Well, we started the month with way too many things hitting the credit card: 2 insurance policy renewals, a new insurance policy, air conditioning fix at a rental, and bathroom replacement at a rental. That eventually led to a $1500 charge for bat removal at another rental.

PERSONAL

My big news this month was handling my HOA’s annual meeting. We’ve been working so hard for the last year, and I tried really hard this year to increase communication between the Board and community. I think I did a good job because there wasn’t any contentious point of this meeting and there were very little questions. I received nice feedback on how I presented the budget and that I did a good job throughout the year. It was a welcomed win since there was a lot of heat in the previous couple of years.

The family’s big news is getting passports for a trip this Fall. The parents already have theirs, but we got the kids their pictures and submitted their application. So our credit card balance is higher than normal because we paid for flights and the cruise itself.

It took us until the last week of June to meet our deductible on our health insurance. It’s only $3,300, so that’s quite the impressive feat. I’d point out that my March surgery took until then to get processed correctly, but at least we eventually got there. I have very little faith that it’s all processed correctly though, so it’s on my to do list to verify that we’re not overpaying into that deductible, which they don’t make easy because they don’t show me prescription fills clearly.

We went on a trip for a long weekend to visit Mr. ODA’s aunt in WV. They have a vacation house there, so we didn’t pay for lodging. Unexpectedly, they provided all our meals. I bought them a gift card and some beer. So between that gift, gas, and the meals on either end of the trip, we spent about $200 for a trip, and it was one of the best vacations I’ve been on.

Two of the kids spent this past week at camps. One was 3 hours per day at a dance studio, and the other was 9.5 hours of all outdoor time for the week. He had a blast, and I’m kind of jealous that he got to play all those games and have a great week.

RENTALS

This month, I received an email from Rent App that a tenant was paying their rent. She didn’t give me a heads up, so I wanted to verify things with her. She said this app pays me in full, but it takes the first half of the payment from her account at the beginning of the month and then the second half of the payment in the middle of the month. They’ve lived with me for for 8 years, so I’m surprised she sought out this option instead of talking to me about a payment plan. The program was extremely sketchy and I didn’t feel good about a single step of it. I gave up the registration process at the point that it required untethered access to my phone, but I wish I would have followed my gut at the first personal information step, as if it wasn’t bad enough I had to give my bank account details for the transfer to happen. The payment eventually came through on the 10th, but I didn’t feel good about it.

Another tenant paid late with the late payment. And another tenant paid late with little to no communication and several follow up conversations. I can’t stand when I have to hunt down money. I’m willing to work with everyone who reaches out. She paid the first one with a (1/3), so clearly she knew the plan. And yet, on the 6th, I had to ask where the rest of the rent was. She said it would be done that day. A partial payment was made on the 7th. Then another partial payment on the 8th to finish it out.

We hired someone to clean out the gutters at two houses. Both houses are inundated with trees over the roof, so it’s something we need to stay on top of because they back up every 6 months. We could add gutter guards, but just didn’t see the point since we could do it. Now we don’t live there. He is also going to cut trees 10′ back from the roof on one of those houses.

And then the bats. One house had a bat show up last Monday. My property manager didn’t think much of it, so we didn’t do anything (I wasn’t even told about it at that point). Another bat showed up on Saturday. The tenant went for rabies shots and got boosters for her dogs. She then took a bat to get tested, which came back negative. She said she wasn’t comfortable staying there, so she stayed with a friend. We had traps set so bats could get out of the attic, but they couldn’t get back in. The pest people will go back next week to check on things.

We have two houses that will be vacant at the end of this month. We were supposed to have one at the end of June and one at the end of July, but the June one asked for an extension. I let them have it, but I’m not thrilled about my timing now. We won’t be able to truly get to work in there until mid-August, and it’s going to require a lot of work (not hard work, just time consuming). Then for the other one vacating at the end of the month, we don’t intend on renting it again. We’re going to let it sit over the winter and sell it in the spring.

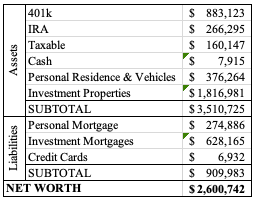

NET WORTH

The way that I update our net worth each month involves overwriting the numbers from last year. So I can easily see that we’ve gained over half a million net worth since July 2024’s update. What’s nice about that is that it’s all appreciation, paying down mortgages, and the stock market with continued savings. We didn’t make any large financial moves that would have adjusted our net worth in one large move like buying a house. I had a conversation with someone about our net worth and goals recently. It would be nice to cross the $5 million threshold, but we’re not actively managing our funds in a way that will cause drastic swings outside of market movement. We crossed $4 million in March 2024.

We’re over $200k from last month’s update. Our credit cards are much higher than last month because of trip purchases and rental work that was unexpected, but needed. Here’s to the last month of summer.