I’m not even sure where to start for this month. It has been a whirlwind. There were a lot of tax payments last month, and this month I was still paying those among several other things.

PURCHASES

I purposely paid my credit card statement a little earlier than the due date so that it wouldn’t be that high for this update, but then I put a bunch of charges on it over the last two days. To catch you up – we’ve been holding money in our savings account for as long as possible. When we were getting 0.2% interest on it, it didn’t matter when I paid the card, so I typically paid it shortly after the statement closed. Now that we’re getting 4.22%, it’s worth keeping the money in there to earn interest, and then paying the credit card closer to the due date.

Our regular-use credit card is currently holding: $300 towards my dad’s iPhone (I should really share that mess of a story in purchasing that) (also, that doesn’t clearly account for my sisters having paid $200 towards that because that’s just “cash” in our checking account balance), $500+ of the kids preschool tuition, renewing our zoo membership for $139 (honestly, 5 of us enjoying the zoo for the year for that price is wonderful), over $200 for signing our son up for tee ball, two car insurance payments, and a rental insurance payment. I don’t typically go through the charges like that, but it’s just been a bunch of just-big-enough charges to grab my attention on our credit card balance. We drove to-and-from NY, so our gas station payments are higher than average too. As a reminder, the credit card balance you see also includes $10k worth of new carpet that we’re paying slowly on a 0% interest credit card.

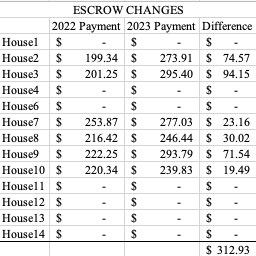

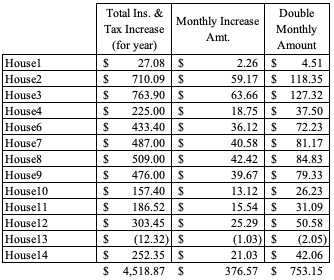

RENTAL PROPERTY EXPENSES

I paid two of our Richmond houses’ taxes. The taxes are due on January 14th, but if I pay them this year, then it reduces what’s viewed as our ‘profit.’ I make sure to pay any known January bills in December of each year. Those two houses are so tiny, so their tax payments being so much larger than they once were kind of hurt (I’ve discussed the increases in property assessments, thereby increasing taxes). It was about $2,000 paid out (on top of all the things I paid over the last two months).

I also had to pay two supplemental taxes for Lexington. Government entities not meeting deadlines is a pet peeve of mine (I used to work for the Federal government). Last year, I completely missed that paperwork I received was a supplement bill for education, and then I received a penalty.I thought it was their typical assessment notice since it was outside of tax payment time. Luckily it was a few dollars, but I was so lost. This year, I paid close attention when I received an extra tax-related document. This supplemental bill was for trash services. Again, a few dollars. But think of all the extra paperwork, staff hours, postage, payment processing cost to collect an extra $20 from every house.

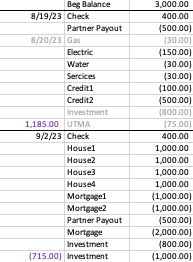

RENTAL PROPERTY INCOME

We had two tenants give us notice that they’re moving out. While extremely unfortunate timing on the year, I’m also human and understanding of their need. One tenant had a traumatic work event that led to him being laid off, and another family bought a house. We’ll find a way to get the houses re-rented as soon as possible, even though our vacancy time may be longer than it would have been if we were looking for a May 1st or June 1st renter. We have someone interested in both houses at this time, so that’s encouraging.

We had 4 tenants not pay in full. They all reached out to me to let me know in advance, and they paid what they could by the 5th (I always appreciate that – it holds them accountable, and it allows me to not foot all of the bills that I have to pay on the houses). As of the end of the 5th, we were short over $3,000 worth of rent ($1300 of that was for the house that has been late since October 1st and is finally working towards paying their debts).

As of today, we’re short $2,400. The tenant who’s playing catch up only has a balance of $960 left, which is great (that’s been a long road). Another tenant typically pays $750 on the 5th and 19th. So they’re not late on $750, but they are late on the $375 they didn’t pay in the first half of the month (this is a special scenario that we put in place for them because they couldn’t pay all at the beginning of the month, so we increased their rent as a concession to being able to pay twice per month without creating more late fees for them… but they’re still late).

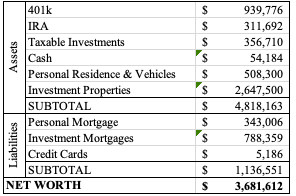

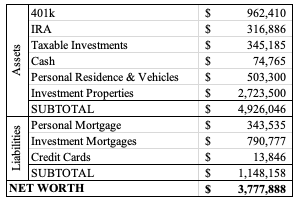

NET WORTH

The market significantly increased over the last month. We also had $28k come in as part of our insurance claim; our cash increased by $35k though, so there’s an additional savings in there. And even though we had large expenses on our credit cards, it’s still slightly down from last month.

BONUS STORY

Mr. ODA and I wait for Black Friday deals to purchase our iPhones. We typically purchase every 3 years. I usually bite for a new phone so that the camera is better, but I’m suspicious that Apple is sending updates to alter the clarity of photos on older phones. How can I take these BEAUTIFUL pictures for the first few months of having a phone, and then all my pictures are grainy suddenly? ANYWAY.

Walmart had a deal that you purchase the iPhone 14 on a payment plan, and they give you a $350 Walmart gift card. These are the deals we typically seek. Apple is still getting their full price for the phone, but Walmart is offering a deal to bring our net to $0. When you want to purchase the phone from Walmart, it asks you to log into your carrier’s account. For this phone, it’s Verizon. We spend hours trying to figure out who the primary account holder is and what that log in it. Verizon does it where you can create your own log in and see you phone’s data at any time, but to see the entire plan’s data, you have to be the account holder (makes sense, but complicates this particular instance). The primary account holder is my mom’s phone number. Who died in March. We finally get assistance with that and log into the account through Walmart. It brings up all the lines on the account, we select my dad’s number, and then it gets to step 2. It says they can’t verify the address on the account and we need to go to Walmart mobile desk in a store. I call Verizon. Can’t help. I call Walmart. They keep telling me to put the item in my cart, which isn’t how you purchase a phone. So no help.

I finally bite the bullet, and on the Saturday after Thanksgiving, march myself to the nearest Long Island Walmart. They can’t help because they need the phone in the store. I swear if I were at my Walmart in Kentucky, they would have helped me. It was actually at the point where I was going to risk waiting until Tuesday so that I could have my phone desk people help me. The Walmart employee actually wasn’t flippant or trying to blow me off; I believe he genuinely thought he couldn’t help me. What needed to happen was that he called their help desk people, and then he was the mediator to figuring out the address. I figure this because a Walmart customer service person transferred me to such a person, who said he’s not allowed to talk to me and has to have a Walmart employee talking to him on my behalf.

I gave up. Sunday comes. I hope that some “overnight” processing of information has magically cured the process. It didn’t. I call Verizon again. Some angel of a lady answered the phone and actually helped me more than I could have imagined. I told her that I wanted the Walmart deal because all the Verizon deals require me to change my plan to unlimited data. I let her know that I’ve already spoken to several people, and they keep trying to convince me that I get a “free” iPhone while my plan increases $30 per month in perpetuity (versus $23 per month for 36 months for the phone). She offered me a deal that equates to $5/month for the phone for 36 months. So I put 100x more hours into this than I should have, but it ended up working out in our favor!