Typically, I write a post around this time of year on how we handled submitting our taxes. This year, I’m going to focus on the return itself, and the concept that a large return is somehow “gaming” the system.

OUR TAX FILING

First, I’ll remind you of our process. I spend all year getting ready to do our taxes. This isn’t a last minute activity where I’m trying to find all the income and expenses and recreate data. I know more than one small business owner that constantly files for an extension because they’re not ready. Make it a routine all year to be organized. This way, once the year is over, you’re just verifying you have everything recorded, instead of compiling all paperwork and documentation for the first time. It’s less stress and you’re doing less work (because it’s still work to file the extension).

Most people have just their W2 income, maybe a little other income, and a standard deduction. However, if you have any more than that, you should make it a whole-year process. I have a spreadsheet that I keep for each rental property. I copy the template over each year for a new workbook, keeping the basics (rent income, routine utility costs, taxes, insurance, etc.) and deleting the extra maintenance costs that went into the houses (plumbing calls, HVAC repairs, etc.). As expenses occur through the year, I input them into the appropriate tab in the spreadsheet. At the end of the year, I verify I have all my receipts/invoices recorded.

Then Mr. ODA sits at his computer while I read off each house’s totals from my spreadsheets. This year, I think we hit a record in that it only took about 90 minutes to do our taxes! That’s probably the quickest we’ve done it since we’ve had all these houses. Actually, let me back track for one second there. I’ve spent all year preparing for tax season by inputting information as it happens. Then I spend about 2-3 hours reviewing all the data to ensure I haven’t erroneously recorded data, haven’t missed data, or haven’t omitted recording an expense or income. But the actual time that it took to go from spreadsheet into software and press file was 90 minutes.

“THE GOVERNMENT IS SAVING FOR ME”

A financial friend asked for “financial wins” recently on Instagram. Someone responded that they received a $5,000 tax return. He then said that he had several people comment that this isn’t a win, but he came to this person’s defense that some people need the government to do their savings for them. He said that, for some people, if they had an $100 each week of the year, they would have spent it frivolously.

I actually think that’s an excellent thought process. I see where he’s coming from there. Instead of someone thinking “let me set aside $100 this week to put towards debt,” it just becomes part of the pot of money that goes out with each pay check. That’s also easy to see as not worth putting towards a separate financial goal because it feels like not enough.

My frustration with the thought process of wanting a large return is that people think they’ve gamed the system and done something special to obtain (or earn) that amount, rather than realizing it was “their money” all along. You can project your tax burden for the year; it’s not a secret formula. Paycheck withholdings throughout the year simply allow you to work with your employer to gradually meet that tax burden as you earn your salary.

We project our tax burden each year. Sometimes Mr. ODA doesn’t listen to me on what our net for the rentals is going to be, and then we owe a lot come April, but that’s our own fault for not projecting with the right variables. For most people, the projection is a much simpler formula.

AIM FOR A $0 TAX RETURN

If you are someone who is going to put that $5,000 towards something productive, rather than frivolously spending it just as you would have all year, then that’s fine. However, I encourage a look at your opportunity costs.

Did you receive your tax return and go buy a 75″ tv? Was that a necessity? Did the money that went towards that tv have a better financial purpose?

Did you spend the whole year living paycheck to paycheck and worrying about the next bill to come in? Did you pay bills late because you needed funds from a future paycheck to cover the balance?

Did you spend the year carrying credit card debt, paying 26% interest on the balance, and then wait for your tax return to pay towards your balance? If you did, then maybe realize that the $5,000 you got in a lump sum could have saved you in interest costs had you just put $400 extra per month towards your credit card balance.

If you pay $200 per month (assuming a 26% interest rate):

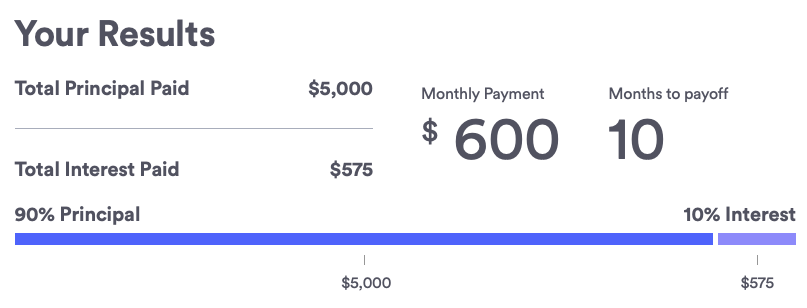

If you pay $600 per month (that extra $100 per week that went into your taxes paid instead of into your pocket all year, causing a $5000 return):

You’ve paid off the balance in less than a year, and saved $1704 worth of interest payments. If you had paid $200 per month for a year and then used your tax return to pay off the balance, you’d have paid about $1,100 of interest, and then would be putting over $3800 of your tax return to pay it off. You also have the benefit of not having a bill hanging over your head at some point within that year, instead of worrying about meeting the minimum payments and continuing to accrue interest.

SUMMARY

So that’s my angst with the “financial win” of the tax return. Something as large as $5000 is an entirely different ball game than $500. Looking to get some money back and using the taxes as a ‘forced’ savings is an option. Perhaps you use that to take the only vacation in your year. But that should still be a reasonable vacation. Spend $1000 or $1500. You don’t need a $5000 vacation when struggling to pay bills or having debt that’s accruing interest.

So while I agree that the forced savings could be an excuse for a large refund, once someone receives a large refund, there should be an evaluation of their financial standing and an education on how that could be turned into a true, productive financial goal.