In November 2023, I posted about rental changes that had occurred over the previous year. I wanted to update that analysis a few months ago, but I didn’t have all the KY data. I recently shared that my rent increases aren’t covering my cost increases, and my portfolio’s cash projections are lower now than when we first purchased all the houses. Here’s more of a breakdown of those changes per house.

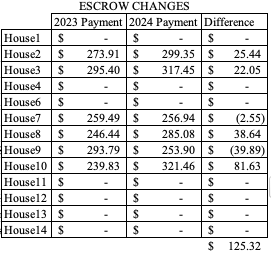

ESCROW

Escrow is an account that your mortgage company holds money to pay your insurance and taxes on your behalf. I have little faith in their management, as I’ve had to follow up on balances in the account and payments made incorrectly.

I created this table to show the differences between escrow payments over the two years. I kept the houses that don’t have an escrow because it can be compared to a future table in this post. There is no House5 in this table because we sold it several years ago (houses didn’t get renumbered because House5 still exists in terms of tax documentation).

INSURANCE

We had 3 insurance claims last year, and a big one the year before. It turns out, our portfolio is looked at as a whole, so 4 claims in a 12 month period doesn’t look good, especially when one of those was 6 digits and one was 5 digits. None of it was egregious, and they were each necessary. We were just a victim of poor timing (and for some reason, the 12 years prior to that with 0 claims of any kind mean absolutely nothing). While our own history is to blame in some aspects, insurance costs as a whole are increasing quickly over the few years. Here’s Google’s AI response:

And with that between payments made in 2023 and payments made in 2024, insurance is costing us almost $2,000 more for the year. I also just made my first 2025 payment, which increased that one house by $343. The total increase from 2022 and 2024 is over $3,000.

From the initiation of insurance on each house (so, when we first bought the house, which were mostly between 2015/2016) to today, we’re paying over 43% more in total for insurance.

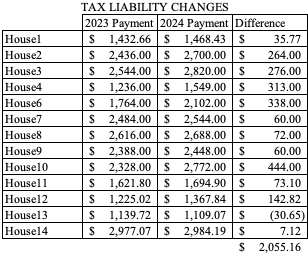

TAXES

The table below shows the change between 2023 and 2024 for our tax payments. Last year, many jurisdictions that hadn’t captured the assessment changes since the pandemic made up for it last year, when we saw about a $3,500 increase for the year. This year, our increase was over $2,000. Fifty-five hundred over two years is nearly $230 per month, spread over 13 rental properties is $17 each. So for those that I didn’t increase rent last year, they’re not capturing that cost increase for our portfolio.

RENT INCREASES

So far this year, I’ve missed two opportunities to increase rent. I had planned on increasing one house by $25 to keep up with inflation costs, but it didn’t register that their notice had to be given by 1/1 (every one else is by the end of the month). The second is above market at this time, which was by design since they’re not easy to work with (tried to phase them out, but they accepted the rent increase). We last raised their rent in September 2022, so it’s been two years. But I couldn’t bring myself to do it. Next year we’ll increase them by $50 per month.

My plan is to increase the rent for 5 of our other houses. Four of these houses are planned to be $50 per month of an increase, and one is planned to be $75. Our management is generally to increase rent by $50 every two years if you’re a long term renter. There have been a few that we didn’t increase for a while, and the carrying costs have drastically increased, so we’re behind now.

SUMMARY

For our cost increases between taxes and insurance, we have over $4,000 that was paid out last year (and it’s really more than that in cases where the house has escrow, so our escrow was increased more drastically that the specific amount of change in bills).

We had 3 houses turnover from long term tenants, so we were able to increase the rent to market value. I prioritize keeping long term tenants, so I don’t always do rent increases. That means that sometimes the rent is stuck below market value, but I’d rather keep a good tenant than push them out with large annual rent increases.

By bringing those houses up to market rent, I’ve made up a good amount of our deficit. Now remember, these rent increases are catching up on multiple years of drastic increases. So even though it seems we’ve brought in more, we’re both making up for previous years that didn’t have such large rent increases and paying for more large scale improvements to these houses, in addition to larger contractor costs.