The President issued a statement calling on Congress to cap rent increases at 5%, specifically for corporate landlords. The statement appears to define corporate landlords as those owning over 50 units in their portfolio. This was not an executive action that is implemented. And while my numbers are different than the numbers of a “corporate landlord,” I do think it’s worth hearing a landlord’s side. I feel that there’s a lot of spite against landlords without a lot of knowledge about their actual financials.

I admit that there is a possibility that some of these companies with large complexes could be raking in on the fees or “utilities” that are in the unit, without actually providing a properly maintained building, but that’s not the case for everyone that’s labeled as a landlord. No one seems to step back and see that this is a business model for landlords, and while everything else around us is increasing in costs, rent needs to as well.

No one predicted such a significant rise in product costs or housing costs in such a short period of time, but here we are. And landlords aren’t in the business to graciously eat the costs of homeownership for renters.

LANDLORD COST INCREASES

The Presidential statement released refers to a press release that starts with, “Today’s U.S. Labor Department Consumer Price Index (CPI) report revealed costs remained largely unchanged in May, with overall inflation cooling faster than economists expected as the Fed considers finally reducing interest rates below a 23-year high.” Is there a comparison to costs that landlords had to take on because the costs of everything increased faster than expected back in 2020-2022? Increases have been seen on small things like a maintenance call for a technician, but also big things like property taxes and insurance.

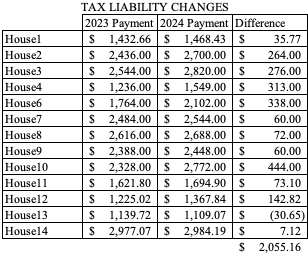

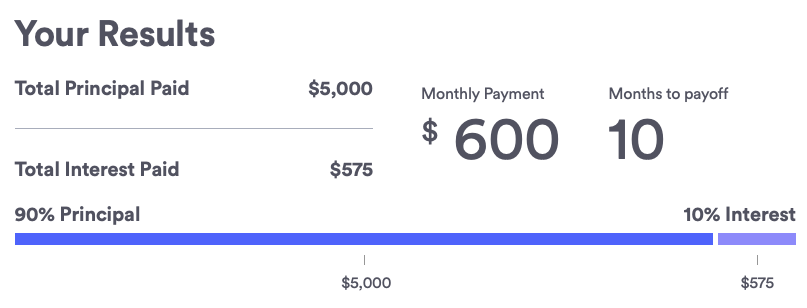

That same article goes on to state, “Since 2019, the cost of rent has risen 31.4%, with wages only increasing 23%, as tenants on average need to earn nearly $80,000 to not spend 30% or more of their income on rent.” In 2019, on one of my properties, the taxable assessment was $95,000, which equated to about $1,200 per year in taxes. In 2024, the taxable assessment was $242,000, which equates to about $3,000 per year in taxes. That’s a 61% increase in just my taxes over that same period of time where they’re complaining that the cost of rent increased by 31.4%. If rent had been set based on the 1% rule in 2019, rent would have been $950 per month. Had I increased 5% each year from 2019, it would be $1,212 in 2024. If I set rent based on the 1% rule now, it would be $2,420. However, the rent on the property is $1,750. So while it’s more than 5% each year since 2019 (the baseline the government is using), it’s set at an amount where I capture my expenses for owning the house, while also turning a small profit.

It’s taboo for a landlord to turn a profit, but that’s why we’re here. It’s an income stream that we’re establishing for profit. I don’t get to pay myself an hourly rate for managing the property. So this “profit” can actually be looked at like a salary. Every time I need to show the property to a prospective tenant, the lease signing, the walk through, every call or text you make, every trade that I need to schedule and coordinate with the tenant on, any fixes or improvements that I do myself. All of these minutes in a day add up, and I’m not directly paid for any of them.

On the particular house that I’m using for the example, we are assuming $300 per month in profit, which comes to $3,600 per year. Would you work as a manager of a company (e.g., hiring trades to fix things, performing maintenance, making sure all bills are paid timely, general management of having liabilities), for only $3,600 per year?

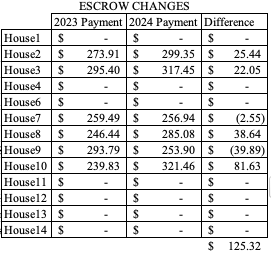

I wrote a post last Fall about the changes in my rental fixed costs from a year prior. I plan on doing the same this fall when more tax information comes due. The house I’m referring to has been at $1,750 for the past two years. However, between 2022 and 2023, my taxes and insurance have increased by $255 per year. That’s a cost that I’ve “eaten” from my “profits.” I could have said that equates to $22 per month increase, and I could have projected a similar increase for the year coming. I could change their monthly rent to be $1,790-$1,800 to keep my profits on a similar path. However, I didn’t, because they’re good tenants that haven’t had many maintenance calls.

However, if I don’t increase every year, then I could find myself in a sudden deficit like I did during the pandemic because costs increased faster than projected. A 5% cap could actually incentivize annual increases because I wouldn’t want to be caught behind and not able to catch up down the road.

LEASE TERMS

The Federal Housing Finance Agency announced protections for renters in multifamily properties that are financed with loans backed by Fannie Mae and Freddie Mac. The protections include: (a) requiring 30 day notice before rent increases; (b) requiring 30 day notice on lease expirations; and (c) providing a 5 day grace period before imposing late fees on rentals. I know for a fact that every single lease I’ve executed personally already has all of these requirements in it, at a minimum. In many cases, there’s a clause for 60 day notice of a potential rate increase, with negotiations being completed before 30 days from lease expiration.

Some states already have this codified. Other jurisdictions have landlord/tenant agreements that give the tenants rights (and awareness of rights) that can be lobbied against if the landlord is noncompliant.

There’s a clause that I’ve seen that requires expired leases to auto-renew on a month-to-month basis instead of for another year. I would argue that a requirement to renew a lease month-to-month instead of annually actually hurts a tenant. A landlord then only needs to give 30 days notice of a rent increase, and they could technically increase it month after month.

SUMMARY

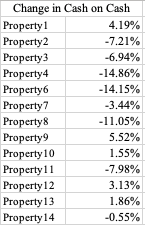

If the ‘cap’ were to apply to me, then I’d be more inclined to increase rent every year. As a general rule, I increase rent for long term renters by $50 every two years. When we turnover a property, we will evaluate market rent in the area and set the monthly rent at what we see (which could be more than $50). In some cases, the evaluation ends up being too high, and we set the rent at something we think more people can afford. For example, there were comparable houses renting at $2,200 near a house we had listed. We’d rather get the property rented than shoot for top dollar, so we listed it at $1,600. While lower than “market value” probably called for, it was $400 higher than what we had it previously rented at, which covered cost increases that weren’t previously covered.

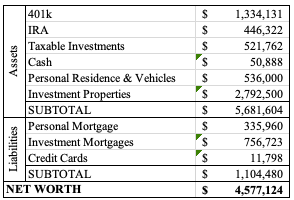

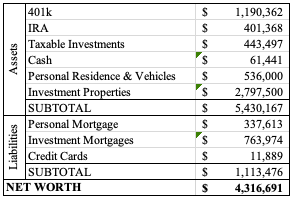

In the post that I previously linked, I highlight that our standard for increases barely offsets our increase in expenses. While we manage each house individually on setting the rates (asking ourselves: do we think the tenant can absorb the increase, do we have to increase to cover actual costs now), our monthly income among all houses was increased by $475. If you add up the cost increases for taxes, insurance, and property management (increased rent means increased fees because fees are based on the rent price), our costs went up $415 (and that’s before any service calls). On a whole, we’ve offset the ‘fixed cost’ increases. We’re taking ‘losses’ on houses where our routine for increases is slower. Therefore, having 13 properties affords us the ability to be more lenient with tenants and to keep good tenants in the house instead of forcing them out with hgher rent increases.

I support having protections in place for tenants. I’m sure there are landlords out there that aren’t interested in playing ‘by the book’ and just being decent human beings like I intend to. However, landlords are people too, and they’re running a business. Creating boundaries without fully understanding both sides of the situation and focusing on data points that only support your theory is unfair. I’ve joined the Landlord/Tenant Advisory Committee in my city. I hope to bring more awareness to the landlord side of things and bridge the gap between landlords and tenants when it comes to responsibilities.