We last purchased a rental property in 2022, after most of our purchasing was done in the the 2019 era. We were busy with 3 kids, and I recently felt like I was coming out of the fog. Mr. ODA and I went to a wealth building seminar in the Spring; my intention was to have that seminar reinvigorate our desire to build our portfolio. It worked well for Mr. ODA, but once options started to show up, I started to panic.

We first went to an open house. It was a bit further away that I’d prefer to maintain a house, and there were a few red flags. For one, it frustrates me that landlords can fill out a seller disclosure claiming they know nothing about the house. I can tell you if I had any roof issues or major system issues in any of my houses, even though I haven’t physically lived there. Mr. ODA wanted to pursue it, but I couldn’t bring myself to get on board.

We were then sitting with his parents one night, telling the story of this open house, and his mom said that she saw a townhouse posted on Facebook that she thought we’d be interested in. It was owned by the son of an old friend of her’s. We asked our real estate agent if she’d show it to us, but she was out of town. So then his mom texted her friend to see if they were there and we could go look. They weren’t there, but they gave us the contractor box code (which is surprising in itself that there wasn’t a sentribox on the door). We went over and the house looked to be in good order, so we put an offer in. We like to surprise our agent with these types of things where all she needs to do is get the contract ratified.

UNDER CONTRACT

The house had been listed for some time when we came across it. It was was listed at $182,500. We offered $182,000 with $2,000 worth of seller subsidy on September 2, 2025. They agreed that day. We ended up needing to redo the contract because the wife wasn’t on the deed of the house, but she had signed the contract, but that wasn’t a big deal.

We had the inspection scheduled for September 10th. There was hardly any issues in the report, and we picked a few of the bigger things to ask for them to fix. They agreed to our list. They gave our agent a receipt showing they had paid someone to fix the items on our list. We did our final walk through the afternoon before closing and were disappointed to find that two of the bigger items (leaks) were not addressed properly and the house was dirty (including things left in the fridge and freezer). Our agent reported that to their agent, and they addressed everything that evening. We swung by the next morning before closing to see it all cleaned up and the leaks addressed.

The appraisal was ordered by our lender and came back at $188,000. That was a pleasant surprise to see we had immediate equity in it.

COMMERCIAL LOAN

We chose to go a commercial loan route. Interest rates aren’t falling as quickly as we expected to see. We have a commercial loan on one of our other properties in town, and I was still surprised to see how easy this process is. The loan qualifications are mostly based on the cash flow of the property. I filled out an application, submitted a ledger of our other property cash flows, and sent in 3 years worth of tax returns.

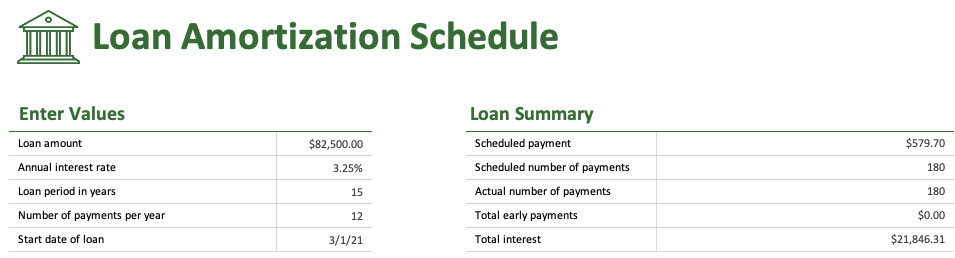

We were quoted at 6.74% interest. The loan terms are a bit different. Our last commercial loan was amortized over 25 years, but there’s a balloon at 5 years. This time around, it’s amortized over 25 years, but the balloon is at 15 years. A commercial loan also means that the taxes and insurance are not escrowed, and I’m responsible for paying them on my own.

The loan is an Adjustable Rate Mortgage (ARM) too. There was no different to us in the 3 year or 5 year ARM, so for the first time, we picked a 3 year ARM. In the past, it was related to securing our low rate. This time around, we’re expecting rates to drop in the near future, so we locked in our rate for only 3 years. It only changes on 3 year increments (some of the others will change every year after the initial lock period). It also has a clause that indicates the rate has a floor of 4%. I also don’t see a maximum adjustment that can happen (we have other ARMs that state an adjustment can’t be more than 2% at the change date).

We were expected to put 25% down. That would be $45,500 based on the $182,000 purchase price, and would leave 136,500 worth of a loan. They ran some numbers and determined that we could only qualify for a loan of $132,000 based on a rent of $1,400. They only us the cash flow to determine the eligible amount and not the rest of our portfolio. Let’s break that down to the fact that a loan of $136,500 equates to a monthly loan payment of 942.23, and a loan of $132,000 equates to a monthly payment of 911.17. So at a rent rate of $1,400, we could cover the monthly payment of $911.17, but we could not cover a monthly payment $31.06 higher. We pushed back for a second, but in the end it didn’t matter and we accepted the loan of $132,000.

PROS

When I look at this place, it feels like a place someone will rent. It’s clean, feels like home, and has a good layout. It has a closet available for a washer and dryer, which is a plus. Both bedrooms are upstairs and each has its own bathroom, and there’s a powder room on the main floor. It’s more secluded than other units in the complex, giving the occupant more grass area to hang out in the front and back.

CONS

We do have some concerns. The townhouse is at the back of the neighborhood. The entire rest of the community has parking right outside their front door. This group of 4 townhomes is separated from the parking lot, so you have to walk a bit further. The trade off there is that it’s secluded, you have a front “yard” (instead of pavement), and you’re more secluded from your neighbors.

I didn’t want another townhouse in our portfolio. With a townhouse, your value is strongly dictated by what your neighbors have done (or not done) to the property. As much as we don’t plan to resell these properties in a short time frame, I do have the thought that I want to be able to sell it when the time comes.

Also with a townhouse, you’re also at the whim of a community manager that is likely not putting utmost effort in. We asked about the HOA at closing and the previous owner said the cost used to be $35 per month. When it was that cheap, they weren’t paying their bills, so the lawn wasn’t mowed and the trash wasn’t removed. They increased the price to $95 two or three years ago, and that has made a difference in the community’s upkeep.

The HOA is due monthly, which is an inconvenience and a surprising process on their part. I plan to pay it monthly until I have confidence in their ability to process my payment and apply it to my account timely. After some time, I may pay in advance. I just went to process the first payment and planned to pay 3 months worth, but then realized that will create a harder tracking mechanism on me right now.

CLOSING

We had our closing on October 16th. It was super quick and easy. I listed the house for rent that evening.

SUMMARY

At this point, we have the house listed for rent at $1375. We had determined the range for rent during our purchase evaluation. Unfortunately, I hadn’t looked at the current market by the time we went to list, and there’s quite a bit out there. I’ve shown it to 2 people and have another showing today. One of the people from the weekend said they were seeing other places on Wednesday, so I’ll hold out on any changes to the rent price until this weekend.