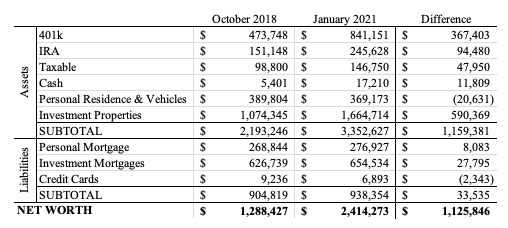

I manage all the financials for my family. Mr. ODA makes the maneuvers, and I record them. Excel is where our organization lives and dies. Sure, I have a degree in Finance and Information Technology Management (i.e., Excel), but it doesn’t need to be complicated or difficult to make tax prep easy for you.

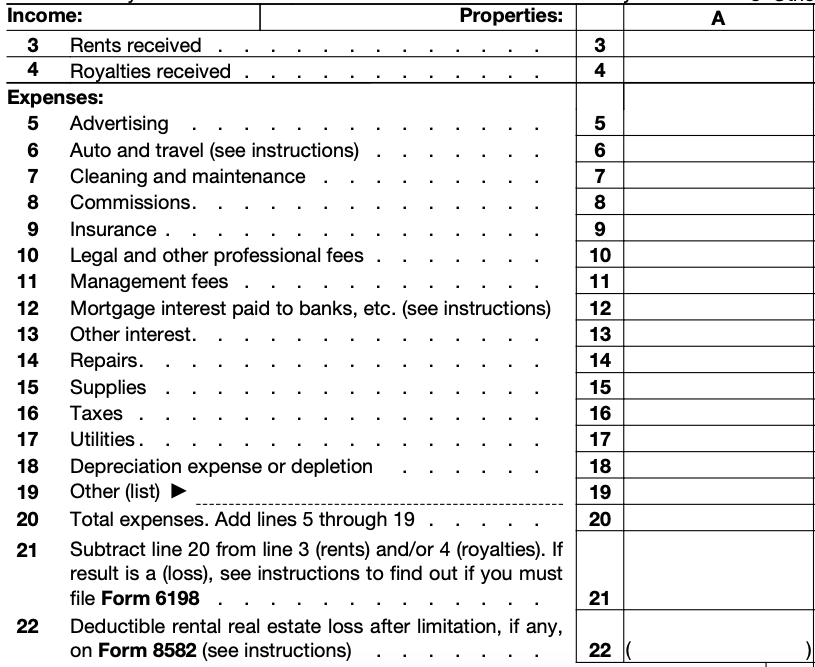

This level of organization allows us to do our own taxes. After the first year of purchasing rental properties, we thought we’d have to hire someone to do our taxes because it would be complicated. It’s not any different than filing your own personal taxes. The software systems available online walk you through the entire process. Each property’s income and expenses have to be entered separately, which is time consuming if you have several properties, but it isn’t difficult.

The most important thing to be ready for your taxes is to make it a whole year activity. If you record income and expenses as they occur, it’s less of a hurdle when the year is over. By recording the activity all year, it then becomes a verification process when the year is over, thereby reducing the possibility of missing something or recording something wrong.

At the beginning of each year, I create a projection of income and expenses, which helps Mr. ODA adjust his W2 tax bracket throughout the year so that we break as close to even or owe very little when it comes to tax filing. Let me dive into that aside quickly.

Go back to Mr. ODA’s tax posts:

– TAXES! Part 1 – What are Marginal Tax Brackets?

– TAXES! Part 2 – Is Your Bonus at Work “Really” taxed more?

Taxes Part 2 is what I’m particularly referring to, but you may need the lesson in Part 1 to know what that means. There are IRS penalties if you fail to pay your proper estimated tax (when you don’t pay enough taxes due for the year with your quarterly estimated tax payments, or through withholding, when required). Title 26 of the United States Code covers the penalties. Essentially, the IRS is saying, “You have to estimate your annual taxes owed, and you’re not allowed to only pay us taxes on April 15th every year, but you have to pay the taxes over the course of the year.” People get excited to receive a refund from their taxes, but really that’s just an interest-free loan you’ve given the government. Perhaps some people do need that forced savings, but wouldn’t it be nicer to have that extra money in your pocket throughout the year?

Back to the point…

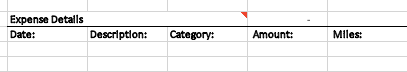

I create a new workbook every year with each house having its own spreadsheet. Schedule E is going to require you to put your income and expenses, per property, not as a whole, so it’s important to have expenses assigned to a particular house. I set up each spreadsheet in an Excel workbook to identify all known costs for the coming year. Not all of these apply, but these are typically the categories of my known costs for each year: property management, HOA, utilities (City of Richmond bills the owner (not tenant) for sewer fees), property taxes, insurance, annual mortgage interest, cost basis depreciation, and prepaid points depreciation. There’s also a chance that you’re carrying appliance depreciation costs (meaning, the purchase of a washer, dryer, refrigerator, etc. aren’t recorded as an actual expense in the year purchased, but are required to be depreciated over its useful life).

As the year goes on, I record any mileage (record the actual miles along with the mileage cost) and maintenance costs. The IRS posts the standard mileage rate for each year here. If a roundtrip to a rental property is 40 miles, then the expense is calculated as 40 miles multiplied by the standard mileage rate, which is $0.56 for 2021. I’ve learned over the years that the software systems just request your miles and do the calculation for you (which is smart and safer on the calculation side), but we want to know what the calculation is going to be, so I enter it as $22.40 in my spreadsheet.

You’ll be expected to input the days your property was vacant, so record that once it’s known.

Each spreadsheet is linked to a master sheet at the beginning of the workbook that shows the net income and expenses for each property. The difference of these amounts are what Mr. ODA uses to adjust his W4 deductions.

I personally assign costs month by month so I can keep track of them, but it doesn’t even need to be that fancy. A running list of these expenses are enough.

The categories are based on what’s going to be requested through Schedule E.

Then in January/February of the following year, I go through my filing cabinet and my email to ensure I’ve captured all of the expenses that I have receipts for, and vice versa to ensure that if I’ve recorded an expense, I have a receipt for it. Having already captured the expenses throughout the year serves as ‘checks and balances’ and doesn’t make the task feel too overwhelming.