We had a long term tenant in this house, who moved out last Spring. We luckily had someone lined up looking for a place to live. There were a few red flags from the beginning, but I went with him because he was a friend of an old tenant of ours. Rent was always paid on time, and everything went fine. Unfortunately, there was a public incident at work in the Fall and he was let go. He asked if he could be released from the lease so he could move back home.

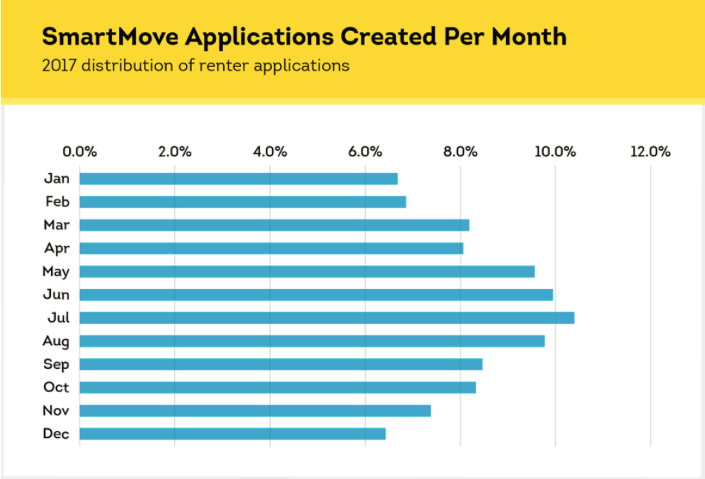

I wasn’t interested in making anything more difficult for them. I didn’t ask for a lease break fee; I just asked that they continue to pay rent until we found someone who could take over the property. It was winter and holiday time, which is least favorable time of year to be finding a renter. They gave notice at the end of November and we listed to house right away. We did our due diligence to get someone in there as best we could, considering it was Christmas time and the middle of winter. The tenant paid January rent on the 1st, as required. Luckily, we were able to get someone moved in on January 5th. The tenant didn’t do anything wrong to the property, so I gave back his security deposit and the January rent they had paid.

TURNOVER

The original tenant had essentially vacated the property, so we were able to get in and do some work to it. The entire place was painted and had extensive maintenance needs met over last summer (after the long term tenant), so this was an easy task to get it ready for a new tenant.

We received a notice from the city that the yard needed to be cleaned up, so we had the tenant go over there and do the work. There was a tree limb that had fallen (and wasn’t reported), so we had someone go clean that up and the rest of the yard for $100.

Several years ago, we had replaced most of the windows in the house. There were 3 windows that were either fine or oddly shaped, so we didn’t replace them. That was a mistake. We ended up spending the same amount on 3 windows this year that we did several years ago for 6 windows.

The front porch of the house is seldom used. The driveway is in the back of the house and leads straight to the kitchen door. The entire front of the house is fenced in too (the house has a huge front yard and small back yard). Due to the age of the house, that it’s a rental, and that the front porch is rarely used, it wasn’t in great condition. It was finally time to replace it. We had our handyman rip out the stairs, banisters, and floorboards to replace it all; it cost us $1,640.

The kitchen faucet wasn’t working right, so we had our plumber replace it. He also tried to flush the water heater to extend the life, but it was broken enough to replace it. We needed a special size because it fits under the counter in the kitchen, so that was $1500.

Other than a clean from our cleaner, that was all that we needed to do.

TENANT SCREENING

We had 4 sets of people show interest in the property. One withdrew her interest form after checking the sex offender registry (understandable, but it is a city home, so that’s not surprising). I was interested in another guy who was retired and seemed handy, but as time wore on, there were several red flags. Another person tried to convince us that his day-trading of stocks qualified him to pay us rent each month, so he was disqualified for not meeting income requirements. Finally, a couple showed interest, and my property manager said they seemed like a decent option in person, so we went with them. At the time, I didn’t really comprehend that one of the tenants was only 20 years old. That comes into play when he shows his age and inability to handle a mature conversation about rent payments a couple of months later.

Due to the unexpected timing of turning over this house, we ended up with an 18 month lease. We didn’t want a 12 month lease, leaving us with another winter turnover. Even though their lease started January 5th, I counted the full month and ended the lease on June 30, 2025. I like a May 31 or June 30 lease ending the best because it seems to be when the most people are looking to move. Once you get to July 31st, most people (in the southern states, at least) are looking to have already been settled in the school district they wanted.

TENANTS THUS FAR

Well, since I had plenty of posts teed up, I’m only getting to post this now, months since they’ve moved in. That means I have a sample size of their tenancy to share, and it’s not good. They’ve had a lot of complaints, which is interesting to me since the previous tenants didn’t seem to have many issues with the house. It’s a 1943 house. It’s not perfect. It’s not spacious. But I assure you, the house is exactly what you see when you first tour it. It’s a cute, little, old house.

The tenants used Venmo to send the first sets of payments when moving in. For some reason, they decided to switch to Zelle; in doing so, they didn’t follow the instructions I gave them, and are sending them to an account I’d prefer them not to, but oh well. In March, rent arrived on the 6th. I was bothered by it, but I let it go. Then for May’s payment, we hadn’t received it by the 5th in the evening. Our property manager reached out to them to ask if they planned on paying that night. They said they had already paid on the 2nd. We explained that we hadn’t received it, and we still see no indication of it arriving electronically. He sent a screenshot of his bank’s information, which did confirm a payment on the 2nd. We said ok, thanks, and we’ll check in the morning.

He then went off the deep end. He attacked us, as if we just sit around pretending we don’t receive money so they’ll send more money. At no point did he stop, think, logically read our messages, and respond politely. He continued to berate us and the property manager over this, where we carefully explained that sometimes there’s an additional verification step required so that this 3-5 day hold doesn’t affect when rent is due. He kept saying he was completely verified and that it’s our bank not accepting the money. That’s not how banks work, but ok.

He eventually agreed to use Venmo. I went back to his January payments, liked them, and ‘friended’ him on the platform so that he’d have the right account in front of him. He did pay June’s rent on time and via Venmo.

In his berating of the house, he talked about how the house was awful. The house that they walked through and agreed to rent. The house that is very small and very old, but is clean and operational. The house is nothing special, but it’s a house with rent under $1000 in 2024 and decent access to the activities in the city.

They complained that the light in the oven was stuck on. They didn’t want to pay to run that electricity in a house that already had a high electric bill. It’s an 800 sf house; if you’re paying $350 per month for electricity, I’d say you’re doing something wrong. All systems in the house have been serviced and/or replaced recently. All the windows in the house are no more than 5 years old. We had our plumber lined up to handle this for us (he’s a good guy!), but they figured out what to do differently to get the light to turn off. What frustrated me the most about this complaint was that they acted like I purposely broke their oven 3 months after they moved in (and I live in a different state), and yet I’ve been very responsive to all their requests for maintenance.

SUMMARY

Overall, everything is fine. They have a lot of growing up to do. I hope at some point they learn that you catch more bees with honey. For now, they’re there until the end of April. We’ll see how the next several months go, but at this point, I’m interested in finding someone else. Based on their hatred of the house, I expect they’ll move out on their own accord regardless.