After several years of very minimal time having to be put into rentals once they were rented, 2023 made up for it. We had a lot of damage to properties, a lot of tenant payment issues, and just a general “can we not talk about rentals for ONE week please” moments. But even with that frustration, this is still the best.

All of these stories were elaborated on in posts throughout the year. This is meant as a summary of all our activities. You can search for the stories through keywords on the website, or just email me, and I’ll elaborate.

PROPERTY MANAGEMENT

In January, I took over management of our Kentucky properties. When we moved here in 2020, it was easier to maintain status quo. In Virginia, we had established contacts in the trades we’d need, and we felt comfortable there. In Kentucky, since we hadn’t lived there, nor did we have direct management of the properties (plus, the property manager did a lot of work in house), we just left it alone and kept paying the management fees. We bought a 4th property in Kentucky in 2022, and I kept it under my management. Through that process, I grew more comfortable with the area and any trades people I would need. Then over the course of 2022, the property management issues finally were painful enough that we cut ties.

We had cut ties with our first management company who was doing zero of the work they were supposed to do. In the process, we learned a few ways we wanted to see a future management company operate. We negotiated some of the fees that this company had. I didn’t foresee how frustrating that would be. For instance, they’d charge us 10% of the contracted price when hiring a company if they couldn’t do something in house. I said, “that’s what management is, and what I’m paying you for monthly.” They agreed to not add 10% to contractor payments. But I never saw the invoices, even when I asked for them, so it was hard for me to know whether I was being charged by them correctly. It turns out, I was always charged that extra 10%, and I needed to request the refund, every single time.

Problems really got bad when a single employee claimed we didn’t pay something we had and immediately charged us for it (over $1,000). We had to get the owner of the company involved. It was a mess. I finally said that’s enough, and even though I had a one month old baby, I took over management. Luckily, we had a clause in our contract that allowed us to cancel the contract (by either party) with 30 days notice.

I met with each of the 3 properties’ tenants they had under management, and I executed my own leases with them. First, their lease was a mess and disorganized (and had errors that were crossed out and initialed). Second, I like having my template in place so that I know what it says, and how it’s laid out. I recently learned that my VA property manager’s lease didn’t have some key information I would have preferred to see there, so I even started using my leases for the properties she manages.

INSURANCE CLAIMS

After having no insurance claims for all our homeownership years, we had three this year. One was on our personal house, and two were rental properties. I covered our own issues in a previous post; a wind storm caused a tree to fall on our deck, one (well, one and a half) on the fence, and a few limbs on the driveway.

We had a bad wind storm come through in March. The tree fell from the back of the property and hit the roof of a rental property. By some miracle, there was not a single puncture of a limb into the house. The roof sustained the fall and weight of the tree. We didn’t even need to fix the roof, just the fascia board and gutter. Insurance was super easy to work with. An adjuster came out, reviewed the damage, and issued a check.

We had another rental property with the water heater in the attic (instead of the crawl space or just anywhere better conditioned than the attic). A 2-week freeze came through in December 2022, and it froze the pipes. When it thawed, water just poured through the ceiling and into the house. There was 2 inches of water everywhere. The ceiling in the master bedroom, master bathroom, laundry room, and part of the kitchen caved in. The walls in the master bedroom and bathroom needed to be taken down to the studs and rebuilt. The bottom 2′ of all the walls in the house had to be torn out and put back together. All the flooring (that we had put in 5 months earlier) had to be replaced. And with all of that said, it actually wasn’t that bad of a process. Since insurance covered everything, it was just what it was. If I had to pay for each step, it would have been more painful (in time, contractor management, and cost). We were “out of commission” for about 3 months, but insurance even covered lost rent.

I sit here and type this while my back deck is still damaged. By the time we got through our claim with the insurance company, we were months out from the contractor getting to us. I’m hoping it’ll be replaced by May.

MAINTENANCE CALLS

I was surprised to realize that we only replaced two dishwashers and one refrigerator this year. Then I realized it’s probably because we’ve replaced almost all the other ones in the last few years – yikes.

We had a house cited by the City for unsightly conditions in the front yard. The tenant mowed and cleaned up some things right away, and we hired someone to come cut up a fallen tree limb that we didn’t know about.

We had another house cited by insurance for not having a handrail on the front stoop (even though we’ve owned this house for 6 years at that point, with the same insurance). We had our handyman install one for us. While he was there, he fixed the ceiling in a bedroom where there had been water damage.

We paid for a flat roof to be fixed, after several years of fighting it and it continuing to leak (it’s so hard to find a roofer to work on a flat roof). That was a debacle because he was delayed for weeks, didn’t communicate, and then took it upon himself to change the scope of work. I wasn’t happy with the new scope and forced him to uphold the contract and do it right.

One house was completely painted during the turnover. We also had the tile and cast iron tub in that house newly epoxied (and then learned that it didn’t even last a year and is flaking).

We also had a new one – wildlife traps. A tenant had a raccoon living in her attic. The management company “fixed” it, but didn’t actually. I hired a professional when I took over management. They didn’t catch anything over the course of a few days, so they were confident nothing was in the attic. They then repaired the hole.

And then the usual – several plumbing/HVAC issues that were resolved throughout the year. Those will always be there. We had a big one with a water main line leak due to trees infiltrating the pipes (and unfortunately, that wasn’t the first time we’ve done that type of work).

We spent $15k across the 13 properties (some had $0 spent) on maintenance calls.

INCREASE IN TAXES AND INSURANCE

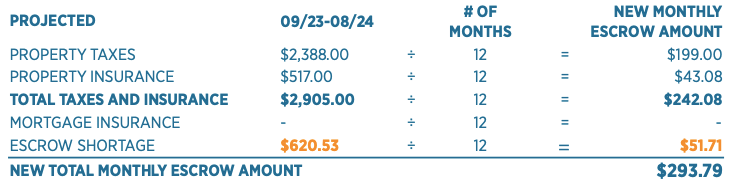

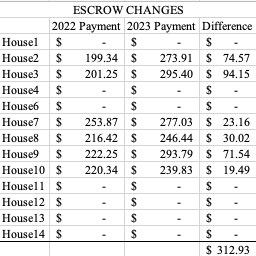

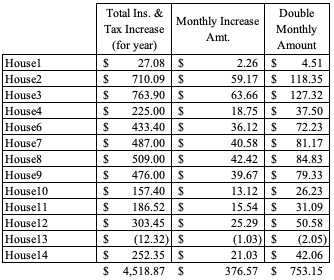

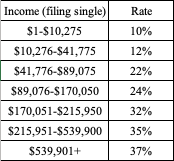

In November, I had posted about how our taxes and insurance charges have increased over the previous year. Our escrow accounts increased by $312 in payments. Our taxes were over $3,400 more than the previous year’s payments, and our insurance policies increased by over $1,000. Both the tax assessments and the replacement value costs were increased by these entities to reflect the higher home prices over the last few years, and that caused a higher-than-expected increase in all these costs. Some tax jurisdictions took their time in catching up their assessments to the skyrocketing prices of 2020/2021, but some took advantage of it right away. We have two houses where the taxes over the last 4 years have hardly changed, but we have others where the costs increased significantly.

INCREASE IN RENTAL INCOME

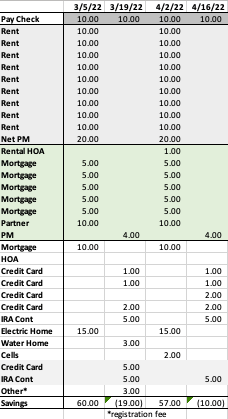

Our total income in 2023 increased from 2022 by almost $12,000. Although, I’ll note that we had over $4,000 paid from a rent relief program in January 2023 that really counted some towards 2022 amounts owed.

Most of my rent increases went into effect in 2022, just based on how the years played out. I had two properties increase by $50/month each in May 2023.

When the tenant flooded the house, we were able to upgrade a few things in there. In that time, the market rent always increased. So we went from $1200/month to $1600/month in rent over that time. It ended up being a problem because the new tenant lost her job, but that becomes a problem in 2024, after we struggled with her paying rent from October 1 through February.

We also had tenant turnover in another property, where the rent went from $800/month to $925/month. The previous tenant had been there several years. We had decent numbers (e.g., covering of expenses) on the house, and she kept struggling to pay on time, so I didn’t have the heart to increase the rent on her. It was my way of giving her a break because she had done something really big/difficult in her life. When we put it on the market, it wasn’t an ideal time of year, so we went low at $925. This tenant asked to leave mid-lease. We ended up re-renting the house at $995.

We had another tenant buy a house and vacate their lease early, leaving us to re-rent it for January 1. We were able to get someone in by February. Luckily, their lease break fee for that time of year was a month’s worth of rent, so we technically weren’t out of any income for that month-long gap. We were able to re-rent the house at $1,650 (from 1,350); that’s not realized until 2024 income though. We also took a leap of faith on this new tenant, who didn’t completely meet our criteria, but she asked for a chance; hopefully when I’m making this post next year, I haven’t regretted the decision to rent to her.

SUMMARY

This year, we had one tenant egregiously not pay rent on time, another tenant continuously pay late by a few days (although for their track record, paying 33% of payments due late is actually low), and a few who needed a bit more time (and communicated in advance) so we didn’t charge them a late fee. We had two houses with insurance claims, two major expenses (main water line replacement and flat roof repairs), and about $9k worth of other maintenance expenses on the houses.

I took over management of 3 of the 4 properties in Kentucky that were under a property manager. We added a house to the Virginia property manager’s portfolio. We had to turn over two properties in the winter wasn’t ideal, but we made it work. Technically, it was 3 properties over the winter, but one gave notice in 2024. We increased the rent on two houses by $50/month each to cover large increases in taxes and insurance payments.

Overall, this was a time-consuming year. We spent more time managing these properties and dealing with issues than any previous year. I can’t say that there was a single month where we just collected rent without any calls or discussion with a property manager. Heck, I could handle the “is it ok if I pay rent on the 9th” type messages, but this year was more than that. Here’s to hoping that everything is moving smoothly in 2024.