This was a good year. We took a lot of trips, made some good memories, and purchased some fun things. While day to day life has been hard with 3 little kids and managing some of my own interests, it really was a fun and rewarding year when I look at the big picture.

PERSONAL: MY YEAR

I went through a lot of growth in this year. I started the year with a girls trip, which was really healing in my mom-of-3 world. After that trip, I hunkered down on my diet and exercise. Over 10 months, I lost 22 pounds. Each kid added about 10 pounds to my body’s desired size (where I just plateau unless I put a lot of effort in). It’s not something that I regularly discussed with people or mentioned, but it is something that I’m pretty proud of and took effort. I ran a 5k in August, where I beat my time from the year before, and it didn’t feel like it took any effort to beat that, which was nice.

But then my oldest started kindergarten, which was a surprisingly hard adjustment in my schedule. He was completely ready for school, and him going wasn’t the hard part. I welcome new phases of life and mostly don’t dwell on the losses that those mean. However, the schedule of the year took me two or three months to get used to. He gets on the bus at 7, #2 gets dropped off at 9, she gets picked up at 12, baby takes a nap from 1:30-3:15, oldest gets off the bus at 2:45. It was just a lot of broken up time in my day, and it took so much out of me each day. I finally feel like I’m used to it and can be productive in those short periods in between.

We were told that our preschool will be changing ownership next school year, which threw a wrench in my plans. Sure, things will work out. But it doesn’t change that I had a plan that didn’t need to be thought about. I had a financial expectation that didn’t need to be budgeted for or considered any further. It was another thing that took mental energy from me. I had originally thought I’d not send the 3rd kid to a 2s year like the other two kids. I spent some days mourning that alone time I was giving up by keeping him home. But I toured a preschool, and that’s my wish list for next year. If we don’t get into that preschool, I’ll likely just keep him home with me and try for the 3s year there. It’s just a socializing desire. I don’t work and need child care, so it’s a privilege to send him if it works out.

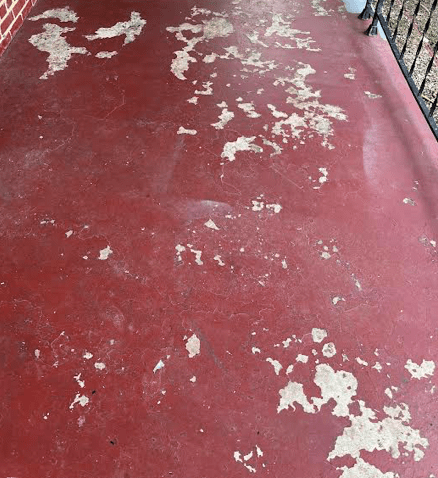

On top of all the parenting jobs I have, my job managing our rental properties is another job that takes a ton of time and mental energy, but no one really sees the fruit of that labor. May was the only month this past year where everyone paid rent on time. While I’m pretty lenient on that, that’s still time that I’m taking to manage and keep up with. I have one tenant who hasn’t put the water bill in her name yet. Supposedly it’s a city issue, and she always pays when I send her a picture of the bill, but it’s still a time sucker that I have. Then add in that we have several maintenance requests that come up, and a few big projects that were needed.

Related to the rentals, I made 44 posts on this blog. I set a goal to post once per week, preferably on Thursdays, for the year. I fell short by 8 weeks, and I wasn’t consistent with the Thursday post each week. I did well when I had inspiration, and I always did the monthly updates, but I didn’t meet my goal. I’ll keep the same goal of once per week, preferably on Thursdays, for this year. While my reach isn’t far, I do hope that someone will find this little corner and gain a new perspective on their finances. Plus, I appreciate being able to go back to our monthly updates to see how things have changed. It’s hard to see it when you’re looking month-to-month, but to see a drastic jump in numbers from a year ago is nice.

PERSONAL: THE FAMILY

We made it to 12 states this year, and that’s pretty cool. The kids got to see a lot, and they’re really interested in different states and their stats. I appreciate that curiosity and the ability to learn while traveling. Only one trip was on a plane, which was to Colorado. We did a 2-week long trip to New York and Michigan, with a few stops in there. We went to Chicago for a wedding and explored the area, took the kids to Gatlinburg for Fall Break, went to Ohio to watch the eclipse in totality, and tagged along on Mr. ODA’s work trip to South Carolina.

Mr. ODA sold his 15 year old vehicle, and we purchased a Tesla. I didn’t have a great experience with one in Colorado, but I think that was more related to the circumstances than actual electric vehicle ownership. I had a great experience with the test drive, and we picked one up by the end of that week. We took advantage of their 0% interest and 3 months of free charging. We also referred a friend of ours, so we received $1000 in Tesla credits that we’ll use for charging after the free period.

We bought a hot tub. That was a purchase that was about a year in the making, so it wasn’t made lightly. There hasn’t been two days in a row where someone didn’t get in it, until we just left for a week (hoping that the water is in good shape when I get back!). Our deck was crushed by a tree in July 2023, and it wasn’t rebuilt until May 2024. Then we had to take the time to make the decisions on what we wanted, get it ordered, and wait for delivery. It was delivered in November, and it’s been a great purchase thus far. We haven’t done such a splurge before, and it’s nice to give ourselves something that we can enjoy.

The kids are doing their activities. We’ve been in a nice lull, but I recently saw our March calendar from this past year and was reminded of all those hours! Our oldest is doing t-ball for a second year. Our second is regularly doing gymnastics, but we’re also letting her do t-ball this spring. Our oldest is also doing an after school activity for checkers, but supposedly it’s in a fun way, so that’ll be interesting to see pan out. He was accepted into an advanced program for his 99th percentile state testing scores, which was a really exciting moment as parents. Our second will finish out her preschool year and go to kindergarten next year. And we hope to have another fun season over the next two months with everyone on skis!

RENTAL PROPERTIES

Besides the management of late rent payments, I had to put a lot of hours into these houses this year. We took a trip to Richmond, VA to work on quite a few of these houses. On top of that, there were several other activities that were needed, management of tenant turnover, and management of rental income, but I’ll save that for a future post so this doesn’t grow too long.

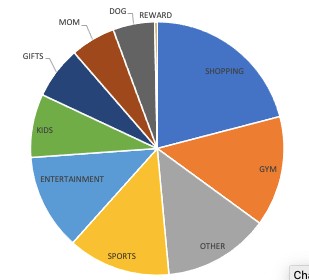

FINANCES

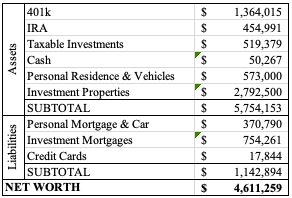

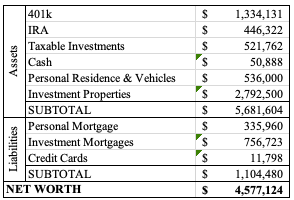

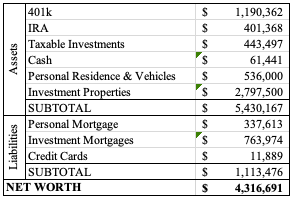

Our net worth increased by $745,000. We started the year with a goal of hitting $4 million net worth, and that was achieved in a short time. Month to month feels like we’re barely moving the needle, but it’s amazing to see that number over the course of a year.

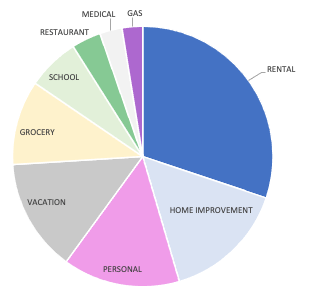

We paid off one 0% interest credit card from our carpet replacement in our personal home, and then we opened a new 0% interest credit card to pay for the hot tub. That new card gets 2% cash back, so it’s being used more than we usually use a 0% interest card. Typically, we just pay for the major purchase and then pay it down over the 0% interest period. This time around, it’s being used for every day purchases so the monthly payment I’m making is more than I’d usually see.

I have a separate post that goes into our extra income that we brought in over the last year, which is related to earned credit card rewards and interest on savings accounts and bonds. That’s even cooler to see the total ($14k!) because that was actual cash that went into our account and was used.

In the last year, I only officially worked 11 days, which is crazy to think about. But I’ve been doing random other jobs to help others out. I’m on our homeowners association board of directors, and I’ve been helping a new school get their financials up and running. I’m ready to take a step back from the finance work because my commitment to the HOA feels more pressing, but we’ll see how the next couple of months progress. It’s just really hard to get things done when I’m rarely without a toddler who wants my attention (unless I get up at 4:30 or 5 am).

SUMMARY

This year has felt like it took a lot more hours from me for work and management of things. But I also feel like I have more energy now that I’m two years from having our last baby. We have lots of other things planned for this coming year, and I hope to take some even bigger trips to see more of the country now that we have a bit less baggage coming out of the baby years. We have no plans to make any big purchases at this time (although there are new windows needed on our house in the next couple of years), and I really hope this year is lots of fun with the family more than anything else.