Over a year ago, we opened a new credit card because we replaced the carpet in our house. This year, we finally were able to make a purchase we’ve been waiting for: a hot tub.

Mr. ODA has wanted a hot tub for a while. We did some exploratory searching in May, thinking our deck project was nearly over. Then the waterproofing was never waterproofed. The contractor ghosted us on it. Mr. ODA bought his own supplies, but it was never enticing to tear up our brand new deck boards in 95 degrees to diagnose and fix the problem. We finally got around to that project in August. Once that was done and life calmed down a little bit, we decided to put more effort into the search. We went to 3 different places one day to get information. Then we sat on that for a week and decided on which one we liked the best and ordered. They told us 3 weeks, and it’s expected to be delivered and installed this coming Tuesday, which is over 5 weeks from our down payment, but such is life.

WHAT WAS THE BACKGROUND?

When we were in the process of IVF to have our first child, Mr. ODA was discouraged by the lack of financing availability. We could either take out an outrageous personal loan, or we could pay it in cash. Their “guarantee” program was $22,000. Up front. That didn’t include the medications that were bought separately.

We never like the idea of paying large sums of money out at once if we can help it. We make our money work for us.. meaning money is constantly moving and being invested in short term securities for us to earn interest on it. Mr. ODA had the idea to open a 0% interest credit card for the IVF payment, and this idea has carried us through several large purchases now.

WHY A CREDIT CARD?

By opening a new credit card, which we strategically pick, we give ourselves a personal loan for 0% interest.

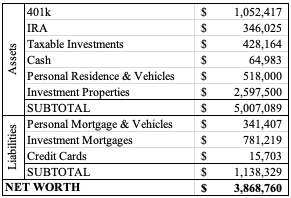

A personal loan averages 12% at the moment. Since we have the cash available to pay for a hot tub outright, paying any percentage of interest to a bank is not something we’re interested in. We could just pull about $10k out of our savings account, our short term securities, or cash out a taxable investment. However, that costs us interest that we’d be paying ourselves. In our savings account, our current balance yields us about $120/month in interest earned. If we reduce that by about $10k, we’d lose about $30/month in interest payments. Instead, a new credit card is opened. It gives us the ability to pay the minimum balance (or more if we want) each month, leaving that cash in our account to earn interest or be invested.

WHICH CREDIT CARD?

When we search for a new credit card, not only are we looking for 0% interest rate for an introductory period of at least 12 months, but we’re looking for another incentive. Many people were talking about “credit card hacking” a few years back, where they’d open a new credit card to get the bonuses and then render that card obsolete (not close it). There are negatives to opening too many credit cards that I’ll get into later.

Not only are we looking for 0% interest, we also would prefer to receive another incentive for the credit hit. This new card gives us $200 cash back for spending $500 in purchases in the first 3 months, which we’ve done without any problem. This particular company has other options on the market. One card gives you 4% back on certain purchases, but there was no introductory rate on purchases. Other cards have an annual fee, which we try to avoid unless it’s glaringly obvious that you’re going to make that fee back in rewards you can’t get elsewhere (e.g., I’m not going to pay a $99 fee to get 2% cash back when I have a credit card that gives me 2% cash back without a fee).

Typically, these credit cards don’t offer us a better incentive than other cards already in our portfolio. However, this new card actually gives us 2% cash back, which is the same as the Citi Double Cash card. This will change our equation of managing the balance a little. Historically, I’ve had a balance on the new credit card, paid $500 per month towards it, and then paid it off before our introductory interest rate period expired. The balance almost always was decreasing, so I knew what I was working with. This card is being used more often, with 4 transactions in the last 3 weeks already on it. I’ll be interested to see if that changes how I manage the balance.

WHAT ARE THE CAUTIONS TO CONSIDER?

First of all, the most important thing to consider is where this purchase is something that you can and want to afford. When your money goes towards one thing, you’re taking it from something else. Weigh whether that’s worth it. In the case of IVF, having a child was more important than any other place those dollars could have gone. In the case of the new carpet, all of the carpet in the house was old and, frankly, disgustingly stained; I wanted the carpet replaced as soon as possible so that I could enjoy what I was living in. And now, the hot tub. This is one of the few splurge purchases we’ve made. We have gotten to a point on making decisions that bring us joy. We were also gifted money over the last year or so that was earmarked for this.

When putting a large sum of money on a credit card, you can’t forget about it. You still have to make the monthly minimum payments. If you don’t, you could have to pay back all the free interest you’ve received thus far and/or start paying interest (to the tune of 22%…so that’s $2,200 in interest on a $10k balance) on the balance immediately. You also need to be able to pay the entire sum by the end of the introductory interest period (or, again, you’ll be paying interest on the balance).

For the credit card that we used to pay for new carpet and new windows on a rental, we put nearly $12,000 on the card in October to December of 2023. We also used it to make 2-3 more relatively smaller purchases. I paid $500 every month towards it. The minimum payment was typically around $100, but I wanted to see the balance dwindle a bit faster than just the minimum. My current balance is $6,500. I’ve been been monitoring our money movement for a month or so, preparing to pay off this balance no later than December 13th (I appreciate this company explicitly listing the date of the introductory rate expiration because they don’t always do that). A balance of $6,500 is obviously less than needing to outlay the full $10k-12k last Fall, but it’s still not a small chunk of change that needs to be fit into our cash flow right now.

Opening a credit card will affect your credit score and history. This may not matter to you if you don’t have any large purchases (e.g., buying a home) on the horizon where you’ll want the highest credit score you can get yourself. However, if you believe there will be large loan-seeking opportunities in the next 1-2 years, opening a new credit card should be carefully considered.

– It’ll count as a hard pull on your credit, which degrades your credit score for one-two years. Credit Karma says the “ding” on your credit lasts only about 3 months, but too many at one time could cause a bigger drop in your score.

– Opening a new card lowers your average credit history. This is why people say not to close any accounts. If you close an older account, it brings your average down. My average is currently 6.5 years, and it’s listed as “fair.” If you have old cards that you’ve kept open, you may need to use it for a transaction to keep it active and open.

– If you’re adding a large sum on the credit card, your credit utilization could be higher than preferred for your credit score calculation. According to Credit Karma, you should be below 30% credit utilization, and being below 10% is even better.

SUMMARY

If you’re about to make a large purchase that you’ve considered carefully and have decided is worth the cost, then opening a new credit card with a 0% interest for an introductory period could be a beneficial option. It’s a way to give yourself a personal loan for no interest. Be sure that you have projected the cost over the course of the introductory interest period so that you know you’ll be able to pay off the balance in time, and that you make all minimum payments on time.