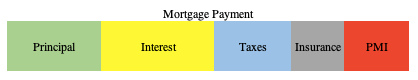

An ARM is when the interest rate applied to the loan balance varies throughout the loan. The loan is typically amortized over 30 years like a conventional loan would be, but the interest rate is variable. There is an initial fixed interest rate for a pre-determined period of time (e.g., 5, 7, 10 years). The rate then adjusts based on prime rates, with a maximum amount allowed for the increase each period of time (e.g., a maximum 1% increase each year for 5 years). This is where people find ARMs alarming, but note these two important points: 1) an ARM can’t jump an egregious amount at the end of the initial fixed term (usually no more than 1% or 2% in one year, outlined by the lender at the beginning), and 2) the rate is based on interest rates at that point in time.

Usually, the benefit of an ARM is a much lower interest rate during the initial term. If you know that your ownership in the property will only be for 5, 7, 10, etc. years, then this is where the benefit is realized. Amortization schedules ‘front-load’ the interest** (e.g., your monthly payment is the same total ($500); your payment in year 1 will be broken out as $375 interest and $125 principal; year 20 will be broken out at $150 interest and $350 principal).

**Every dollar of your loan is being borrowed for a length of time determined by the outstanding principal on the loan. At the beginning of your loan, all 30 years are being borrowed, so the proportion of principal to interest of each monthly payment results in far more interest being paid. Every month you pay a little bit of principal, gradually decreasing your outstanding principal amount, meaning you are no longer borrowing it and will pay slightly less interest with each monthly payment.**

Therefore, if your interest rate for the initial term is less with an ARM than it would be with a fixed rate loan, you’re saving considerable interest for the time that you own the property. You’ll need to compare the interest rate savings during the discounted initial term of an ARM with the 30-yr fixed quote your lenders offers. Also evaluate an ARM based on how long you anticipate owning the house. If you’re looking to hold a property for more than 7 or 10 years, an ARM’s benefit is probably too risky since interest rates after that timeframe are unknown. Also, the more years your ARM offers for an initial fixed period, the less the discounted interest rate is.

In our current very low interest rate environment of 2020/2021, ARMs are rarely beneficial compared to a 30 year fixed rate.

An ARM is identified by 2 numbers. A 5/1 ARM means that the initial rate period is 5 years, and it can change every year thereafter for the life of the loan. A 5/5 ARM means that the initial rate period is also 5 years, but it can only change the interest rate every year for the 5 years after the initial term expiration. Here’s an example of a 5/1 ARM quote. It shows that the initial period is 60 months (5 years) and the maximum the rate could ever be is 5% more than the initial term, but that doesn’t mean there’s a guarantee of an increase since the interest rate is still based on the rate sheet at that time.

We found ARMs to be beneficial for our primary residences. We had several people try to talk us out of locking in an ARM. However, once we investigated the loan terms, we learned that there are strict parameters around your rate changes that absolved some of the risk others were using to dissuade us from the option. Yes, it’s a gamble, but interest rates have remained fairly steady or decreased over the last 10 years of our home ownership.

When we moved just outside of DC, the move was solely to get back to living together because our jobs had separated us. Being in the Federal government, the easiest way for both of us to get a job was the DC area, but we didn’t want to live in that metro area with the higher cost of living and a lot of traffic for very long. The rate terms offered were 4% on a 30 year fixed, or 2.5% on a 5 ARM. We owned the house for 3 years and 2 months. Over 38 months, we paid just over $23k in interest. Had it been the 4% on a 30 year fixed, it would have been over $37k in interest, which is a $14k savings. By paying less interest, that means that more of each monthly payment went towards principal than it would have, resulting in $4,700 more to principal. Additionally, by having a lower interest rate, our monthly payment was $250 less. Over 38 months that’s $9,500 less we had to pay, freeing it up to save and invest in other ventures.

For our second primary residence, we also had an ARM. We expected our time outside of Richmond, VA to be longer than the DC area, but not forever. I was uncomfortable with a 5/1 ARM and wanted the 7/1 ARM, but Mr. ODA picked the 5/1. We owned this house for 4 years and 9 months. Our interest rate was 2.875%. At the 61st month, it could have risen by 2% for the first year and 1% for each of the next 4 years. Had we gone with a conventional 30 year loan, the interest rate was going to be 4.125%; we would have paid $54k in interest during our ownership. With the ARM, we saved $17k in interest, put $5,300 more towards principal, and paid over $11k fewer in monthly payments.

We purchased our current residence a few months ago. We have a 30 year fixed conventional mortgage at 2.625%. Since interest rates are so low now (you can see how previously, we’d be around 4% for a conventional and got lower than 3% by choosing an ARM, whereas now interest rates are less than 3%) and we plan on being here for a much longer time, we didn’t pick an ARM.

As illustrated in the examples for the first two properties we lived in, ARMs can be a powerful option in strategizing your mortgage to work most efficiently for you. They are not without risk, so pros and cons must be weighed along with future forecasting of your life situation. If used in the best circumstances, they can help you shift tens of thousand of dollars away from interest and towards principal and other investments to aid in reaching financial freedom.