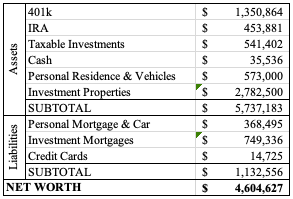

I mentioned at the beginning of the year that our general financial goal is $4 million net worth. I acknowledge that this is not a specific goal that most people can relate to. But I also pointed out that we weren’t always sitting with nearly that amount in our accounts, and that made me start thinking about where we were. This is long, but I didn’t think it worth splitting into multiple posts. I’ve gone into the topic in general, but this is our actual story and the steps we experienced.

This is just meant to show you that you can grow each year and slowly chip away at a goal. Everyone makes fun of the “don’t buy Starbucks everyday” philosophy. It’s not that saving that $7 per day is literally going to make you a millionaire in itself. It’s saying that if you’re willing to spend that $7 daily, that’s likely indicative of other spending in your day, and you should be more deliberate with your spending. I saw a meme on Instagram that said something similar about buying decor for your home, and if you’re willing to spend “just $25 on this lamp,” those little expenses add up over the year. I’m a broken record in saying make every purchase a deliberate, thought-out action; I went into how much effort (and years) I put in to purchasing a $4 tape dispenser on this post.

The background here is to first show you how I had no money, but I’ve been diligent on my spending and working towards goals. Mr. ODA was more of a saver and more prepared for the big life expenses in your early 20s. The part where we work towards buying a house is where we really buckled up and made life decisions that kept us on that track. Our money philosophies have gotten us to where we are today – every dollar has a purpose.

MY FINANCIAL HISTORY: COLLEGE, WHERE I STARTED MY INDEPENDENCE

I never liked relying on other people, so I was interested in making my own way as fast possible. My parents gave me an ultimatum during my sophomore year of college – either become a resident assistant for free room and board, or take out loans to help pay for it in the next two years. I didn’t want to take out loans, so I started looking for off campus housing. I didn’t mind living on campus. I have no idea why I was so dead-set against taking out loans and how that would have been ingrained in me at that time. But living off campus would allow me to pay month to month, instead of living on campus where I’d have to pay each semester’s housing costs up front.

On top of that, my dad offered me to buy out his car. He had let me drive the car to college that year, but around Christmas time, it started acting funny. It turned out that second gear in the transmission needed to be replaced. He said I could pay for the fix, and then it could be my car. I didn’t like the idea of being 3.5 hours away from my family and having a car that appeared unreliable. So I went car shopping, and I leased a Honda Civic. My car payment was about $300/month. I leased it instead of buying it because I didn’t need to put any money down.

I worked three jobs that summer after my sophomore year of college. It was so hard. I was working 40 hour weekends, and then I’d put hours in during the week. I remember getting burnt out and being overwhelmed because I had to miss my sister’s graduation party. I was working at a catering hall, which meant late hours on Friday and Saturday, and early hours on Sunday. I was also working at a bagel shop (big on Long Island), which was a 5:45 am call time, but at least I’d be done by 10 am. Then I was working as a cashier at K-Mart, which was Monday through Thursday in the afternoon or evening, and sometimes on Friday.

Even though I was working all those jobs, I still struggled with paying my bills once I got to college for my junior year. I paid too much for rent because I wanted to live on my own. None of my friends were interested in living off campus, and I was too afraid to live with someone I didn’t know. My parents ended up giving me $100/month for 6 months so I could pay to run my heat. I remember it being October, and I told my mom that I hadn’t turned my heat on yet. So she sent me the money each month to cover the heating bill instead of trying to live in layers and blankets because I didn’t want to pay for it.

When I moved back up to college, I was working at JCPenney while going to school. I did pretty well. My grades didn’t suffer, and I still felt like I had a life so I didn’t get burnt out with only work and school. I took on extra shifts and stopped going home for the smaller holidays (e.g., Thanksgiving) so that I could work.

MY FINANCIAL HISTORY: MY BIG GIRL JOB

My guidance counselor told me that financial firms would be expecting internships on my resume. This was 2007; financial firms were fat and happy, so they weren’t paying interns. I kept my eye on the job boards (which were literal bulletin boards) in the financial building. I found an internship with the Federal government that was paying $13/hour! I applied in August. I heard nothing for weeks, so I gave up hope. Suddenly, I received a call asking me to come in for an interview on Halloween! I had never interviewed before, so this was scary. Then the guy told me that they didn’t even know if they were going to hire a mid-career hire or go the internship route, and they had never had an intern before. That was the second time I gave up hope. A month later, I received the job offer, and I started working in December 2007.

From the start, I put money into the Thrift Savings Plan (TSP), which is the government’s 401k equivalent. My parents told me to take each raise I got and put it right into there also. If I was used to living on the lower amount, then keep the rest in savings. I followed that advice until I maxed out the contributions. I didn’t have trouble paying my bills, but I wasn’t saving as much as I should have for rainy days.

MY FINANCIAL HISTORY: MEETING MR. ODA

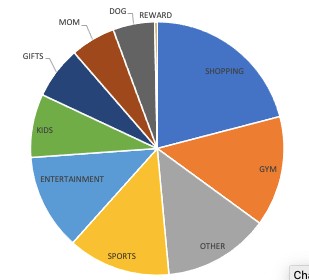

Mr. ODA showed up in my office in October 2009. Shortly after meeting him, we were hanging out, and next thing I knew, he was asking me my social security number. He was signing me up for a rewards credit card, since I had a credit card through my bank that was getting me no incentives. By the time I met him, I was living comfortably, but I wasn’t saving with a goal in mind. Whatever was left over became savings, and it didn’t matter to me what that number was. I was maxing out my TSP and paying my bills comfortably, and that seemed good enough for me.

OUR FINANCIAL HISTORY: IN A RELATIONSHIP

Mr. ODA came with a lot more money than that into the relationship. He had always been planning to save for two big purchases: an engagement ring and a house. To me, buying a house was somewhere down the road, but I didn’t have the confidence to move forward on that. I hope to instill that confidence in my children because that would have made a big difference.

Mr. ODA designed my engagement ring at a little mom and pop jewelry store in Harrisburg, PA (long story on where we’ve lived, for how long, and why). He proposed in November 2011. In December, I moved to DC, and Mr. ODA joined me shortly after. We lived in an apartment. We lived halfway between where he and I worked, but I admit we paid way more for rent than we prudently should have. Even though I grew up in the shadows of New York City, actually living in a big city was scary to me. We went on a house hunting trip, and I struggled with anything that didn’t look really nice/new. We were able to get a reduced rent rate, but at about $800 per month for each of us, it was significantly more than the $450 per month I was paying in Albany, NY.

The goal was to rent for a year while we scoped out the area to find a house to buy. We didn’t know anything about Northern Virginia, and we wanted to go to open houses to learn how far our money would go. Newsflash: not far.

OUR FINANCIAL HISTORY: A WEDDING

While we explored the area for a house, we were also planning a wedding. We paid for more than half of our wedding. My parents gave us a chunk of money towards it. If I had been married in Kentucky, it would have covered most of the wedding. However, I grew up on Long Island, and a wedding is a very different kind of event there. I probably wouldn’t have known any different had I not attended several weddings in South Carolina, where weddings were low key. After looking at venues in both Kentucky and New York, I ended up breaking down one day that I had always dreamed of a specific type of wedding, and Kentucky just wasn’t it.

I saved as much as I could in all the other areas since the venue was so expensive. The venue cost included all the catering, staff, and cake. I went cheap on invitations, my dress, favors. I just didn’t have the cash on hand to do a lot, and I wish I had done more. I also wish that I had been married on site at that venue instead of in my hometown church, but it is what it is. I also went cheaper on the photographer, and the day was terrible because of him. I recommend to everyone to get a good photographer and really check their portfolio (and if they do crazy things for photos, don’t trust that they’ll not do crazy things when you ask them not to).

We got married in August, after our November engagement. We had to lay out over $12k for that. The unexpected part of that was that we found a house to buy earlier that summer.

OUR FINANCIAL HISTORY: OUR FIRST HOUSE

Mr. ODA was a good saver. The problem was that he didn’t expect to pay for a wedding, and he didn’t expect to live in Northern Virginia. He was expecting to buy a house around $150k. We were struggling to find a house with walls and floors (literally) at $350k.

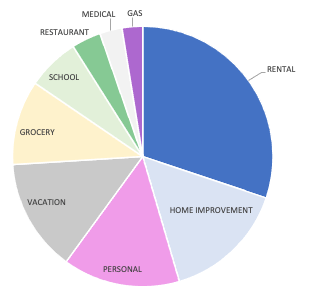

We lived a meager state for that year. Our goal was to spend less than $5 per day on food. That meant we weren’t spending money at restaurants. We were packing our lunches for work days. We were living off of macaroni and cheese. We weren’t taking trips. And yes, we were literally tracking our expenses on food each day.

THIS IS IMPORTANT: We were preapproved to buy a house up to $750,000. THAT IS STUPID. We didn’t want to pay PMI, so our purchasing power was based on our down payment being 20% (if you don’t come to the table for a conventional loan with 20% of the purchase price, the bank tacks on PMI). Between loans we could take from each TSP, cash on hand that we projected to have with our savings over the year, and possible liquidation of investments, we projected we could have about $70,000 on hand. That means we were shooting for $350,000 as the purchase price.

Our Realtor knew we were approved for double that, but we held our ground on our price range. We considered several properties. We put an offer in on a house at $380k. It was a bank owned foreclosure that they had flipped for resale. The flip was bare bones, but the house looked ok. We wouldn’t need to put immediate work into it. Our offer was declined. Then later that day, the bank called and asked if we still wanted it. We were instructed that the previous bidder attempted to counter the bank, and that’s why we were given the offer. We weren’t willing to lose it and accepted. We were under contract for a $380,000 house. That meant we needed at least $76,000 by closing.

Mr. ODA and I each took out TSP loans, we were gifted money from our parents, and we used our savings. Our final closing costs were just over $78k. We got our 20% down, so no PMI. We then spent the next 3-5 years paying ourselves back in our TSP. The loan payment amounts were adjustable, so we paid more when we could, but we had the flexibility to back off some of the payment totals if we needed to.

OUR FINANCIAL HISTORY: SELLING OUR FIRST HOUSE

We bought our first house in July 2012. We sold the house in September 2015. In that time, the house appreciated by $70k. On top of that, we had the 20% equity we had put down, and we had the equity for the principal payments we made over the previous 3 years. We were moving from the DC area down to the Richmond, VA area. We ended up purchasing a new construction home for about $360k. After putting 20% down on that purchase and paying off some debt (I had a car payment, and even though it was 0.9% interest, I wanted to manage less payments per month), we needed to decide on what to do with the rest of the money from the sale. Mr. ODA convinced my to put that towards rentals.

OUR FINANCIAL HISTORY: RENTAL PURCHASES

With that extra equity we had sitting in our account (which we had in an interest earning account), we purchased 3 rental properties (all with at least 20% down). The leap of faith we took into a landlord role, while figuring out things we didn’t know as we went is why we’re where we are now. We created a semi-passive income stream with these rental properties. Our savings continued to grow, which we used to purchase several more rental properties (again, with at least 20% down each time).

OUR FINANCIAL HISTORY: MRS. ODA ‘RETIRED’

By 2017, we had several rental properties, had paid off all our debts (e.g., car, TSP loans, IVF cost), and the net from the rentals was enough to replace my six-figure income. At that time, we had no kids, so there was no ‘real’ reason for me to not be working. As I continued to work, we kept it in mind that we’d be losing my regular income in the near future. I kept working, drawing down my leave balances, until our son was 8 months old (May 2019). I’ve worked a few random jobs here and there since then, but that was for something to do and not because we needed money.

MAKING GOALS

Mr. ODA had a goal of $1 million by 30. He exceeded it. At no point did we say “reach $4 million by 40” or anything like that. However, we’ve regularly tracked our net worth and made smart moves with the money we have. We don’t keep money in a liquid state for long. We make sure our money is working for us as much as possible. We take calculated risks that allow for interest earnings.

We also keep our ears open for extra income opportunities. We’ve been secret shoppers before, and I’ve taken on different short term work roles. That extra income isn’t meant to be frivolously spent; it’s income that we still utilize to move our family’s goals forward. We don’t buy the latest gadgets, but it’s not like we don’t have nice things. We spend will intention within our means; we don’t take out personal loans (e.g., furniture loans, layaway loans).

A goal that keeps moving due to preference is that Mr. ODA will stop working a full time job as well. The lack of insurance options is keeping that from becoming a reality, but if we really wanted to push it, he could quit tomorrow because we’re in a good financial spot. Nearly a year ago, we set up a separate bank account to have his pay check go into. It’s nice to know that we can live without his income, all the while having that bank account as a safety net.