I’ve been working on the ‘year in review’ posts for 3 months. I really want to be consistent on tracking our spending and making sure I’m being intentional in our spending. Our main credit card had the nerve to tell me that it was exporting 461 line items for me to categorize and manipulate in Excel. We have 8 credit cards. So that wasn’t a fun realization.

Additionally, if I track it more than once every two years, I may be able to better categorize our spending. For example, a Walgreens purchase may be pictures that I printed, or it could be a prescription. My Amazon purchase may be clothes for the kids they needed, a gift for someone, something in the home improvement category, etc. The entertainment category can include exercise that we’ve paid for (e.g., 5K, ultimate frisbee, kids’ activities) or a trip we went on.

There’s also no direct way that I’m tracking where a credit card expense has been offset by someone paying us back. For instance, I put $980 on my credit card for a trip, but someone paid me $480 for it via Venmo. That offset is in my year’s total transactions, but not in a manner where I can capture it for this year-long-view of expenses. Additionally, we go out to eat at restaurants, but Mr. ODA gets paid for some of those as a secret shopper.

EXPENSES

This doesn’t identify the actual money spent in each category, but it shows how categories align with each other. To simplify this graph (and to allow all bars to even be seen), I combined several smaller categories into an overarching category. For example, the entertainment category includes anything from doing a brewery tour to traveling to another state. Home Improvement includes $10,000 worth of new carpeting, so it’s an outlier. This also doesn’t include expenses that were paid for out of our checking account(s); although nearly all of our expenses are paid via credit card to gain the rewards.

MEDICAL: We spent the first half of the year managing doctor appointments. They were mostly for the baby, and then halfway through the year, I started having serious vertigo issues. The baby was born a little early, had jaundice, diagnosed with reflux and put on medication, and then had trouble gaining weight. My 3rd baby then needed to have formula supplemented, after I nursed two kids and had extra milk to donate to NICU babies. That was an unexpected psychological and financial change. Once he started to become healthier, I hit a wall. After a week of wondering why I kept feeling lightheaded and dizzy, I woke up one morning not able to walk a straight line, and if I even attempted to, I’d throw up. I was diagnosed with an ear infection, which seemed to make sense, but the antibiotics didn’t stop the vertigo episodes. After several specialists, I was given the same thing that I always am: “your symptoms don’t fit neatly into any one category, and I don’t know what’s wrong with you.” Luckily, most of my symptoms have died down at this point. And thankfully, outside of random viruses and a bout of pink eye through 3/5 of us, the others were healthy.

SPORTS: We joined the Y and were really strong for the first 3 months. Once my mom died, I didn’t have it in me to go exercise, and then I got sick for most of the summer with that vertigo issue. Mr. ODA played softball, vintage baseball, and ultimate frisbee; I was able to play some ultimate frisbee and run a 5K. The kids did swim lessons at the Y (and was quite a terrible experience). Our oldest attempted soccer for the second time, and then cried through all practices and games. Our middle thrived in ‘acro’ for the second half of the year. I plan to finish our this semester with her in acro, but I think she’s going to love gymnastics after that.

TRAVEL: We traveled to NY for my mom’s funeral. I took 3 flights in a few days with the baby, all with points (which American Airlines was super easy to work with for last minute flights and using points). We went to the middle of nowhere Tennessee with Mr. ODA’s family, to NY two more times, a short family camping trip, to Indy for some kid-related fun, and a trip to Cincinnati to see Christmas lights and take the kids skiing for the first time. I bought myself new skis (I had been snowboarding for the last 13 years), which led to buying the kids ski equipment (although, it’s noteworthy that we bought them second hand and their skis and boots totaled $100 for two kids). That then led to buying mid-week season passes at our local ski resort. On top of our family trips, Mr. ODA took two work trips, a golf trip, and a mountain biking trip.

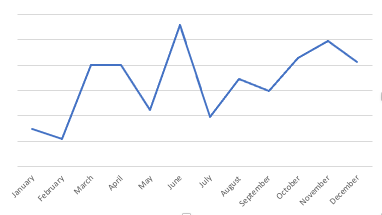

GAS: Typically, our gas usage can correlate to our travel because we usually drive somewhere instead of fly with 3 little kids and all the gear they come with. In June and November, we drove to NY, so those have bigger spikes in the graph below (June also included a trip about 4 hours away). In the beginning of the year, we were more interested in staying home because we had a new little baby, but we ventured out more towards the end of the summer.

RESTAURANTS: I was pleasantly surprised to see the amount spent each month in this category. I didn’t feel like we ate at restaurants all that much in the last year, but I was concerned with whether the numbers who support that. There’s an outlier in March because we spent a lot at one restaurant during the week of my mom’s funeral. On Long Island, food is a big deal; while every one else was paying for meals, I felt it was our turn. We don’t need to actually mention how much that meal was. May’s spike was simply the volume of times we went out to eat, and the majority of them being related to Mr. ODA’s secret shopper gig.

HOME: In July, we had a storm come through that wrecked our neighborhood. No one reported the damage to the National Weather Service, which makes me sad because I wanted to know if it was a tornado! We had several trees fall. One took out our deck, another took out our fence, and another cracked our driveway, but missed Mr. ODA’s car by centimeters. We fought insurance for 5 months, and now we’re in the queue to have it replaced some time late Spring.

CAR: We bought a car. That’s $6,000 worth of the “Home Bills” category. Since most of our bills actually can’t be paid by credit card, it’s surprising to have such a high category for that on the graph, but that’s why. They allowed us to do two $3,000 transactions on a credit card so we could get the points, and then we paid the balance by personal check.

GROCERIES: I’d like to watch this spending more in the future. A purchase at Walmart may include non-grocery items (e.g., shoes), but that is being lumped in with the groceries because I can’t possibly siphon out individual transaction expenses for an entire year in one sitting. So here’s a graph of our “grocery” spending per month, but noting such a caveat.

SUMMARY

While I know we’ve had some larger one-time expenses, I’m still not happy to see the amount spent in each category. I feel we’re diligent in our food spending, but I think we can reduce that amount.

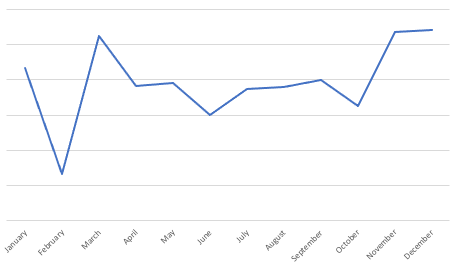

I removed rental information, any rewards received, the $6,000 car purchase, and the $10,000 worth of carpet purchase to try to show that our spending is consistent month-to-month. Again, the baby kept us home in January and February, but we’re generally consistent in spending. I hope that I can review our expenses more often going forward so that I can more accurately categorize our spending.