Well, my desire to post every Thursday fell off there. I started a new job, Mr. ODA’s Federal job has been in limbo, and just general life things have been going on and keeping us busy. The kids started t-ball in the past few weeks, our youngest was waitlisted at both of the preschools we tried for, and the rentals have needed more attention than average. Let’s dive in.

NEW JOB

I was approached by someone I serve with on our HOA board. They were looking for a new person who has a financial background, was really organized, and could handle talking to people regularly. It appears that I made such an impression on him and his wife. I wasn’t ready to get back into the workforce. While I have enjoyed my temporary jobs I’ve done since I quit my career in May 2019, I always had a ‘sunset date’ on those activities. I knew that each job was only for a short period of time, and I’d get back to freedom/flexibility. This was a new territory they were asking of me – be on a set schedule and away from my kids.

I expressed that my need for entering back into the workforce was that I wanted to be part of my kid’s activities and I needed to work between school hours for the most part. They expressed a desire for me to work 30 hours, and that just wasn’t feasible. Based on what they told me about the tasks required of the job, I was able to come up with about 18 hours of work, knowing it would likely become 20 hours. So far, I’ve worked more than 20 hours each week as I’m learning, and things are not moving as quickly as I expected them to. I’m 2.5 weeks in, and at this point I can do all the main tasks. Where I’m struggling is the knowledge of all the “one off” transactions and how some people are treated a little differently than the standard.

Overall, I’ve been super grateful that Mr. ODA has given me the space I needed to get my feet under me these past couple of weeks, and I’m really enjoying learning these new tasks and being involved in this sector.

FEDERAL WORKERS

It’s been rough around here for almost two months now. While Mr. ODA is still employed, there is a daily concern that the news will come in. There’s no security like there used to be expected for a government position. The blows have become a bit more scattered than it being such a daily barrage, but there’s still uncertainty and daily updates and waiting for more information that’s occurring.

PRESCHOOL

Both old kids will be in regular school next year. Our youngest has a late-in-the-year birthday, so he wasn’t eligible for preschool until this coming school year even though he’s already 2. The preschool where both of the other two went to shut down. My middle is finishing out the year there, but next year, they sold the preschool concept off to a third party. The company that took over has terrible reviews, and everything about them screams ‘daycare.’ While people need daycares, and that’s fine, we don’t need that. I wanted a space that had a curriculum.

The school previously had a daily agenda and an expectation that the kids were there from 9 to 12. This new school has a come and go as you please set up, and they couldn’t provide me a break down of their daily schedule. The admissions person was actually quite rude and condescending to me, after taking 4 days to return my phone call. I’m not in a desperate need for our youngest to go anywhere, so I won’t be trying to enroll him there.

We had hoped to get into another preschool by our house, but the closure of our old school sent a mass exodus to the nearby preschools. I told Mr. ODA that I wanted to join their church so I could get 3 weeks ahead on signing up, but he said that wasn’t ethical and was more than just saying “I want to join your church.” So I didn’t. But several other families did. And they got in. And I’m still really sad about that. He’s waitlisted there, and there’s been no indication of hope that he’ll get off the waitlist.

I tried for a “moms day out” program, which would cover one or two days per week (I was looking for 2 days previously). He’s waitlisted there, but she gave me a glimmer of hope that even though they don’t have a lot of turnover, there is a chance a space opens up either right at the end of this school year or at the beginning of next school year.

I had originally ‘mourned’ the loss of my freedom with the preschool closing down. I have been at my kids’ beck and call for 7 years by the time our youngest would go to school. Even though it was only going to be 6 hours per week, I was excited to get things done that have been on my to do list for years and just run errands unencumbered. I’ve lessened my extreme feeling on that over time, but it still would be nice to have a few hours dedicated to me and my schedule at some point.

RENTALS: RENT RATE

I evaluated our current tenants and their rent rate back in December. I should have just written the letters at that point and been prepared for the deadlines, but I didn’t. So this week, I got those rent change letters prepared, printed, and mailed. We typically change the rent by $50 every two years for our long term tenants. That’s the approach we took here except for a couple that needed more catch up. One tenant has already responded and executed a change to increase their rent. I have 4 more out there waiting for the tenant to tell me they accept the adjustment or will be leaving at the end of their lease. I also have another tenant who will be staying another year, but I didn’t change their rate since I had changed it by $25 last year.

RENTALS: TERMITES

We have a house that we purchased with termite issues. We knew it going in. We had it treated, and then we fixed the really bad areas. We then didn’t get notification about an annual warranty payment they would do, so our coverage lapsed for a few years. We saw swarmer termites in one part of the house and called them back. They offered to let us backpay those missed warranty years, saving us about half the cost it would have been for a new treatment. Well, we’re paying for that now. For the last 4 years, they’ve checked the property once per year. They’ve noted termites actively being there with more damage, and they didn’t clearly communicate the concern of the condition until this month. We have major problems in the house. One wall in the laundry room is so bad that the termites ate the backing off the drywall and the drywall is all cracking off the wall because it’s not being held onto anything. It really hasn’t been fun, but I know we will be able to fix it. So far, we’ve had the crawl space cleaned out and relined with a vapor barrier, and some plumbing issues fixed that were creating a perfect moist condition for termites to gravitate to. We still have to rip up the carpet, fix the subfloor, lay LVP, rip out a shower insert, reinstall the insert, and get the shower operational after that. It’s a lot.

PERSONAL FINANCES

Mr. ODA reduced our monthly contributions to our investments. We were putting $3,000 per month in (3 separate $1,000 transactions), and now those have been reduced to $500 three-times per month. The kids still get $100 per month each into their UTMAs.

We’ve been so busy that we have hardly spent any money. Outside of insurance and medical payments, the only extra spending I’ve done is for our daughter’s birthday parties we’re having this month. I’ve bought some clothes since I’ve lost weight on my post-three-kids journey too. Usually, we’ve booked a trip by now, but we haven’t done that either. Overall our spending is lower than it has been.

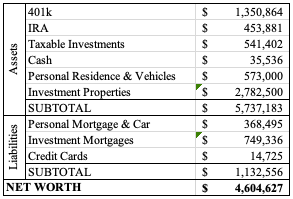

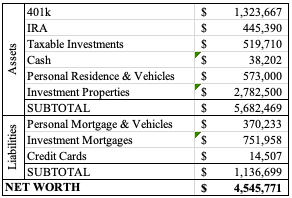

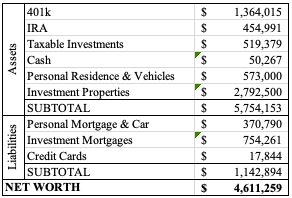

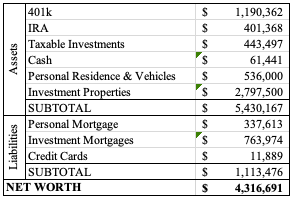

NET WORTH

The market is well below where it has been, and all our numbers show it. We are over $189k lower than last month. I haven’t updated our property values yet. I’ll probably do that next month as the spring market ramps up.