We started getting emails about end of school year activities, and boy was that a surprise that we’re at that point. The middle one is done mid-May and the big kid is done at the end of May. Less than 2 months until summer break.

Mr. ODA took the second round of the government’s offer for administrative leave, which means he would only have a few weeks left working. I’m still working my part time job, which is taking way more hours than we had planned for. I’m enjoying it, but it’s been a juggling act with the family, which is probably why my son who absolutely loves school begged me to stay home because his belly hurt last week.

Buckle up because apparently I have a lot to share this month.

RENTALS

We received about $600 in tax payment reimbursements from one of our localities, so that was a fun surprise this month. Really helps my psyche that I have a tenant who hasn’t fully paid, didn’t tell us why ahead of time, and hasn’t been up front with when she’s going to actually pay us.

I executed 2 short term leases. Both included a rent increase for their short term period; one house is increased by $75 and the other by $25. Luckily, both are here in the Central KY area, so we can flip it between tenants. One is scheduled to leave June 30th. That house will need new carpet in the bedrooms, and it’ll need probably a whole-house paint job again. They smoked in there, even though we covered the lack of smoking rule multiple times. I’d be more upset about it if the carpet hadn’t reached its useful life years ago. The other house leaves July 31, and I can’t even tell you where we’ll need to begin with that one. She made a wood feature wall without permission. She had a giant fish tank without permission. She spent a lot of time doing things that really weren’t an improvement, so I’m definitely worried about what we’re going to uncover in that house. Mr. ODA and I are talking about fixing it up and selling it. We may look for a short term renter so that we can sell it in the Spring instead of this Fall.

I had 2 other properties accept a rent increase that will go into effect later this year. I require 60 days notice for changes so that starting at the 30 day mark I can begin advertising it if needed. One house goes up by $25 per month as of June 1, and the other goes up by $50 per month as of July 1. I also have another property that has a rent increase of $50 per month going into effect next month.

I have 4 houses that renewed another year, and I didn’t change their monthly rent rate. There are 4 more houses that haven’t been discussed. My intent is to have them renew for a year at their current rate. There are 2 of those 4 that could leave at the end of this term, but time will tell.

We have multiple maintenance issues to address. One house requires a tree trimmed off the roof, the siding cleaned, and the back deck stained/painted. We still have termite damage we’re dealing with at a house in Richmond. I have a leaking toilet that was just addressed, and then they hit me with a faulty HVAC unit during a heat wave. Then we have some houses that really need eyes on them to see what condition they’re in at some point this summer back in Richmond. It’s amazing to me how people just don’t care to tell a landlord that something is broken. I woke up this morning to a text that one of the houses here has a flooded basement due to a water heater failure.

I spent some more time fighting my insurance guy here. It irks me so much when I see him offer up his services on the local facebook group for property owners. He’s quite terrible. I sent him photos of a house that had some issues with a cluttered backyard and had the tenant clean that up. I had to fight him last month on an increase where he changed one house from a crawl space to a basement when I assure you that the vines growing through the windows solidify it should not be deemed a “basement.” When the dust settled from that debacle that he was insanely unresponsive to, I ended up owing $9.68. When I asked why my account wasn’t put back the way it was found before this mess he created, he said he didn’t know but it’s probably from the audit and changing square footage. HIs guessing and not actually answering infuriated me. I gave up and paid it, but then I ran to get quotes from other people. I hadn’t done that before because our 4 claims in a 12 months period are killing us (again, because I really wanted trees to fall on us!). I hate when people make the claim that because it’s not a lot of money, I should just give up and accept it. That’s a ridiculous way to treat people.

PERSONAL

Our electric bill is almost double what it was this time last year thanks to the vehicle charging and hot tub. Our electric bill is relatively low, so that’s not all that surprising. We also have 5 full people in this house now (as much as you can count a 2 year old as a full person… but he knows how to control light switches and eats a ton of food that we need to cook him, so I’m sure he’s a factor there!).

I’ve been working at my new part time job for over a month now. Mr. ODA was making fun of my hourly rate, but I’ll tell ya, it felt good to receive a paycheck that wasn’t $45 like it was for a day of subbing at the preschool.

I took the kids to get haircuts. My middle has had her hair cut once before, but I’ve cut the boys’ hair forever. I had family coming into town and the oldest was looking really shaggy. So I swallowed my pride and threw money at the problem, which is very out of character in this household. I just didn’t have the time to cut their hair, clean them, and clean up the mess. For $66 and 45 minutes from the time I left home until I got back, it was well worth it to me.

I had a medical procedure done this month. We haven’t met our deductible. In February, they said I had to pay my deductible to them. I said that didn’t make sense and refused to have them hold $2800 of my money for 2 months. They gave me an attitude and said I could never ever ever ask for a payment plan in the future, so that I could pay $500 to hold the date. I then showed up for the procedure, knowing I haven’t met my deductible, and they didn’t take any money from me. Another business model that bullies the customer into illogical money decisions. I also had an eye doctor appointment that was frustrating in itself, but I’ll spare you those insurance and communication details.

On top of everything else I’m juggling, Mr. ODA is coaching our kids’ t-ball team. Coaching means that I am team mom. That means that I’m responsible for communicating updates from the league (in the slow and haphazard fashion I receive information), gather value card sales that are required of every team member, organizing a basket for a raffle, and the best one – raising $350 for team sponsorship. What the heck, man?! Where did I say that my signing up of two children to play in the league means I have history or ability to gather money from businesses?? Well, I did it. I raised $350 and another mom raised $200 for the team.

No financial impact, but I’m also juggling our HOA board duties. I released our longstanding property manager and hired a new company, which took effect April 1. That’s taken a lot of time to get them stood up and make sure we stay on track for our annual meeting schedule in June.

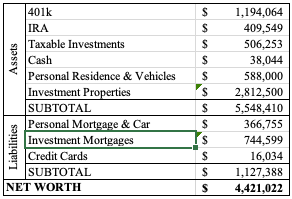

NET WORTH

And with all of that said, that doesn’t even address the giant reduction in our investments that continues to happen. To counter some of the loss, I updated our property values for our houses. I don’t do that every month because they don’t move very much, but I can usually count on a few increases as the spring market ramps up. Our net worth did slightly increase (based on yesterday’s market closure, not today’s) from last month, which was a nice surprise.

I wonder why I’m tired and bogged down, but that post outlining what I’ve done recently made me realize all I was able to accomplish even though I felt like I was a jack of all trades and master of none. Hopefully things will settle down in our lives going forward now, even if I know there are definitely two house turnovers in my future.