Back when I spent my days working in front of a computer, it was easy for me to analyze our spending. These days, with 3 kids in tow, I’m lucky to record our finances timely. There’s no time for analyzing. But over the past two years, I haven’t been happy with our spending total for the year, so it was time to look into it a bit more. It’s hard to know what has changed since I don’t have month over month, or year over year, trends to compare this data to, but it’s a start.

There are some caveats.

- I don’t include any spending that isn’t on a credit card here. That means some of our rental property bills aren’t captured (they’re paid via Venmo or check), but I decided that’s ok because I can see that in a different way (a separate spreadsheet). Those expenses are reactive and a necessity to running the business, so it’s not like I can change a spending trend there. I’m more curious about our actual expenses and where our money is going for personal decisions. There will be some rental expenses captured here though.

- I’m doing this analysis for the first half of the year. If this was for a month at a time (which is a goal), then I’d be able to dive deeper into spending at each place. For instance, at Walmart, those expenses aren’t always ‘grocery.’ However, I don’t have the time to go through all the purchases and siphon out non-food purchases. I did go through most of the Amazon purchases and categorize them.

- If a purchase was made at Lowe’s or Home Depot, it’s classified as home improvement. It may have been rental property work, but generally it’s related to something we’re doing at our house.

- If a purchase was made while on vacation (such as amusement park, tolls, hotels, dog sitting) , it’s categorized as ‘vacation.’ If we were on vacation and purchased food, it wasn’t labeled as vacation. All fast food or restaurant purchases for the first half of the year are categorized as ‘restaurant.’

- If we did an activity from home, it’s labeled as ‘entertainment.’ If we did something related to sports (this includes swim lessons, ticket purchases for performances, etc.), then it’s labeled as ‘sports.’ The entertainment versus sports delineation is because something like a single tournament could be considered entertainment, but I kept all sports items as ‘sports.’

- None of this includes whether we were reimbursed by someone else for a purchase. For example, we purchased tickets for 15 of us to go to an amusement park on vacation, but we only paid for 4 tickets of that personally. Mr. ODA is a personal shopper for restaurants, so much of our restaurant shopping around town is actually later reimbursed in that process (but not captured here because it’s not a credit card line item).

In the process of going line-by-line on my expenses, I discovered that I never received a refund for something. I placed an order on Etsy for a personalized gift for my niece’s birthday. A few days later, I went to check the status of the order, and I discovered that the shop I ordered from was no longer selling on Etsy. I was frustrated that I received no email that told me my order wouldn’t be fulfilled. I contacted Etsy customer service. At the time, I misunderstood Etsy’s billing process. I assumed it was charged when the item shipped. As I was just going through charges, I realized that the amount was charged on the date of purchase (e.g., not when shipped), and I had never received a response from Etsy. After another frustrating round of attempting to contact customer service this morning, I finally received a resolution. Now my ‘to do list’ has to keep track of this refund appearing. It’s $10.01, so it’s not the end of the world. However, it would be nice if Etsy shuts down a seller (their words), that they manage the outstanding orders without me having to take my time to get it corrected. Plus, if I let every “it’s just $10” go, it could add up quickly.

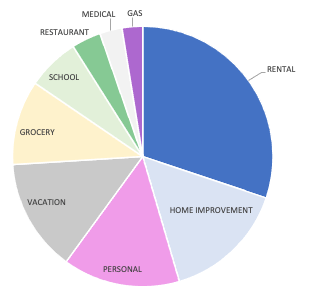

FIRST HALF OF THE YEAR SPENDING

By far, our largest slice of the pie up there is for rental expenses. Honestly, I’m happy to see that so much of our credit card expenses are taken up by rental expenses we had. I pay our insurance premiums (where they aren’t escrowed) via credit card, and I can pay our county taxes for one house with a credit card, which I do for the cash back rewards. There was flooring replaced at one house, which was a significant amount of that slice.

The ‘home improvement’ category includes new patio furniture we purchased, but were reimbursed by insurance (a tree fell on our deck). It also includes the electrician work and dirt fill purchases that we needed for the deck rebuild. Our house has a few more fairly large projects we want to complete, so I expect that to continue being a larger chunk.

I know that our “grocery” expense isn’t completely groceries. I’d like to focus on this category of spending more in the second half of the year. I want to quantify what’s purchased at Walmart that is actually grocery versus personal shopping type purchases. I think that our grocery purchases are higher than they should be, but I can’t put my finger on exactly why. Historically, I’ve blamed it on ‘bulk’ shopping; Mr. ODA will go to Kroger for the “buy 5” type sales. I’m not sure that’s it though.

We don’t eat at restaurants very often. We usually eat at fast food places while we travel or are away from home at an inopportune time. When we’re at home, we’re usually eating at a “personal shopper” experience where our food cost is mostly reimbursed (although that’s not captured in the chart).

Our health insurance deductible is $3,200 per year, so we expect slightly more than that each year in the medical expense category (and based on how deductibles work, that expense is front loaded in the year). I actually pre-paid a bill at a child’s urgent care visit. I paid them $50, but that visit, along with two more visits since then, came to a total of $12. I’m waiting for their reimbursement of that difference.

PERSONAL SPENDING

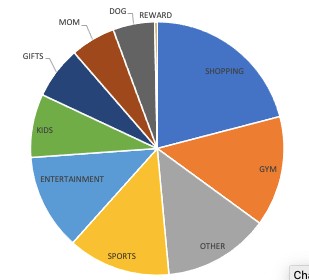

I’m going to dig deeper into the ‘personal’ category. I labeled a bunch of things as ‘personal’ as a means of not having too many small slivers of the overall spending pie. This includes all gifts, needs for kids (new shoes), clothing for kids, gym membership, sports, etc. It includes a ‘shopping’ category. I spent some time going through my Amazon orders and categorizing them, but the ‘shopping’ category was too daunting and difficult to parse out further. About a third of the ‘shopping’ category is Amazon orders through Mr. ODA’s account that I didn’t pull up to categorize. The rest is random purchases that were probably related to gifts or kids clothing.

For entertainment, this is small things like going to the movies (which we go for $2 per ticket), bowling, and aquarium. The largest chunk of this pie part here is actually 4 season pass lift tickets for our family’s future winter season. I put the ‘mom’ category to see what I’ve purchased for myself that wasn’t a necessity (e.g., a travel cosmetic bag, baseball shirts to wear to my son’s games), as well as my one hair cut and one pedicure that I’ve gotten this year so far. The ‘other’ category is boring stuff – utilities, car maintenance, professional fees, etc.

Had I gone through my Walmart orders in detail, I would have been able to identify some more purchases that could be removed from ‘shopping’ and put into other categories. For instance, the ‘dog’ category is actually higher because I order his glucosamine and tooth cleaning treats from Walmart most of the time, and that’s a monthly expense. His annual vet appointment is in the Fall, so this will be a larger slice of the pie for the end of the year.

SUMMARY

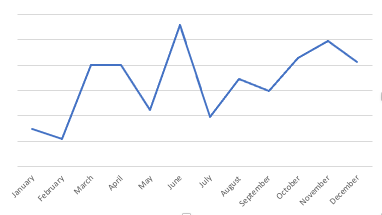

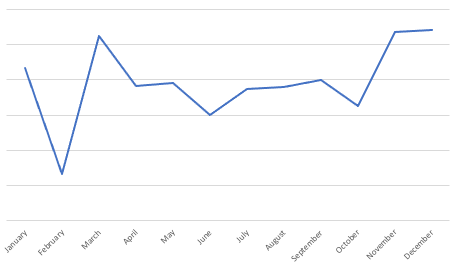

Our annual credit card payment total for the last three years have been about the same. While it’s a ‘win,’ that it isn’t increasing, it’s still at a number that I don’t like. Mr. ODA has been working towards a ‘retirement’ date. We’ve pushed it back just because his job hasn’t significantly impeded our lifestyle, but the day will eventually come. If it’s next year, I’d feel better if our credit card payments weren’t as high.

I went into this expecting my grocery category to be higher than I’d prefer. I didn’t identify much of what is causing that, so I’ll try to focus heavily on watching that expense each time it hits the credit card, rather than trying to remember what each purchase entailed six months later.

I was surprised to see the gas category such a small sliver of the pie. We’ve done a lot of trips (although, I suppose a majority were in July, which isn’t captured in this data). It appears living in a smaller city and doing things mostly on this side of town means we’re not having to fill up our tanks too often.

Overall, I didn’t notice any egregious spending. We don’t spend for the sake of spending. This year we traveled more than we had the previous two years, but mostly our spending is the same. Now that we’re two years into our house, there are less projects that we’re putting money towards. I’m encouraged that now that I’m looking at this, I’ll be able to identify areas to scale back.