I share these turnover stories for both sides. I want to show landlords that others go through what they go through. I also want tenants to see that if you communicate regularly and are up front, a landlord can work with you in nearly every situation. It’s the surprises that landlords don’t want to manage. I think back to my time as a teller in a bank – if you were nice to me, I had leeway; if you demanded action from me without any polite undertone, I knew every single rule that there was.

We bought this house in June of 2017. We had to put a little bit of work into it, and we had it rented in September. That tenant needed to break the lease early, but she had a family member who wanted to take over the lease. She passed the background check and moved in mid-July of 2018. She’s lived there ever since. Her lease renewed on an annual basis, July 1 through June 30. She rarely asked for anything, kept up the house as if she was going to live there forever (at least as of my last inspection), and was friendly.

In February, she messaged us that she’d be leaving the house as of April 30th. Even though her lease went through June 30th, she had given us plenty of notice, and a May rental is easy enough to get rented (we typically see less people looking for a lease in the Fall and Winter), so we went with it.

Shortly before she let us know that she’d be leaving, I had an old tenant ask if we had something available. We didn’t, but once she gave notice, I messaged the old tenant back. We ended up going through the process of screening the person she had interested (a friend of her’s) and approving him. Not having to list the house for rent, show the house, and then review several applications is a positive.

TENANT NOTICE

Not that this matters now, but to share how people act, I’m going to include this story. Be a nice person. Be a straightforward person. Take responsibility for your actions. Skip this section to get back to the actual turnover work we did.

On February 7, she said she would move out on April 30 and will leave the house “in impeccable condition ready for the next tenant.” It was understandable that she needed more space, and she shared that she had secured another place already. She stated she’d send a formal letter, but that never happened. She also shared that she will leave a shed she had purchased, and that she already had paint on hand to give the walls a fresh coat.

On March 13, she shared concerns about the house that we should address (according to her) before another tenant moves in. She again stated, “the house [will be] spotless and freshly painted and the grass will be mowed.” She said the house needs a power wash, windows replaced, and the bathtub resurfaced. Then the fun. She changed the lock on the yard gate, and she hadn’t told us until now. She said she replaced the lock on the back door because she “was burglarized twice.” The house gets broken into and you don’t think to let your landlord know OR to let them know you changed the lock??

Here’s the next kicker. “I officially move into the new house on Wednesday, but I’ll be taking the extra time to get everything moved and in order for the [current] house.” That “Wednesday” would have been March 15.

There was a lot more back and forth, but we communicated through my property manager at this point because my property manager was handling her husband getting in there to get some work done. We were told that we could get in to start work before the end of April so that we could rent it right away.

Then comes April 19. “I had to push back the date to give a key for the contractor until .. the 26th.” Then came all the stories. Guilt inducing stories. She also stated she was about 80% moved out. She said “everything will be ready by my move out on the 30th.” So I laid down what we were told at that point. We had been told (either through our texts or through my property manager) of several “move” dates. Now we’re told she’s not out and has no intention of letting us see the property, let alone get work done, which is what we agreed to previously.

I politely stated I had concerns. I went into the background of who these people are that are “working” for me, and that they’re friends. I tried to ease her feelings of a random man entering the house (that she had told us she had moved out of on three different occasions). My biggest issue at this point was having a new tenant commencement date. No, I don’t need access before the end of your lease, but that’s not the expectations that were set. So I made future plans based on the agreement we had. If the house wasn’t going to be ready, I needed to line up contractors for the first week of May. I wanted to know the needs now, not on April 30th when no one is available for weeks.

She had said she was going to paint, but it was clear that her timeliness was not in line, and that this would fall on me. I said “You had mentioned that you would repaint the walls before the end of April. That was very generous of you, but it’s not required. However, if you won’t be painting the walls, I need to know that now because I need to get a painter scheduled basically today to be able to have him there on May 1st.” She double downed that the house would be painted.

I also was upset that she changed the locks without telling me (a lease violation, as well as a common sense violation). Had I known and been provided a key, then I would have already given my property manager the key. Instead, she’s holding the key hostage because she doesn’t know MY property manager, and that was unacceptable.

On April 23rd, she told me that no one was to do work on the house until after her lease was over. I was too frustrated to provide pleasantries at this point. I said “I explicitly asked the status of that.” And I said “you said we could be in after Wednesday and that May 1st wouldn’t be an issue. I was trying to prevent exactly this situation – a last minute surprise that affects our schedule/business.” More excuses. And I do understand that people who hand out excuses like lollipops in a doctors office don’t realize that’s how they’re acting, but it’s quite frustrating being on the receiving end of an endless list of excuses that are meant to cause guilt.

My handyman went over there on April 26 and took pictures of two rooms (it’s a two bedroom house…) with stuff packed to the ceiling. And then she shared that she forgot about things in the attic during the final walk through. “80% moved.”

We ended up pushing the new tenant to May 5th as the move in date. Had we kept it on May 1st, we would be liable for “damages” in some way by not providing him a place to live on the commencement date. So we quickly got a new lease signed with a commencement date of May 5th.

TURNOVER WORK

We had the entire house painted. There were an obscene amount of decals left on the walls that had to be removed. They had been on too long, and the paint came with the pieces or it left indents, so they had to be sanded down. Then there were also an obscene amount of command strips all over the walls that had to be removed, and the walls repaired because they were knock off command strips and not the real ones that actually come off easily. Since the house was beige and needed so much prep work for painting, I decided to just change the color. Our handyman had to do all the prep work and then do two full coats of my light green color on all the walls.

On top of painting all the walls, he had to fix some of the trim. My tenant decided to [poorly] paint SOME (not all) of the trim black. Doors were painted black, trim was painted black. It was not good. So I then had to pay for 4 coats of paint on the trim work to get it to white. It was originally the same beige as the walls, so for $3,500, the house now has all white trim and a pretty light green wall color, which probably brightened the space nicely.

When we bought the house, the tub had been painted and started peeling. It wasn’t something we had the expertise to manage. The tub was original (read: cast iron, heavy), and the paint wasn’t horrible enough to warrant immediate action. We covered the main issue with a mat in the tub, but over the last several years, it wore away. We had our handyman epoxy bathtub. While he was at it, he also epoxied the walls to cover the blue tile. I didn’t hate the blue tile, but someone at some point had repaired the wall by the toilet, and then replaced the blue tile with white/beige tile.

That’s what it looked like when we bought the house, and this is what it looks like now. The decal on the toilet is icing on the cake for this saga.

Then there were random little tasks that my handyman had to do, like replacing door knobs that had been removed and scraping the paint off my brand new windows. He also had to change the locks on the house because we think she kept helping herself back into the house, and we had to change the lock on the laundry room door because she couldn’t find the key.

SECURITY DEPOSIT

In Virginia, I have 45 days to return the security deposit or share the charges placed against the deposit. I learned early on to take the full 45 days because tenants don’t provide their final utility bills (as required by the lease), and so I don’t want to return the security deposit only to find a surprise utility bill 30 days later. So while I knew the charges by the end of the first week after this tenant vacated, I waited to ensure no surprises popped up.

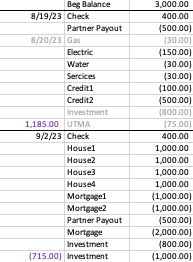

In my disposition letters, I reiterate the lease agreement terms, including the amount of security deposit that was held from the beginning of the lease term. In this case, I reiterated that her lease term went through June 30th, even though her notice was given through April 30th. I also shared that the itemized list I provided doesn’t include items that I couldn’t fix yet or that I hadn’t fixed yet (e.g., stickers on the once-brand-new vanity, spray foam on windows, and the lack of proper yard maintenance). I also stated that we had days of lost rent due to the condition of the house when it was vacated, which she isn’t charged for. With all those caveats, the total still came to about $2,800. The security deposit I held was $945. This left a balance of $1,937, which I chose to not pursue collection on.

I have not heard from that tenant since the letter.

NEW TENANT

The first tenant ever had contacted me and asked for a place for someone she knew. I didn’t have one at that moment, but this house came available shortly after that conversation. I sent the background check to the new person, and he passed everything. We had agreed on a May 1st commencement date. I had some delays with the passing of my mother, but then I gave the new lease to our property manager. The new tenant dragged his feet on getting it signed, which was a red flag. He struggled with getting the first month and security deposit funds together, which was another red flag since he had two months notice for this agreement. Luckily, there have been no issues since we got everything squared away on May 5th.

When we first started renting this house, the goal was 1% of the purchase price as monthly rental income. This would equate to about $650. However, the market rent at that time called for higher, and we had rent set at $795 from 2017 through 2023, never having raised the rent on the tenant. With the drastic increases in property values, therefore causing increases in my taxes and insurance bills, rent was now set at $925. Had I listed the house for rent, I would have listed at $950. Since this was an “off market” agreement, I was comfortable with a rent reduction.

SUMMARY

All in all, this was an easy turnover. Having the contacts of a handyman is greatly beneficial at this point. For a small house that’s under 900 square feet, we spent a lot more than we typically would for turnover. We project turnover to cost 10% of the annual rental income. In this case, that would have been under $1000. However, we didn’t have to turnover the house for 5 years. That’s about $5,000 had we turned over the house every year. So the total bill coming in at just over $3,800 essentially says we’re still “coming out on top.” It also provided us an opportunity to increase rent closer to market value. We’re 4+ months into this tenant’s tenure, and all seems well.