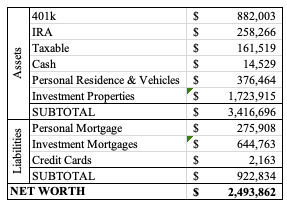

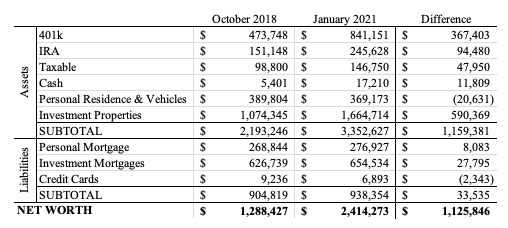

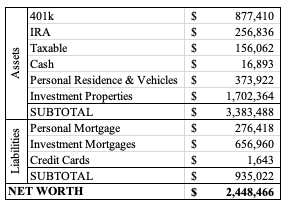

On the surface, a jump of $1.1 million in just over 2 years seems impossible, but here’s the break down of how things changed in our finances during our child-rearing hiatus.

The highlights:

– Mrs. ODA left her job;

– We purchased three new properties;

– We sold one property;

– We paid off two mortgages and significantly paid down two others;

– Our investments grew based on market fluctuation, as well as our continued investment; and

– The value of the properties we own appreciated.

401K

Since I met Mr. ODA, I maxed out my Thrift Savings Plan (TSP, the Federal government’s 401k) contributions each year. Before that, I had been putting money into the TSP, but hadn’t maxed it out. I left my career position in May 2019, at which point I stopped contributions to my TSP. However, we put in as much as we could for the year before I quit (if Mr. ODA has his way, we’d have maxed out my contributions); I contributed $13,070 over the first 4 months of 2019. My balance on June 30, 2019 (it’s a quarterly report) was $300k. I have gained $127k over 19.5 months based on my investment strategy for the account with no new contributions. Mr. ODA continues to max out his contributions of $19,500 per year. His account balance has increased due to annual contributions, a loan repayment, and market fluctuations.

IRA AND TAXABLE

A Roth IRA has maximum contribution limitations per year. For 2019, 2020, and 2021, that amount is $6000. We each put $500 per month into the Roth IRA to max out the contributions. We have maxed out the contribution limitation every year we’ve known each other (10 years), and Mr. ODA had done so before Mrs. ODA knew such a thing. We don’t time our contributions throughout the year because we don’t want to stress about when the perfect time is and then possibly end up throwing five grand in when December rolls around. We have taken the ‘set it and forget it’ (essentially dollar cost averaging) approach to the Roth IRA investment.

Dollar Cost Averaging – Since we know we want to put $6,000 in for the year, we break it down into $500 a month and contribute on the 30th of every month regardless of individual pricing. This eliminates the need to pay attention to, and the effect of, volatility in the market. Some may say that dollar cost averaging is not a prudent idea because the market always goes up over time (essentially you’re setting yourself to pay higher and higher per share as the year progresses, on average), but I just can’t handle the psychology of dropping $6k on January 1 and not having anxiety for the rest of the year that it was the right decision.

As for the taxable accounts, this includes accounts we have set up for our children – UTMAs (however, the growth of these funds are not taxable to us because they are taxed at the minor’s rate – 0% for us). An UTMA is the Uniform Transfers to Minors Act. It allows an account to be set up in the child’s name without the child carrying the tax burden of the money. The IRS allows an exclusion from the gift tax up to $15,000. We put $50 per month, per child, into the account. This is also ‘set it and forget it’ with automatic deductions from our checking account.

CASH

Our cash balance really has no meaning. We bring in income and we pay our bills. We don’t purposely keep a savings account balance (as I shared in the Leveraging Money post, we’re not interested in maintaining 3x our monthly income in a savings account at 0.01% interest rate). We don’t purposely project how much to put towards mortgage principal.

We currently have a larger-than-normal cash balance, which is left over from selling our primary residence in September. It hasn’t been dwindled lower yet because we have a fence install that needs cash and we were paying down the last of our large credit card. Now that most of these things have happened, we’ll put more of our cash balance towards the investment property mortgage we’re currently paying down.

PERSONAL MORTGAGE

In October 2018, we had been living in our previous house for just under 3 years. In January 2021, we had only made 1 mortgage payment on our new home. While our current home cost slightly less than our last home and we put 20% down for each house, we had more years of principal pay down in October 2018 than we currently have.

PERSONAL RESIDENCE AND VEHICLES

We sold our Virginia home for $400k in September 2020. The valuation of that home rose significantly over the 2019-2020 years due to lower inventory with high demand in the Central Virginia area (probably all over the country, but I don’t know those details).

Also in September 2020, I traded my vehicle in for a van (and I couldn’t be happier :)!). That increased our vehicle valuation since the van is 3 years newer and a higher cost than my previous vehicle.

Even though my vehicle value rose slightly, Mr. ODA’s vehicle’s value continued to decline, and we purchased a home in a lower cost of living area, therefore having a lower value.

INVESTMENT PROPERTY VALUES

Since October 2018, we’ve purchased 3 properties, increasing the total property value of our portfolio. Additionally, all of our properties continue to increase in value. The Virginia homes have increased significantly over the last two years. In the table below, I’ve provided each property’s change in value from January 2020 (oldest snapshot per property I have) to February 2021.

Note that this is a projection based on the internet’s valuation and not an exact science. The only house that we have a recent appraisal on is the one that we refinanced in January 2020. That house’s appraisal was $168,000; we paid $112,500 in July 2017.

INVESTMENT MORTGAGES

Of the three most recent purchases, one was purchased with a partner, split 50/50, and the other two were the last two KY houses purchased. These three added $215k of new debt. However, you see that our mortgages on investment properties have only increased by $27k, which doesn’t exactly say “we bought 3 new houses.” That’s because we’ve paid down (and sold) about $150k of mortgages in addition to 2+ years worth of mortgage payments going towards these loans.

In May 2020 and January 2021, we refinanced two properties. Quick tidbit – we signed the refinance papers in May under a tent in a parking lot, and we signed the January refinance at our kitchen table with a traveling notary. While the interest rate and monthly payment decreased, the loan balances increased because we rolled closing costs into the principal and took $2,000 cash out (the maximum allowed) in each case.

We sold one property that we had been paying down the mortgage on; in October 2018 it had a balance of $11,142, and we sold it in January 2019. We had been paying down the mortgage because it was our lowest balance. When we made that decision, selling the house wasn’t in the immediate future. An opportunity presented itself, and we sold it.

We’ve paid off two mortgages during this period. One was in January 2019 with a balance of about $44k, and another was in April 2020, which also had a balance of about $44k in the October 2018 calculation. Our intent to paying off mortgages was two-fold. It increases our monthly cash flow that helps Mrs. ODA stay home with the kids, and it gets Mr. ODA closer to being able to leave his job. Plus, due to Fannie/Freddie requirements of having no more than 10 conventional loans, it creates the opening for us to get a new mortgage if the opportunity arose. The downside is that it de-leverages the house’s financials and creates a smaller cash-on-cash return for the property.

We have also paid down 2 mortgages over the last two years that aren’t completely paid off.

– One of those properties is the one that we purchased after October 2018 with a partner. It has our highest mortgage rate. The affect on the numbers here just shows that the principal balance of that mortgage is smaller than it was originally, thereby not increasing the mortgage total ‘fully,’ if you will. The principal pay down on that mortgage has been $44k total, but we’re only responsible for half of that.

– On the other mortgage, we’ve paid almost $28k towards principal between October 2018 and now.

CREDIT CARDS

We open new credit cards with 0% interest for an introductory period when we have large purchases looming. Not only is the 0% interest beneficial to us for an introductory period of 12-15 months, but we strategically choose new cards that come with a welcome bonus (points or cash) when you reach a moderate spend level in the first several months. Given the strategic timing of a new card before a large purchase, this bonus is easy to achieve. When we have large balances on credit cards, it’s because we’re purposely carrying a balance month-to-month at 0% interest. We have never paid interest on a credit card balance.

LIFESTYLE

Despite Mrs. ODA leaving the workforce, our net worth increased for all the reasons listed above. The one unmentioned piece, because its not directly tied to any accounts, is lifestyle. While our net worth, rents, and investments have increased, our lifestyle has not creeped. We still make strategic decisions, spend money mainly on needs, look for wants that provide our happiness without breaking the bank, and generally keep our financial future at the forefront of our daily lives. We live like no one else does so eventually we can live like no one else can.

Living intentionally allows us to get to where we want to be.