I manage all our income and expenses (at a high level, like credit card payments, not individual line items). I have a spreadsheet that I set up in 2012 and have used religiously since then. I’ve shared how I set it up in the past, but we’ve entered a new phase that makes my spreadsheet even more important to me.

BACKGROUND

FIRE. Financial Independence, Retire Early. This isn’t a post about FIRE specifically, although it’s the movement that sparked Mr. ODA to go down our financial path.

The purpose of our rental portfolio was always for both Mr. ODA and I to quit working. We had covered my income before any kids were born, but I kept working because there was no reason to not be working. Once our son was born, I took 14 weeks maternity leave (not a separate bucket for Federal employees back in 2018; it came out of my own accumulated sick leave), then I worked about every other day for 8 months while Mr. ODA and I swapped child care roles, and I burned down my leave.

While we don’t plan to work full time, we do plan on keeping part time positions. We’ll work on things that bring us joy, rather than an office job with office politics. Since I stopped working, I’ve done odd jobs, part time. For example, I worked as a census taker and served beer at a local race track over the last 4 years. These were all seasonal, part time positions, with no long term commitment.

Now that I quit working, it’s Mr. ODA’s turn. We hardly skipped a beat when we left my six-figure salary behind (although a pandemic probably helped curtail spending on our behalf!). However, the thought of losing his salary as a safety net and losing insurance are two items that have caused some pause.

THE SPREADSHEET

For you to understand my panic that I’ll get into here, I thought a quick reminder was necessary. This is how I manage our money. It’s nothing fancy, but it works. I don’t miss payments. I can allocate expenses to a specific 2-week period against what income is brought in at that time.

There are two parts to the spreadsheet. Well, there are about 10 tabs, but this first tab, with two sections, is what’s pertinent.

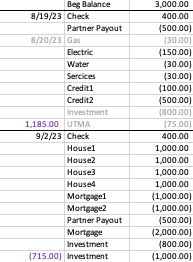

Part 1 is this section. This image is a very scaled down version of the section. We have 13 houses, 6 mortgages that get paid, 6 credit cards that get paid regularly, and a few other lines that I removed.

All numbers are made up place holders, except the investments. I deleted my IRA contribution line because it’s wonky (but I will max out IRA contributions), but I wanted to show how much we’re investing regularly. There’s $75, per kid, per month, going into their investment accounts. Then there’s general investing happening with one $1000 transaction and two $800 transactions per month. Mr. ODA is investing into his IRA to max it out ($6500/12=$541 per month..sort of).

You can see that I’ve listed Mr. ODA’s pay dates at the top, and then his salary income on the next line. The gray section accounts for all rental income. I’ve allocated the income into the salary two-week period that makes the most sense (about half pay me on the 1st or 2nd, and the rest pay on the 5th). The green section shows routine rental property expenses. The entire next section are our personal expenses. The blue is left over from when I was managing two personal homes last summer (but kept it to differentiate our house bills versus other bills). The next gray section (which I’m only just realizing is a second gray and should be a different color as to not conflate the two grays.. what a rookie mistake) accounts for expense that come out of Mr. ODA’s bank account. Finally, I have an “other” section. This is where I capture large expenses that don’t need their own line item because they only happen once or twice a year. Here I’ve put tax payouts that will be due in October (that’s 4 houses worth, and it’s last year’s numbers – because I want to know how this year’s amount owed, when it comes in, changed from last year’s to discern if it’s reasonable or if I need to dig into it).

This is part 2. Now, part 1 accounts for the general timing of income and expenses, but it doesn’t perfectly capture the due dates, scheduled payments, or whether I’ve paid it and it’s hit the account.

The top line is linked to the section that I update our checking and savings account balances. Then I transfer all the items per pay period into this list format. In this example, let’s say I’ve already scheduled the gas payment. So I mark it as gray and put the date in the left column. Similarly, our investments are automatic, so I mark them in gray as we get to that two-week period.

At each border lined, I put the total for that section. You can see that at the end of the 9/2/23 pay period, I project a negative balance. Truly, we seem to have more income than I project (rewards cashed out, someone paying partial rent a little early, etc.), so I don’t take any action until I need to. There are Federal regulations regarding savings accounts; so we can only make 6 withdrawals from the savings account before fees apply. I manage these projects to know whether I need to make a withdrawal. If I need to, then I project what other expenses I may have and transfer a little more than I deem necessary.

THE PLAN

So our first step to him leaving is to pretend we don’t have his salary. Mr. ODA set up a new bank account. The majority of his paycheck goes into that account. We still have $250 going into another account, and about $400 going into a third account because we need to meet the requirements of direct deposits to prevent any account maintenance fees.

Our general principals in account management was always to take money into our main checking account, pay out bills for that two week period, and put the balance into savings. However, that wasn’t creating any forced feeling of managing without Mr. ODA’s salary. I’m more of a visual learner, so I appreciated this concept of having the money automatically transferred to a completely separate account.

EXECUTION OF THE PLAN

The first month of this plan had me on edge. The accounting in the checking account meant I was constantly back down to a balance of about $500. When I worked in an office, I was at the computer everyday checking our money. Now that I’m responsible for 3 tiny humans, I’m rarely on the computer. I project out our routine expenses, but there have been plenty of times where a $100 or $500 charge goes through that I didn’t have listed in my expense column for that period. Therefore, I like to keep at least $1000 as a buffer in the checking account to cover those little expense that can add up. So keeping the projection to less than $500 in the checking account panicked me.

Now wait. It’s not that we only had $500. We have a savings account linked to that checking account. We have this online account that’s taking Mr. ODA’s salary and just building the balance because we don’t use that account for anything. We have Mr. ODA’s old personal checking account. And last but not least (as my adorable 3 year old says all day long), we have plenty of investments that can be liquidated within 24 hours. We have the money. It’s just the panic of having the money in the spot where the bills are being paid.

SUMMARY

I’m sure there are easier ways or “better” ways to account for this. I don’t like automatic payments for bills because I like scheduling them against our cash flow. I’ve used this exact set up since 2012, and it hasn’t failed me. Taking full responsibility to pay bills means I am very scared to miss a payment and cause a negative hit on either of our credit reports.

Now that we’ve eliminated about $5,000 per month of income, without changing our spending in any way, I’m interested to see how things go. We have a great spending mentality – we’re not spending on frivolous items and we weigh the cost benefit of a purchase to us. That’s not to say we can’t do better. I’m sure we can be more diligent about our grocery spending or at least cooking what we already have in the house (we don’t spend much at restaurants in a month). I’ve already started tracking our expenses month to be sure we can watch our trends and re-evaluate our spending if needed.

Now that we have this account growing with no need for it to pay the bills, we will use it for fun things. We’re not very good about doing fun things. Two summers ago, we wanted to buy a vacation home at a nearby lake. We decided that instead of spending $1200 per month on a mortgage to go to the same place all the time, we’d plan vacations each month and spend up to $1200 without “guilt.” It was great. We had so much fun. But it lasted 3 months. Having a newborn put a damper on activities, but we’re ready to do the same again.