This month was unbelievably painful financially. And yet, I appreciate that we’ve set ourselves up that we can handle these things without stress, even though the balances on credit cards made me feel like I was drowning. At one point, we had over $30k on credit cards. I’m still juggling life as a mom, financial consultant, part time worker, and volunteer on the HOA board. Oh, and managing two vacant rental turnovers, throw in 2 trips away from home, and school starting.

RENTALS

We had one house pay late, with little notice and communication (if you’ve been here, you know this is a pet peeve of mine). They paid the late fee at least. I had another house pay partial on the 3rd and then true up on the 6th. Again, no communication, and she beat me to asking what the deal is. I also had a tenant who already pays twice per month be late on both of this month’s payments, so that also brought in late fees.

In a story for another time, we have two vacant rentals. 11 of 13 houses renewed. Two houses each actually moved out of state, and unfortunately, my kind heart scheduled both of them to end their leases on July 31st. We’ve been spending all our time at these two houses. The one had smokers in it (against the lease) and we’re struggling with that. We’ve replaced the carpet and painted all the walls (except 2 closets and a powder bathroom) and it still smells funky when you walk in. Then there’s just the routine type turnover things like scrubbing and wiping dirty hand marks off the door frames. All of these things will be detailed in separate posts. The other vacant one was quite the story, so that’ll be multiple posts. Our attention isn’t as heavily on that one because we’re going to likely sell it instead of re-rent it.

We replaced a roof ($5500), replaced an HVAC ($8300, but split with a partner), evicted bats ($1480), and made decisions on flooring replacement in another house with extensive termite damage. Seriously. Financially painful. Coming this next month, we will also be paying for termite repairs at another house where we tore out carpet and laid LVP.

HEALTH COSTS

I tend to focus heavily on this topic in this blog. It’s surprising because it’s not really the niche of making money, but insurance and doctor bill processing seem to be wrong more than they’re right. Therefore, it falls more into “protect your money” than anything else.

This is a longer story for another post yet again, but the gist is that the insurance company took 6 months to process a claim. They sent me the bill in June. I called 3 weeks after the bill arrived to find out they had sent my balance to collections because their system flagged it as a January overdue balance…even though this was my first invoice on the matter. Love it.

The end result here is that we needed to add $1600 to the credit card.

PERSONAL

I don’t know that there’s much personal life happening with all those other things we’re managing. We took 2 trips. One didn’t cost us much because the grandparents take care of a lot of the cost, another one cost us more than usual because I put a lot of effort into food that we usually don’t do when we travel there. Overall, the trips were fairly inexpensive financially, but they took a toll on me due to the time commitment and what we had to give up by doing these trips.

Otherwise, we’ve just been wrapping up summer and starting school. We’re about to get back into baseball season with lots of practices.

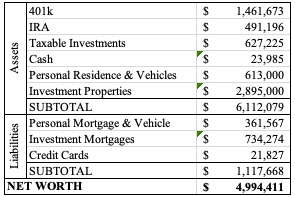

NET WORTH

The market had a big jump last week and my update of financials occurred Thursday morning. Unfortunately, life put a blog post on the back burner while we were turning over a rental, so I’m only getting around to posting this now. The market is in a fairly similar spot as of yesterday’s close, and I’m thinking we’d even be over $5 million if I were to fully update our financial status right now. We’ll just hope for the best for next month.

In October, we’ll pay off our $15k credit card that we’re carrying, so that will be a big swing in our credit card balance two months from now. We need new windows at our house (the seal keeping in the gas between the panes is going on quite a few windows (or went years ago), and it creates this streaky dirty look to them), but I think I’ll appreciate not carrying this large credit card balance month to month while we utilize the $0 interest for a while.