This one has been pretty easy, but we did have an interesting issue arise with the first tenant.

This is our largest house at 4 bedrooms and 1.5 bathrooms, and 1281 square feet. It’s a cape cod style house, so the upstairs has slanted ceilings, the half bath is not anything to write home about, and the HVAC struggles to work up there. The carpet on the stairs could really be replaced (but it hurts me to spend money on stairs because they’re soooo expensive compared to carpeting a room!). But the house has a huge fenced-in yard with a nice deck that’s a great selling point.

The kitchen was renovated at some point, so that’s held up well – and lets face it, who doesn’t choose baby pink knobs for their new kitchen cabinetry? But the plumbing and roof have been painful.

I’ve already told many of the stories about this house through other teaching posts, so bear with me if things sound familiar.

LOAN

The house is in Richmond, VA, and the purchase was very simple. We offered $109,000, and the seller countered with 112,500 and 2,000 in seller subsidy (i.e., closing costs), which we accepted. It was listed on June 22 at $119k, and we offered on June 25, so I’m actually surprised we got the contract agreed to so quickly.

Quick note here: after reviewing real estate contracts in NY, KY, and VA, Virginia wins. Sure there are several states that I haven’t ventured into, and this is an extremely small sample size. The paperwork is simple yet thorough, all while being in plain language. So if you’re needing a template to work off of, look up Virginia’s purchase agreement.

We settled on a 30 year conventional loan at 5.05%. We received a $200 lender credit since we closed on several properties in a short period of time. This is the house that we refinanced and received an appraisal of $168,000! We had already started with equity in the house because it appraised at $114,000 at closing.

INSURANCE

Interestingly, we couldn’t insure the house through the company that we had gone with because they have a 5 rental limit. Our agent was able to quote us through another company though, so our process appeared seamless. However, the quote was much higher than we anticipated. We went through a friend to insure it, but shortly after closing (literally a week), we were able to find an even cheaper option – that was awkward.

THE NEIGHBORHOOD

Not a category that usually gets mentioned. I discussed the neighborhood of the one house we sold already, which was because I didn’t realize it was in a higher-than-average crime area that tenants honed in on. But this neighborhood is worth mentioning.

Rentals aren’t prevalent here. In fact, many of the homes are the original owners. While working on the house when we first purchased it, the neighbor across the street approached me. He as-politely-as-possible threatened me that this is a nice neighborhood, that everyone keeps up their property, and that they don’t want any trouble. I assured him we have good standards as landlords, and we haven’t had any neighbor complaints for any of the tenants we had in our houses.

The location also comes into play for our first tenant.

TENANT #1

This house is under a property manager for 10% monthly rent.

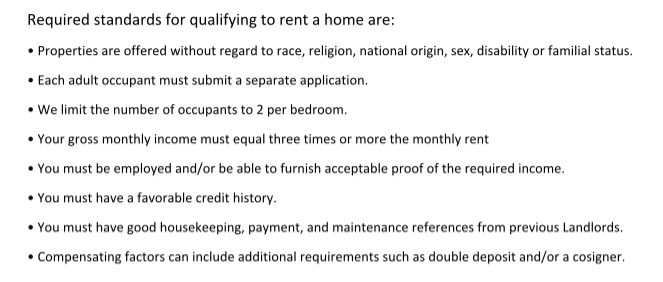

As with most of our tenant searches, no one fits perfectly into our requirements. We offset this by a higher security deposit or having another signatory on the lease. We had two prospective tenants – one was a mother/daughter combo (an adult daughter) and both had bankruptcies in the last year; the other was a man and his family that had an eviction 7 years prior. We chose the one with an eviction. His application actually said that he “will also respect the property to the utmost.” Boy did he.

He first requested that the carpet be replaced. It was actually a reasonable request because it wasn’t the best. Here’s the carpet on the second floor. Old, bottom of the line padding; a gorgeous blue; lots of wear spots.

We decided to refinish the wood floors on the first floor because 1) he wasn’t moving in for two weeks, and 2) it would save us in the long run to put that investment into the floors instead of carpeting every few years (and risking someone completely ruining it before its useful life was up). It was $1850 and the company was able to start immediately and get it done before the tenant moved in (granted, it was the day he moved in, but it did get done). And the refinish turned out great!

He asked us for a screen door, but we said that wasn’t a necessity. He asked if he could install one himself. We agreed, as long as it didn’t prohibit our access (e.g., he can’t lock it, give us a key). This later becomes an issue because he locks it after vacating and we need it rekeyed.

This tenant had a few late rent payments and struggled with paying rent on time, but overall he was a good tenant to have. He took care of the property and let us know when he ran into issues (it’s amazing how many people don’t tell us of a problem in a timely fashion).

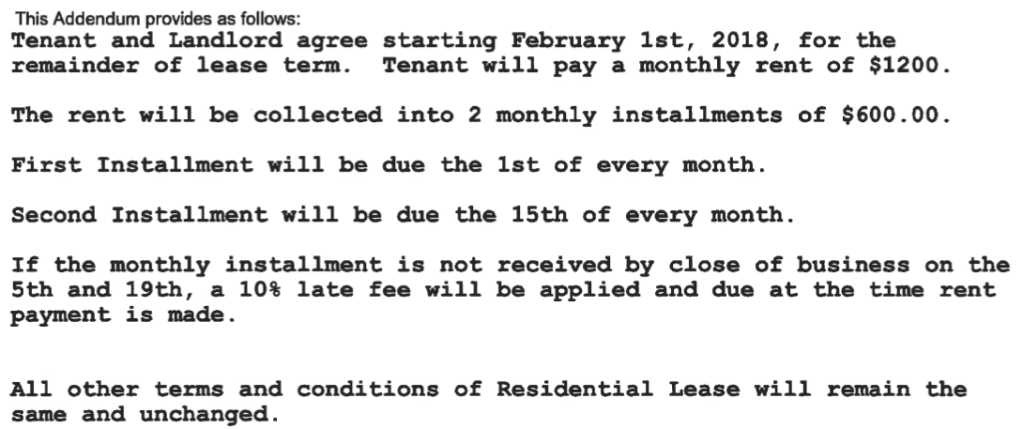

Just as we did on House 5, we offered this tenant the opportunity to pay rent in two installments each month. His rent was $1150 from August through February. He took the opportunity and we executed an addendum to change the rent to $600 twice a month. Again, it’s an inconvenience to us to collect two rent payments, but it theoretically should save the tenant money if they’re constantly in a position that they owe late fees (if he usually pays $1150+115=1265, then 1200 is a better position).

And then the fun happened!

I was at WORK one day, answered my work phone, and someone on the other end asked to speak to the owner of [this house’s address]. I barely used my work phone for work calls, so to receive a personal call on my work phone was very surprising. I informed her that I was the owner. She then went on to ask me questions about the tenant occupying the residence. I couldn’t answer a single question – hah! I let her know that I really didn’t know who was living there or the status of the home because I have a property manager. She was very nice and understanding, and she called my property manager.

She was with the school system. Apparently, our tenant had moved into the City public school district, but kept his kids in the adjacent county school system. It was April. I thought it was ridiculous that the school system would investigate this with 6 weeks left of school, but technically, he was in the wrong. And get this – he blamed me for it! Our nice tenant turned on us and went crazy. He claimed that he could just walk away from the house …. honestly I don’t remember his reason for it, but somehow he thought he had a case.

Virginia has a wonderful statute that says if the house is vacant for 7 days, the owner takes possession without any court interference. There’s also a statute that says we can’t collect double rent, and we need to be doing our best to rent it out if given notice. We tried to keep communication lines open with the tenant, but he was silent. We had told him that we were willing to release him from his lease obligations if we found another tenant, which we did. He was responsible for May’s rent and late fees, and we would have a new tenant move in June 1. We also informed him that he would be responsible for the leasing fee associated with finding a new tenant, which was basically considered the ‘lease break fee’ and is fairly generous ($300 instead of a standard two-months rent that’s typically seen as the fee). It kept going south from there.

On top of the rent owed, he had several lease breaches – room painting (clarification: rooms are allowed to be painted as long as it’s a neutral color or painted back to a neutral color before vacating), wall patching and painting, house cleaning, mowing, re-keying, and utilities since he turned them off. By mid-June, he still owed us $874.76. We made an arrangement with him that he’d pay a certain amount each pay check, but he failed several times. We finally threatened to take him to court, which would affect his credit score and increase the balance owed since court fees would become his responsibility. Since he had been working to rebuild his credit since his bankruptcy, we thought this would light a fire under him.

We went to court.

Court also added a 6% interest charge on the outstanding balance, which now included the $58 court fee.

It took him over a year to pay the balance. By the time the court judgment arrived, his balance (after paying $50 here and there was $660. The court doesn’t put a timeframe or process on the judgement, but leaves it to the two parties to determine the payment schedule. He didn’t adhere to it well, but we did eventually get the whole balance paid. Mr. ODA also took this opportunity to have fun with calculating interest payments on a declining ‘principal’ balance that isn’t getting payments on a predictable schedule!

TENANTS #2 & #3

These tenants were/are much easier. The second tenant in the house had several large dogs, but we didn’t see any damage to the house. She eventually broke the lease to buy her own house in November 2020; we can’t fault someone for wanting to take advantage of low interest rates! She gave the appropriate amount of notice, but the lease was going to be broken as of 10/31, which isn’t a great time to have a rental come open. She ended up being very gracious with the situation, paid us one month of a lease break fee, and we kept her security deposit.

Right after she gave us notice, we had an old tenant reach out to us. They had moved back into town (I’ve mentioned them several times) and asked if we had a 4 bed/2 bath house available. Amazingly, we did. We showed them the house and they signed a lease within a few days.

Since turnover was fast, and I didn’t really know the status of the house, I didn’t get a chance to paint the house. All the rooms had been white except for the one room that I repainted after the first tenant had painted it lime green. The house really needs a whole paint job, and so I offered her an incentive. If she wanted to paint any of the rooms, she could knock $75 off the rent per room. So far she’s painted three rooms.

MAINTENANCE AND REPAIRS

The plumbing in this house has been horrendous. We had the tub snaked as soon as the first tenant moved in ($150). We then had issues with hot water, which required several adjustments to the water flow rates to coincide with the tankless hot water heater ($325). We had the upstairs toilet serviced ($120). Then a year later, we had to service the hot water tank again ($570). Tenants had complained that the upstairs sink drained slowly. We had attempted to snake it and fix it several times, but it never seemed to work. We finally just bit the bullet and replaced the plumbing – from the second floor to the crawl space. That work and the drywall patching cost us $1563.

Then there’s all the roof work. Shingles had flown off during a storm, so we had those replaced ($350). We also had a leak in the flat roof over the laundry room. We had a roof guy come out, and he said the roof hit its life expectancy. He replaced the pitched roof ($4135), and not the flat roof. So we’ve still had issues there that will need to be addressed.

SUMMARY

That sounds like a lot of money, but we’ve owned this house for 4 years now with our rent being double the mortgage (slightly better now too with the recent refi). When purchasing properties, any good investor is going to build maintenance and capital expenses into their numbers that determine if it’s a worthy investment. Rent cash flow wins out, and all the rest is just the cost of running our business – not to mention the $60k of appreciation we have on paper in just 4 years. It’s also worth noting that these things took up about 10 days worth of action from us over those 4 years, so most months, we just collect the rent with no other action required from us.

No property is going to be perfect, and this business relies on people, the tenants, to make the business profitable. No path will take a straight line, and being flexible to the ebbs and flows of rental property investing help make it fun too!