A few years ago, I set out on this journey. I wanted to talk about money so that people would start talking about money. Talking about money is taboo. Someone will act funny talking about what they bought their house for, yet it’s public record that can be found in 2 seconds. People act like it’s “cool” to say they’re broke, as if it’s a badge of honor. I want people to talk about their spending and find ways to move forward so that money isn’t controlling their life.

In addition to that general goal, I’m also sharing lessons learned as we navigate owning rental properties. I hope that information helps both landlords (including potential ones) and tenants. I want tenants to understand the work that goes into owning the house and renting it to someone, and how the statement, “I can own a house for less than rent” doesn’t get you very far because you’re not the one maintaining the rental.

At the end of 2022, I was in the process of moving to a new home, renovating the new home, and was very pregnant with two toddlers nipping at my heels. My posts were just the monthly financial updates (and I didn’t even get to a December post because our baby was a sick little one). It was always in the back of my mind to make a post, but I didn’t have the bandwidth. It took until the last day of June for me to get my feet under me and start posting again. A few years ago, I tried to post twice per week. This year, my goal was once per week, with a schedule of Thursdays. I posted 31 times in 2023. I posted every week from June 30th until December 31st, except for Thanksgiving day.

MONEY

We used to make much bigger moves in our finances – buy a house, sell a house, pay off mortgages. This year, we did things differently. Mr. ODA discovered Treasury Direct. He invests in these short term savings bonds. They’re available from 4 weeks to 52 weeks, but we’ve only held them for 4 or 8 week periods. We had three different insurance claims over the last year or so, leaving high savings balances for a few months. Treasury Direct was a way to get our money to work for us, earning at a faster rate than a regular savings account.

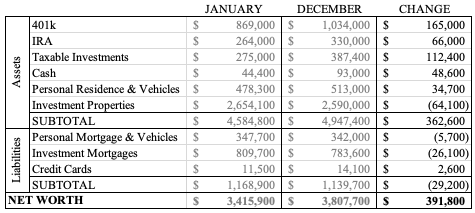

Our net worth increased by almost $400k, which is impressive since there wasn’t a large swing with a new house purchase. In January, home values were still high. However, the higher interest rates over this year cooled the market some, leaving our values $64k lower than January.

The goal all along has been for both of us to quit working. I quit in 2019, but have been doing odd jobs here and there. Mr. ODA’s quit date continues to be pushed back for a variety of reasons, but it’s something we’ve been planning towards. One step towards that goal was that we opened a new checking account. Nearly all of his pay check goes into that account, and we don’t touch it. While I could manually track our money as if we don’t have his income, it was a big step to helping us visualize him not working and how our finances would play out. I’m happy to report that I haven’t felt the strain of not having his paycheck coming into the account.

We opened one new credit card this year. We open new credit cards when we have a large purchase coming up. It started with our IVF journey, and we’ve continued that concept. It’s a “free loan” for us. We could either pay the total sum immediately (typically over $10k) from savings, or we could get an interest free credit card, allow our money to earn interest in savings, and then pay the balance by the end of the interest-free introductory period. That’s the path we choose. We replaced the carpet in our new home – the living room and entire second floor except bathrooms – for over $10,000. That’s sitting on an interest-free credit card right now, and I make $500 payments each month, until I need to pay the full balance at the end of the introductory period.

INCOME

Since I quit working my full-time-Federal-career in 2019, I’ve done several odd jobs. I’ve wanted the small break from being in the house, the small opportunity to have conversations with other adults, and a small feeling of contributing to the household’s finances. 2023 was the first year that I didn’t contribute more significantly. I worked 1 day as a substitute teacher in a preschool; $47 was deposited into our checking account. Comical. Even though in the literal “job” sense, I didn’t contribute much, I did work.

Besides the fact that I had to care for a newborn baby and keep three kids and a dog alive for the whole year….. 😉

I manage our rental properties. This year required a lot of management. I’m managing the work that needs to be done at each property. I’m recording expenses per property. I’m tracking income each month to ensure that we’ve been paid rent from everyone (and one property made this a very frustratingly daunting task).

On top of that, I also have worked to declutter and organize our house. As our last baby grows, we don’t need all the baby accessories that take up space. By selling these, it’s providing the ability to buy things that the kids need now. I brought in nearly $1,000 through that process.

Mr. ODA signed up to be a secret shopper. He goes into restaurants, follows the instructions he’s given, and is essentially reimbursed for the meal. He “made” about $750 doing that. It’s important to note that we’re spending money to get that money though. If he spends $15 on a meal at an assigned restaurant, he may be getting only $15 back from the company. Sometimes they offer a premium if they can’t get people to select the “shop,” but it’s just a few dollars.

CREDIT CARD REWARDS & INTEREST EARNED

Every year I love to tout this category. This year, the interest earned section far outperformed any recent years. I typically make a post where I go into the details of how our credit cards are earned, so this is just an overview. For the sake of this conversation, this is based on rewards redeemed as cash. Citi makes it easy to see how much has been earned/redeemed, but Chase has a portal where things are different. Chase allows for your points to go further if you redeem through their travel portal. That makes it hard to manage “earned” versus “redeemed” for a total each year, because the amount earned is inevitably less than it’ll be redeemed for.

Between all our credit card redemptions for cash and interest earned on checking and savings account, we brought in $4,000.

GOALS

I want to track our expenses more often throughout the year. I want to be able to get a handle on trends we’re making with our expenses and whether there’s an opportunity to cut costs. When I do this review once per year, it’s not giving me a lot to work with.

Mr. ODA is discussing leaving his job this year. It’s something that’s been on the table for several years now, but there’s never been a real reason to leave his flexible job where he has a bunch of leave and benefits.

Mr. ODA is working towards a financial advisor certification though. It’s a big deal, and I’m excited about it. He loves to talk about money and help other people with their finances, so I’m hoping this is a springboard for him to doing more of what he enjoys.

I’d like to work more. The few temporary jobs I’ve had have been more time consuming over a short period of time, whereas this substitute teacher position right now is so sporadic that I’m only working 1 day per pay period. While I appreciate the availability I have, I’m looking for something with a little more consistency (granted, for the Fall semester, I would basically be available everyday of the week, so maybe that will help).

We’d like our deck and patio to be replaced, which will then lead to more home improvement expenses. We plan to build a privacy feature wall under the deck, so that we can add a hot tub on the patio. There’s also an old hookup for a tv, which means some sort of tv set up is planned for out there, which may be further expenses. We have two more bathrooms in this house that haven’t been touched yet, and I plan to do a few upgrades.

A lofty goal will be that we keep our tenants in place and don’t have any insurance claims this year. The last year has definitely been more taxing on us than previous years.

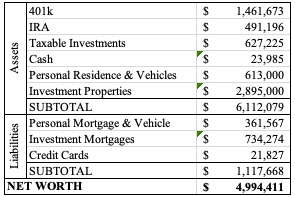

I think the big goal is that Mr. ODA wants to hit $4 million in net worth. Mr. ODA was 30 when we hit $1 million, 34 at $3 million, and hopefully 37 for $4 million (I don’t know when $2 million occurred because we weren’t updating regularly). Being that we’re at $3.98 million now, and that we grew by nearly $400k this year without any drastic moves (buying/selling a house), I think it can happen!

NET WORTH

This “net worth” graph isn’t the best since I didn’t update our net worth from February through June, but I kept those months in there so you can see the trajectory. I’m sad that life got in the way of my updating those data points. If I just post the first and last month, you can see there’s an increase. But that doesn’t show you that there are dips along the way, and everything is based on a single snapshot in time, even though balances are changing daily. I hope that I’m able to track each data point this year and in future years so I can see these trends.