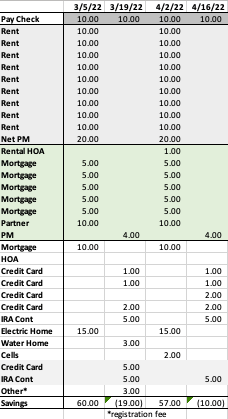

RENTAL FINANCES

It’s the calm before the storm with rental payments. We’ll owe multiple jurisdictions’ tax payments over the next month. We only have 5 houses with an escrow account, so I’m responsible for insurance and tax payments on my own. I don’t mind it because that means I don’t have to keep money tied up in an escrow account balance, but it does mean that there are large outlays multiple times a year that need to be properly accounted for.

I recently made a post about late rent payments this month. The one who I continue to charge late fees didn’t even pay on the day they said they would. I despise having to hunt tenants down for payment. She emailed me that “September 5th payment” would be late (ugh … it’s due on the 1st, maybe plan for that day instead), she said it would be paid on the 8th. I had to ask on the morning of the 9th where the payment was. I was giving her a few hours to respond and planned to send a notice of default. Lucky for them, I got distracted and busy, and I didn’t get around to it. They finally responded Saturday night that they had lost power and were distracted, but they sent payment then.

I paid out the invoice from our handyman that I had been waiting on, which was $810. I had mentioned that I’m waiting for an invoice from our HVAC guy, but I think he’s not charging me for the service since he had to go back after installing a new condenser. I’m STILL waiting on the roofer to complete the job on one rental. I signed the proposal on July 5th. He finally started the job at the end of August, but decided to change my scope of work without approval. That delayed the project another week. Then I have no idea what has happened over the past week and a half, but supposedly it’s finally done.

A plumber came out for a hot water heater issue at one of the properties. The tankless water heater wasn’t powered on. I don’t even know how that happens, but it seems like something that may become a bigger issue. The company even said they don’t service or work on electric tankless water heaters, so I don’t even know where we would go from here.

PERSONAL FINANCES

In my last financial update, I mentioned that our insurance adjuster had finally came out, three weeks after the tree falling on our deck. He took a week to get us the estimate. We then responded the next day with all the errors and omissions in the estimate. It then took 3 weeks for our email to be acknowledged (even with multiple phone calls). We finally escalated this two weeks ago (State Farm doesn’t make it easy to escalate beyond your desk adjuster answer the phone), had an estimate redone by our adjuster (supposedly) about 12 days ago, who then told us the supervisor approval process would be 3-4 days. Giving the holiday of Labor Day and benefit of doubt, we didn’t push it until Monday, hoping they’d do the right thing and get us information. Mr. ODA saw that we had been reassigned a field adjuster on their portal. So guess what? For an event that occurred over 10 weeks ago, we’re starting over! Lovely.

I paid the kids’ tuition for preschool late. Luckily there’s no late fee charged. The school “opens” links each month. I tried to pay it around the 20th of August for September because I knew the last two weeks were going to be crazy with visitors. When I couldn’t pay it that day, I completely forgot about it. I was part of the “hey, you didn’t pay” email from the director – so embarrassing. Our oldest is going 5 days a week, so now his tuition is $350 per month; our second’s tuition is $175 per month.

Our 0% introductory interest rate on our credit card we opened 15 months ago expires at the end of this month, so that’s over $5k that needs to be paid. Then our credit card statement balance owed on our regular card is about $4,800 because of large rental property expenses. I haven’t paid it yet because I need to transfer money from savings, so I’m waiting until the last minute to do that so we can earn interest on that amount.

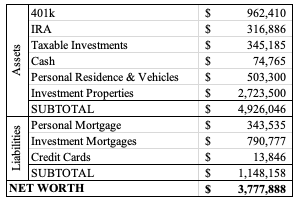

NET WORTH

Nothing too exciting to note here. Credit cards are still high, but that will be significantly different next month with our 0% interest card being paid off.

I asked Mr. ODA for his 401k updated amount yesterday, and he made a comment that I should wait to update until today because the market went up yesterday. I had already done the majority of the work, but an ailment and children meant I didn’t get to posting yesterday. So this morning, I updated just our investment account totals to see the difference. The chart above is yesterday’s numbers. Today’s 401k, IRA, and taxable investment account totals are $10,000 higher today than yesterday. That means that if I had updated the numbers today instead of yesterday, we’d be showing an increase in net worth from last month’s update by about $6,000. Instead, I’m showing a slightly lower net worth by about $4,000. It just goes to show how much the market can affect the numbers on any given day, and my net worth in trending generally upwards, but it may not seem that way because of one day’s market closure.