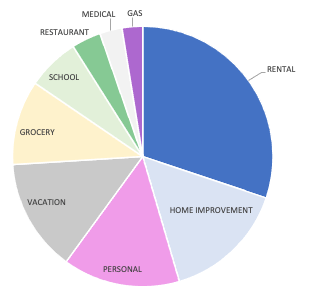

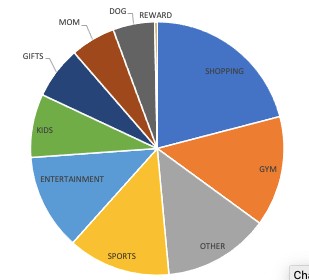

Many of our activities over this last month were already paid for or minimal cost. We went to Colorado, and we’ve been doing back to school type activities. Mr. ODA was in Colorado longer than the rest of us (I flew home on my own with 3 kids!), and he went on a work trip for a week, so my goal has been activities outside of the house as much as possible in this final stretch before school starts. We’ve had quite a few activities on rental properties too.

RENTAL PROPERTIES

Historically, if the 1st through 5th of the month falls on a Friday, that’s the day that I receive rent. Meaning, if the 3rd is a Friday, then I get rent that day. This month, the 2nd was on Friday. I received very little rent. Going into the 5th, I was still waiting on 60% of rent payments; I was already told by 3 tenants (making up 23% of that amount I’m waiting on), that rent will be late this month. Luckily, 2 of those 3 tenants had paid partial rent already. That left 4 houses going into the 5th that hadn’t paid and I hadn’t heard from. That’s more than normal and was a bit worrisome. By the time of this post, I’m missing nearly $2,000 worth of rent, which is over 10%.

We’ve had several small actions that needed attention from our handyman, so I paid out on that. We had an AC go out before a hot weekend, so we had our technician go out and fix that (I haven’t seen that bill, but it’s expected to be around $1,000). Mr. ODA went out to a local house to properly fix their kitchen cabinets that were apparently never installed correctly (before we owned the house) to install them into the studs.

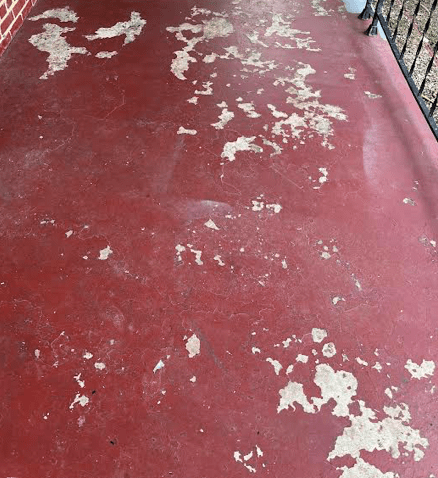

I was called for a garbage disposal that wasn’t working, and I attempted the fix on my own. I was nervous going into it, but I successfully fixed it in about two minutes. That felt good. I also went out to check on a roof replacement at a local house, and Mr. ODA replaced their deck. This tenant doesn’t communicate well whatsoever with us. She said “the deck is in bad shape.” That was it. Didn’t send a picture, didn’t give any details. I went out to check on it, and the deck stairs were hardly sturdy and none of the pickets were installed anymore around the decking part (it’s more of a landing than a deck when you think of size). It’s infuriating that people could not communicate such a dire issue. Most of my tenants do a great job, but this is why annual inspections are necessary.

PERSONAL ACTIVITIES

It has been a crazy month! I have thrived with the busy scheduled and a sense of accomplishment.

I was elected to our Homeowner’s Association board of directors this past month. I’ve spent a significant amount of my time going through that information and trying to get things organized and back on a schedule. I had my first meeting on the Landlord/Tenant Advisory Committee. And I joined on with a start-up school to be their financial consultant.

We signed our oldest kid up for Fall Ball and our second for gymnastics. She did acro last year, but I said all year that she would thrive better in actual gymnastics where they do more activities than dance. Our oldest started kindergarten, which is really exciting. That also required a lot of attention between back-to-school activities and paperwork to be filled out. I ran a 5k with zero training (I had run 1.4 miles the week leading up to the race), but my friend and I beat last year’s time by 5 minutes!

We worked on our own deck. A tree fell on it last July. We had to get our insurance company to understand our issue and fully cover the repairs that were necessary (it took them forever to get an engineer involved instead of all different adjusters). We finally got started in March on the replacement. After weeks and weeks and weeks of our contractor working on it, he finally ghosted us because he couldn’t get the waterproofing to be waterproof. So this past weekend, we tore up our deck boards and repairs the waterproofing issue. It’s supposed to rain this weekend, so hopefully we’ll see that our fix worked finally. Once we prove to ourselves that no water is getting down there, we can have the electricity finished. We also built a little wall to hide the storage being kept under the stairs under the deck, which was cool.

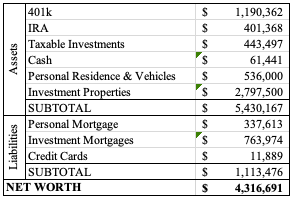

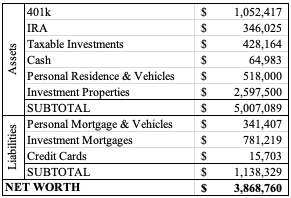

NET WORTH

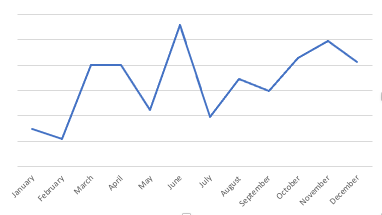

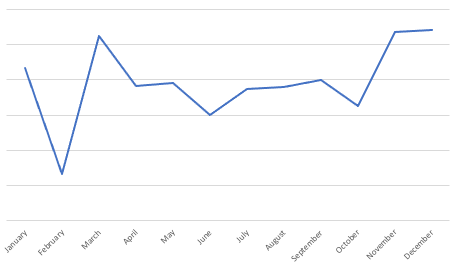

Obviously, our investment accounts diminished slightly since last month, as the stock market has been a constant discussion point recently. Last August, my updated said: Our overall net worth went down slightly from last month because of market fluctuation. So this seems to be a typical cycle! Last year it was offset by a large insurance check we received, while this year our cash balance is much lower from last month to this month.

I have about $9k to still pay out on a roof replacement (insurance is covering most of it), about $1k to pay to a plumber, and a couple of other odd jobs that are waiting on invoicing. Our net worth isn’t 100% accurate this month because I don’t have access to a few accounts (well, I have the log in and password, but it requires either text or email verification to get logged in, and Mr. ODA holds those and isn’t available – annoying!). I also have a $1500+ insurance payment to make, but I’m purposely holding off until this credit card statement cycle ends so that I can feel like one month isn’t a crazy high balance.

To update our net worth, I have spreadsheets set up that I overwrite from last year. Last year’s August update had our net worth at $3.78 million. So even though this month is over $27k less than last month, we’re still up over $500k from a year ago without any drastic changes in investment portfolio.