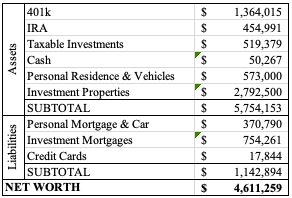

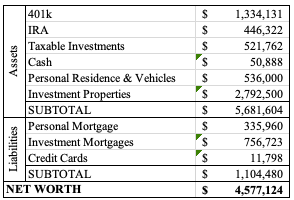

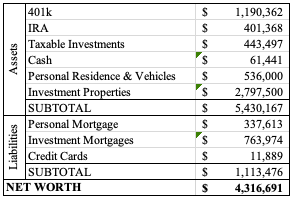

We’ve hit some pretty big milestones financially. Mr. ODA casually mentioned a certain number by a certain age, but our goals were more associated with quitting our full time jobs. I quit my job in May 2019. We’re in a situation for a couple of years where we’ve been ready for Mr. ODA to quit, but we keep pushing the date back because his job isn’t preventing us from doing the things we want to do.

How did we get to the point where we replaced my income and I could quit working without scaling back anything financially? We took risks. Some of them were big ones. Some of them weren’t so big, but they felt big at the time. Most risks worked in our favor, but some did not.

RETIREMENT ACCOUNT LOAN

Mr. ODA and I both worked for the Federal government. Their version of a ‘401k’ is the Thrift Savings Plan (TSP). There were two loan options that were available: a primary residence loan or a general purpose loan. You then repay the loan back to your account with interest (the interest is paid into your account as well). When we took our loans, the rate was just over 2%. According to tsp.gov, the rate is currently 4.75%. There’s a fee of $50 to take a primary residence loan and a fee of $100 to take a general purpose loan.

While you’re missing out on the compound interest of your account when you take the loan, the ability to buy our own house, create that equity, and be at the beginning of our careers made the decision easy for us. We made extra payments during the repayment period, and we were able to adjust the regular payments up and down based on our financial needs each month. We have no regrets in our decision.

ADJUSTABLE RATE MORTGAGE

An adjustable rate mortgage (ARM) sounds scary. A variable rate. Most people are used to locking in a 30-year mortgage. I’d venture to say that most people also think they know what an ARM entails, so they don’t even consider it. We considered it. We looked into it in great detail. We couldn’t see why more people didn’t use it. We actually were very hesitant over this decision the first time because an ARM’s reputation is very negative. However, we took our time to lay out the numbers and see what would work best for us.

The first time we used an ARM, we knew we had no intention of being in the DC area for more than 5 years. By using an ARM, we saved thousands worth of interest in our mortgage payments over the three years we owned it.

There are several “fail safe” parameters in an ARM. For one, you do lock in a rate for some period of time. We considered 5 year, 7 year, and 15 year options. Then after that period of time, your rate can only adjust within the contractual terms. For example, we have one rate that can adjust 2% in either direction at the 5 year mark, and then 1% for each of the following 4 years after that, with a cap of paying a maximum interest rate of 7% (this is an old loan, clearly). The rate adjustments aren’t a given, and they’re adjusted based on the prime rate at that time, not based on the whim of the bank or the maximum it could increase.

We also ran the numbers based on the interest rates. An ARM’s incentive was that the interest rate is lower than the 30-year conventional loan rate. I don’t have the details since this post is more of an overview, but the ARM saved us money we paid towards interest. Interest is a higher percentage of those earlier payments in an amortization schedule. We either sold the house or paid the loan off early, so the ARM adjustment never came into play, and we saved all that interest cost.

BUSINESS/COMMERCIAL LOAN

A series of events had us asking a local credit union about loan options. They offered us a commercial loan. This one has a big catch though: there’s a balloon payment. Our loan is amortized over 30 years, which is how our payments are calculated. However, the balance of the loan is due at the 5 year mark. That balance is going to be about $175k. We have no plans to pay that off by that time (we aren’t even making extra payments towards it). We will refinance it. The pro here was that our interest rate for a loan closed on in 2022 was 3.625% (when mortgage rates were in the 5% range). Hopefully by 2027, interest rates are lower than they are today; this is a gamble at the moment.

PARTNER

There’s a cap in the “Fannie/Freddie” world of the number of mortgages a person can hold. That cap is 10. There was a point where we had completely leveraged ourselves and ran out of room. We had a Realtor friend interested in more rental properties, and he agreed to front our down payments, which we’d pay back with interest, and have a 50% share in the houses.

We signed an agreement with him that outlined our payments to him for the down payment he covered (which we paid off in about 3 months), and it established our 50% shares in the two houses purchased via this method. We purchased the houses in April 2018 and February 2019, and put them in a limited liability corporation (LLC). Each month, I collect rent from the houses and pay out our partner’s share. These houses don’t ask for much (one has been rented since before we owned the house and one has a tenant that has been there a few years), but if they need something, I handle coordinating the maintenance request. We should have set up a schedule where I’m paid for my time since Mr. ODA and our partner really don’t do anything for these houses, but luckily the requests are few and far between. We split all costs 50/50.

RENTERS WITH COMPENSATING FACTORS

I have several examples of entering into lease agreements with tenants that don’t have a perfect record. In these instances, we typically request some sort of compensating factor (e.g., a cosigner, an additional security deposit). We give everyone the chance to tell us about their financial and rental history before we run a background check on them (telling us doesn’t cost anything, but a background check does).

We had a prospective tenant not disclose a bankruptcy on her record. I could have immediately disqualified her and her husband, but I gave them a chance. They lived in that house for a year. They only moved because his job after grad school took them out of the area, but they set us up with a new tenant at their departure, and she stayed there for several years. Then they moved back to the area, and they requested a house of ours. We had one available, so we happily had them move into it. There’s one success story from giving someone a second chance.

I also have a couple that doesn’t have a happy ending. We had purchased a house without vetting the area. I had fully vetted a house two blocks away, but I learned my lesson that the crime of an area doesn’t need more than one block to change its ways. This house was in a bad area. The house itself was adorable. It attracted wonderful people to come see it, but they’d check the crime history of the area and decline applying (understandably). Someone came forward with a 448 credit score. That’s pretty bad. She wrote a really nice letter though. She disclosed everything up front and said she just wanted a roof over her and her son’s heads. I believed it. We then spent months and months struggling to get her to pay her rent, even offering her a payment plan several times and changing her lease structure to allow her to pay twice per month (hopefully eliminating the constant late fees she was accruing). We eventually gave her 30 days notice to vacate the premises due to lack of payment. She didn’t even make it a year. Instead of listing the property for rent, we ended up selling it. That was a whole other debacle where we entered into a contract to close by September of that year, but we didn’t close until the following January due to the lack of financial qualifications on the buyer’s end.

PAID OFF LOANS/MORTGAGES

This doesn’t appear to be a big risk. What could go wrong with paying off your mortgages? Well, if we didn’t have a cash reserve, and there was an emergency, then we paid off these loans with the cash on hand, leaving nothing to cover that emergency. However, those dooms-day concerns rarely come to life, and we had continued cash flow that replenished our accounts.

The positive here is that we freed up cash flow. Instead of having mortgage payments to make every month, we now have the cash to go into savings or towards any higher-than-expected bills. Besides the house we sold, we’ve also paid off 6 mortgages. That means that we’ve paid less interest to the banks, and that’s more money in our pockets.

We haven’t paid off any other loans because they’re all below 5% interest (they’re actually all below 4% except for 1 with our partner, and we would need his buy in the pay that off, which he hasn’t wanted to do). After payments to mortgages, our property manager, our partner, and utility payments, we have over $8,000 in cash flow per month. I will note that this doesn’t include things that I need to save up for each year to be able to afford (e.g., taxes and insurance), and it doesn’t include maintenance needs that crop up. Cash flow is important for us because if Mr. ODA quits his job, that’s less income to offset our regular personal expenses.

FINANCIAL AWARENESS

On any given day, we’re weighing several financial decisions fluidly. There are the givens that we have to pay the bills that are out there. I have to pay all the mortgages and utility bills. I weigh the best time of the month to pay each bill, which means that I may not pay them as soon as the statement arrives, but may wait until closer to the statement due date (but never carrying a balance unless it’s 0% interest). Then there are the options such as paying additional payments towards a credit card with a 0% interest rate, additional principal payments to a mortgage, or additional investment plans. We’re not looking to apply for any loans, so the $9k balance on a 0% interest credit card doesn’t have any attention of mine except the $500 I pay each month. I have it marked on my calendar when that 0% introductory rate expires, and I’ll have to pay the balance in full.

Our money is handled by a full, big picture, approach. Each day, there’s a chance that we come to a fork in the road and make a different decision because the variables changed slightly. We don’t put our money into “buckets” or “envelopes.” In my experience, people who handle their money like this end up overspending.

We hit our goal to replace my income well before our son was born, but then I kept working until he was 9 months old. While I was still working, we could have easily said, “we hit our goal, but since you’re still working, let’s put all that money into a slush fund of some kind.” When people see any “extra” money, they then look for their next splurge. They feel they deserve something for saving money instead of putting that extra money to work for you and your future.

There are those “autopilot” moments in our finances, but when it comes to making a big change, we put pen to paper and check the details. We aren’t going to take $100,000 out of our investment accounts to pay off a 2.5% mortgage. But one day, we will have to consider what to do with our loan that has a balloon payment, which shows it’s not a hard and fast rule that we won’t pay off anymore loans early (because if interest rates are still at 7.5% in 2027, it may not be worth refinancing that balance).

LIVE SMART WITH INFORMED DECISIONS

Take the time to make informed decisions and research the data for yourself. Run models with the projection of money to see for yourself if it works in your situation. Don’t spend your days listening to other people’s opinions on actions. If we had listened to opinions, we wouldn’t have taken a TSP loan or taken out ARMs.

We’re at over $4 million net worth, have a solid cash flow (which is important because if our net worth of $4 million was tied up in a retirement account, that wouldn’t give us the ability to live comfortably now), and have plenty of money going into accounts for the future (for both us and the kids). Our spending is managed regularly with an ingrained thought process. Take the small, first step for yourself without other people’s opinions weighing you down.

If you want to live differently from everyone else, you have to take action and think for yourself.