Last March, it was time to make a decision on renewing the tenant’s lease on House9. There were several variables at play, and we ended up adding “lease break” terms to the renewal agreement. Here’s how and why we did such a thing.

LEASE BREAK CLAUSE

All of my leases are set up as a lump sum fee. This means that if the rent is $1,000 per month, then the lease is a legal binding agreement for $12,000 for the year. If you wanted to leave 6 months into the agreement, I could hold you accountable for the entire sum. In reality, this wouldn’t happen. I’d have to show a good faith effort to re-rent the property once the tenant vacated the property, and they’d only be responsible for the time it was vacant, at most.

The point here is that there is no section of my lease agreement template that allows the lease to be “broken,” and the tenant to leave “early.” In some instances, a tenant will request the flexibility to leave early, and we typically charge up to a month’s rent for that ability. We most often use this for tenants that expressed interest in buying a home. There are some other fee structures that we use depending on the circumstances, but this will focus on those instances where we know in advance that this is a possibility.

ORIGINAL LEASE AGREEMENT TERMS

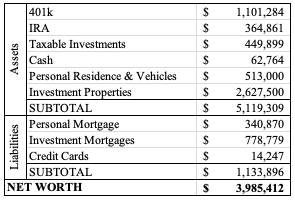

The tenants had signed their original lease in June 2020. From the beginning, they were clearly money savvy. They had said from the beginning that they were looking for a place they could live until he finished his schooling, which was about 2 years away. They negotiated a two year lease for $1,280. In September 2021, so 6 months before their lease was set to expire, he reached out with an offer. His program was set to end in May 2023, but they didn’t want to commit to any longer than that since he could be placed anywhere upon graduation. He asked to go month-to-month after that.

We agreed to extend their lease until May 2023, but it would be $1,300 (instead of $1,280) between 7/1/2022 and 5/31/2023. We decided not to engage in the month-to-month conversation that far in advance, which he understood.

In March 2023, we started discussions on their status. They were about to have a baby, the market had cooled for buyers, interest rates were high, etc. They didn’t want to rush their buying process. Instead of paying the premium for a month-to-month lease, we decided on another year-long lease, but it would have a “lease break clause.”

NEW LEASE AGREEMENT TERMS

The new lease was executed for $1,350 per month, which was still a bargain for their property. However, we added lease break provisions, as seen below.

The thought process here was that we were protecting our financial interests based on the time of year. First, we required a month’s notice. Our original lease already states that we can have access to the property to show it to prospective tenants, so that wasn’t repeated here (although it is worth noting that this in our lease agreement, since renting while a unit is occupied is not always a given; we struggled with our property manager in KY getting access to our properties (that was a property manager issue)).

I don’t know if there are facts to back this up, but it seems (through my own years of renting, as well as all these years as a property manager) that most people are looking for a rental to be somewhere between May 1 and July 1 as the start. A quick search tells me that the common months are May to September. However, in the south, we start school in mid-August. If you’re not moved by August 1st, I’d venture to say you’re not preferring a September 1st start date.

If the tenant left in the summer months, then the fee was only 1/2 of a month’s rent. We had a good chance of being able to re-rent the property if it was during the summer and before everyone focusing on back-to-school in the end of August/September. If they requested a lease break between September and the end of March, then it was a full month’s rent. This was due to the fact that the turnover process was going to be longer than our typical turnaround, and it would put us at a disadvantage in re-renting the property down the road. We then put that there would be no fee if they left in the last two months of their agreement because 1) we’d likely be able to rent it quickly, and 2) as a way of showing that we’d meet in the middle since they were such great tenants.

EXECUTION OF THE LEASE BREAK AGREEMENT

The tenant had used our property manager as their Realtor for a new home purchase. She tipped me off that they’ve be giving their notice shortly, sometime at the beginning of November. I naively thought that meant they were newly under contract, but by the time their notice was given, they had already closed on their new home. They purposely waited to give their notice so that they had time to move their belongings without being rushed (which is fine; I don’t know why that reads negatively). On November 24th, they let us know that they’d be leaving by 12/31.

While the fee was due upon notice, per the lease agreement, it wasn’t something I was willing to fight. If you’re a good tenant and hold the lines of communication open, I’m happy to treat you as an equal. They paid the fee on 11/29, and then they paid their December rent on 12/4.

LESSONS LEARNED

Honestly, it worked just as planned. We weren’t able to rent the house for January. The lease break fee alleviated the pressure to settle for a tenant just to fill the house because we had the month’s income already accounted for. We’ve done something similar in the past, and this set-up has worked well for us. It gives a little grace to the tenants and real life needs, while still protecting our interests as business owners.

We put the same type of clause in another tenant’s lease. They executed the clause on February 23rd, letting me know they’ll be leaving by the end of March. If they broke their lease in March or April, there was no fee (their lease was set to expire April 30th, so it’s one month early).

Their are times where a tenant doesn’t know up front that they’re going to find a house they love or a job is going to move them. We handle each on a case-by-case basis. Generally, it’s either going to be a month’s worth of rent as the fee or it’s going to be a fee of $250 (the amount I pay to the property manager) and they pay rent until we find a new renter (which has never taken more than 6 weeks, and is typically a few days turn around for me).