading time for money, or where you’re not cushioning the pockets of an executive while you make a certain salary. Perhaps you just needed your eyes opened to the chance to make your money work for you. Or, perhaps you’ll learn that you like the stability of being an employee, and you don’t want to change. But I urge you to take a look at the options and see what works best for you, now that you’re away that there are options.