I have so much to say. January is a big time where people are willing to talk about finances, so many thoughts enter my mind that I want to squash some preconceived notions. Unfortunately, I just don’t have the time.

PERSONAL

At work, I’ve spent this year managing year end things and getting the 2026 processes stood up. I’m supposed to be part time, but I’ve been putting way more hours in because of that process. The guy who was helping me left for another position and was out of the country all last week, so I had to make sure I was extra on top of things. With all those actions going on, I also was pulled into hiring someone to be my assistant (for lack of better term… it’s not assistant as in answering the phone and getting the mail… it’s doing the daily bank reconciliations and those types of tasks so I can focus on policy development). This has taken a significant amount of my time, but hopefully this person will be on board to help in a week.

Our youngest started preschool last month. He only goes 2 days per week, and both are my work days. I’d really like to get to a point where I can actually take advantage of guilt-free, kid-free time.

I have a new years resolution that I’m keeping close to the vest, but one part of it is to walk 10,000 steps per day. I’m failing miserably, but it’s a work in progress. My 7 year old son asks me constantly if I’ve hit my step goal. So…. maybe I’m teaching him it’s ok to fail, but keep trying? His new years resolution is to get better at being his nicest, and that’s just adorable. He also says he wants to learn basketball, and I just can’t bring myself to do that. We are signed up for Spring baseball that should start in March. The youngest has to wait until next Spring, but I can’t wait to see what he can do. I’ll probably also be putting swim lessons back on the docket in the next couple of months. The youngest hasn’t had any lessons. The oldest passed the test for his yellow band, but he needs to have a free style stroke to get the green band. The middle needs confidence; she can absolutely swim, but she likes to pretend she can’t do things.

RENTALS

Last month I reported that at the end of the day on the 5th, I was still missing 25% of the month’s rent. As of 7 am on the 5th, I had only received 30% of rent. Many came through, but there were more than the usual amount that didn’t. For one, I had to manage a grant program from one of the places a tenant lives. The check finally arrived yesterday, but it’s dated December 12th. They mailed to my PO Box, in a town I left in 2020. I didn’t even know my lease had an address on it, but that’s how long these people have been there. The check was returned to them, so my tenant went down there to give them my new address. I don’t love these people having my address, or that they now officially know I don’t live in the same state as them, but I needed to get this check. I gave them the address over her phone and received confirmation she typed it in. Somehow the check was returned to them, so my tenant had to pick up the check and FedEx it to me (I told her she didn’t have to pay that kind of money for that!). I have a tenant that pays twice per month (and pays a premium for that); her second part of rent is due tomorrow, so we’ll see if I can finally be fully paid for this month by the 19th.

I have a tenant who fell into some unfortunate circumstances. Her current plan is to vacate her place by the end of March. She’s lived there since 2019 with a dog and 5 cats, so that place will need all new carpet and a new paint job, but hopefully will be ready for a May 1 rental. Because she’s always paid and I knew her financial circumstances, I’ve been slow to increase her rent. She’s paying $975, but the market rent should easily get at least $1200. The house is in really good shape and is newer. We had people fighting over the other house in that town at $1150, and it’s an older house with only one bathroom.

FINANCES

Well we traded in our van for a newer year, but that’s a story for another post. I also still haven’t fixed my retirement account access from when I got a new phone number, so that’s a made up number.

I’m going to be tracking our spending much closer this year. We’re generally on the same path with our spending, and I know we don’t do anything extravagant. With Mr. ODA’s lack of income, I just want to keep a closer eye on that and pivot if we need to.

Mr. ODA has a more exact approach to figuring out what we can spend per month without dipping into savings. I like my number better (and it’s lower). I took our rental income, deducted rental fixed expenses, deducted our typical bills, and was left with just over $1300 per month. That would go towards food, clothing, gas, etc. If I remove things that are offset by a shop (Mr. ODA is a secret shopper) and the long term investment purchases (i.e., car and windows), we’re at $987 as of the 18th.

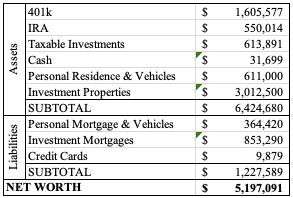

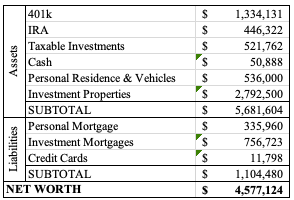

NET WORTH

We put $1500 on a credit card and finances $7500 to be able to save $1000. We also put $5500 on credit cards towards windows, which is also another post that’s coming. Our net worth took a hit for both these things. I also wasn’t able to update 3 accounts, so they’re just estimates, but at least our net worth still went up.