*I’ve been working on this post for a week, so my numbers are a week old, but I don’t want to re-update them. I’m also posting on a Tuesday just to get this ‘out the door.’*

I’m starting to pull myself out of the overwhelmed hole I felt I was in. There’s still a lot going on, but I feel better equipped to stay on top of things. I had just been so exhausted, that I didn’t have the energy to do anything extra each day, and I was just getting by. Last weekend, I was able to work on pressure washing our patio and deck furniture (which was long overdue), and then I stained our deck. That’s been a pretty good springboard to me getting a fire lit under myself to get other things done, so that’s felt really good.

Our middle child graduated pre-k on Thursday. That was a big milestone, and my poor girl is so sad that she’s going to miss her teachers. She’s really struggled with my going to work and not being home all the time (although my time not home, while she would be home, averaged about 10 hours per week). I have things better organized at work, and I’m feeling good about my tasks and role in the office, so the hours I’m spending there are dwindling. I had agreed to about 20 hours per week, but I was closer to 26/28 each week. The biggest issue was waiting for someone to be available to help me, and then that everyone else is full time, so they don’t realize I’m trying to get out of here by 2 pm each day. This week our oldest graduates kindergarten and has many events around end of school.

RENTALS

One of the mortgages has been paid enough that the balance dropped from 6 digits to 5 digits. It’s still a lot of money owed there, but that felt like a nice accomplishment when I went in to capture the balance!

June is Richmond tax season for these houses. That means I’ll be paying out large chunks of money for the houses we have no escrow on.

We had a few maintenance needs come up. One house had the water heater flood the basement. Luckily, I think we’re OK on that front. We replaced the water heater. The gas wasn’t hooked up right, so the tenant called the plumber to get that squared away. This happened while I was in a different state, and I’m so grateful it happened in a house with a handy tenant.

We had some flashing fall off a roof line. This wasn’t a priority to address at the time, but the tenant started claiming allergies were flaring up because birds were getting in the attic. Sometimes you just need to accept that’s the story you’re hearing. We had a handyman go over there and verify there are no birds anywhere. The “hole” she thought she saw was just where the soffit was hanging a bit, but there were no gaps in the wood structure itself. He tacked up the soffit, and I contracted with another company to repair the one piece of flashing.

That handyman also went out and handled a wasp nest. At that house, the tenant says a window won’t stay open when she opens it, and we let her know it’s on our radar now, but it won’t be fixed just yet as our people are spread thin and that’s not an emergency. That house had a temporary tenant in it (housing with our current tenant). To cover the tenant and us, I asked for a $500 deposit. When they moved out, I had our tenant sign that there was no damage, and I returned the deposit.

We’re still working on the major termite damage that occurred at another house. There was quite the domino effect. Leaks from bathrooms and the laundry room created a very wet environment, which created a breeding ground for termites, which feasted on our wood all over that place. The crawl space got cleaned up, but we’ve been waiting over a month for the bathrooms to get replaced and fixed. I’m hopeful that it’ll start next week, but frustrated nonetheless.

I had a leak from a toilet bolt at another house. I was frustrated because we had just been called out for water on the floor at this house recently, but it turns out this was necessary. When the house is a certain age, things just wear away and need replaced.

We also had a limb fall from a tree at another rental. The tenant explained how much of a liability it was for me. I love when tenants instruct me on my level of liability (that’s sarcasm). We have a tree guy that’s been super useful for many things and he handled it the next day with no problem.

PERSONAL

We haven’t been spending much money. Most of our money these days goes to grocery shopping. On our current statement for our main credit card, we only have 11 transactions recorded for over 3 weeks.

We paid our last month of pre-school for our second. They are closing the school and they didn’t want to add on days for the snow days that occurred, so they gave us $50 off the last month of tuition to cover the 2 days we were owed for make-ups. Since the school is closing, everyone scattered, and we ended up not getting into another preschool next year for our youngest. So at this point, that’s an extra $375 per month in our pockets next year – unless a spot opens up for the littlest.

Mr. ODA took the buy out, which I think I mentioned last month. His last day of work was April 30th. He said he’s settling into the not working concept and starting to get over the desire to know what’s happening at work and with his programs he worked so hard on. He’s done a lot of work around the house here, including treating for termites in a very intense fashion, but that was cool to see.

NET WORTH

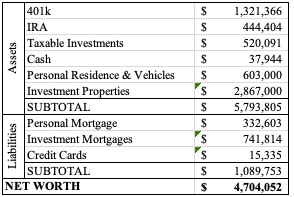

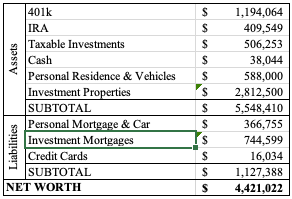

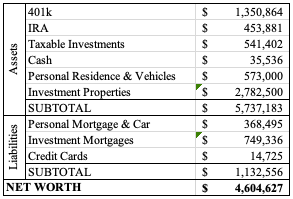

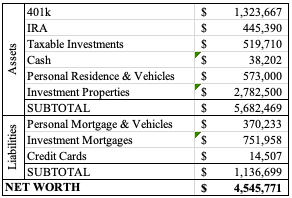

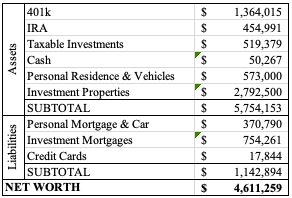

Two months ago, my job asked for my goals. It’s a specific document that I was to fill out. Someone else had mentioned their net worth goal, and our next big step would be $5 million net worth. Well, the market has been in shambles, and our net worth plummeted from where it was. I thought it prudent to not make such a goal when our net worth is completely reliant on the market actions right now (i.e., we’re not selling/purchasing or making any big moves that would drastically change our net worth outside of the market actions). We’re finally on the upswing and now at the highest net worth we’ve been, so that’s encouraging after those big dips recently.