Before I get into an update, I have a quick perspective moment. Our preschool has a 3.5% processing fee to pay monthly tuition online. Tuition is $265, so the processing fee comes to $9.27. If I paid it online instead of writing a check each month, that would be an extra $83.43 I paid for basically nothing. For perspective, I spent $82 on a grocery run of essentials (e.g., dog food, paper towels, milk, eggs, etc).

RENTALS

I had to give notice to one household by 1/31 if I were to raise rent. Their lease ends 3/31, and that will mark 3 years with me. I was panicking because it’s our most expensive house (it’s also our nicest and biggest, and it’s fairly close to downtown). Rent has been $1750 for the last 4 years. Last year I missed the notification to raise it because a January deadline surprised me, but this year I put it on my calendar for January 1st to do. And then I dragged that calendar reminder through the whole month, only needing to then set an alarm to make sure I did it at 8pm on the 31st. I raised it to $1800 and they accepted within the hour. Phew. They’ve been late three times in 4 years and clearly communicated what was happening each time. We’ve had two major issues at the house that they rolled up their sleeves and helped mitigate the damage before the tech could get out there. They’re just really great tenants.

I had two tenants pay rent before the 1st and one partially pay before. That was surprising since the last two months I’ve had very late payments come through. I still have one person with a partial payment outstanding as of this morning.

We had a water heater go out on Thursday in one property, but otherwise I’m counting all my blessings that we made it through 2 weeks of below freezing without incident.

PERSONAL

I’ve preached monitoring your spending by writing it down for years, but I hadn’t done it. I had done it a few times retroactively, but I never made the time to keep on top of it to make pivots. With Mr. ODA leaving his career, that’s a high six-figure income that we’re without now. I’m working part time, but that’s basically a one-to-one ratio of income to health insurance. I’ve calculated that we need to be about $1350 per month in spending outside of the mandatory bills (e.g., mortgages, utilities, tuition, insurance). My threshold is lower than what Mr. ODA said is his threshold, so this isn’t a hard-and-fast amount, but one that is my “I feel OK if we’re close to this number” concept.

We screwed that up a good bit by purchasing a new vehicle and putting new tires on said vehicle immediately. We also had to pay for a previous heating issue fix in our house and a downpayment on new windows (which, quick side note, are glaringly needed as we go through 2 weeks of single digits and can feel the drafts). I’m also not counting the things that we do as mystery shops since those are effectively reimbursed (sometimes our cost isn’t fully covered since it’s a whole family outing and not a single person, but I’m not drilling down in that detail since I don’t have the specific break down of how Mr. ODA is getting paid). If I take those things out and remove expenses for rentals, then we spent $1597 in January.

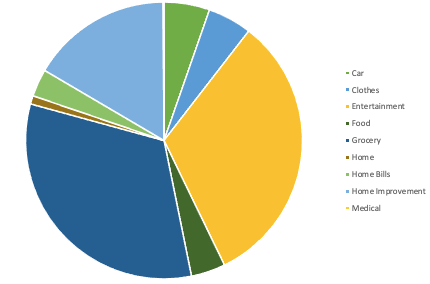

This isn’t the best representation of our spending, but I’ll develop this information as I have comparisons month over month. I also can’t seem to pick a better color scheme without it being a very manual process. Grocery, Entertainment, and Food are our biggest slices there. The entertainment category is basically why I gave up categorizing things years ago. Here I put things like going out for a drink, because while it’s at a restaurant or bar, the sole purpose was to have a drink and hang out. It also includes going to a gymnastics meet with my daughter, my fitbit purchase (I guess because I’m counting it as extra spending and not a necessity), and gift giving costs. We spent $528 on groceries this month, which feels low. I pushed really hard to clear out the food we have in the house already during our 2 weeks of being snowed in, but I hope that this is an accurate representation of monthly spending on groceries.

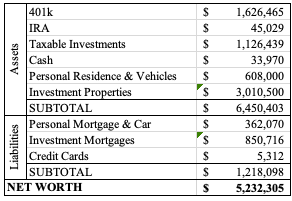

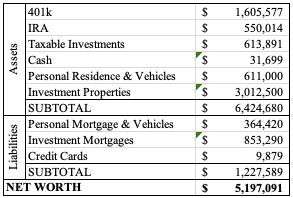

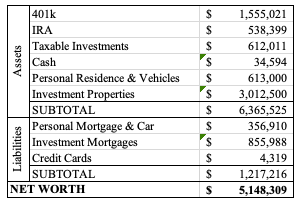

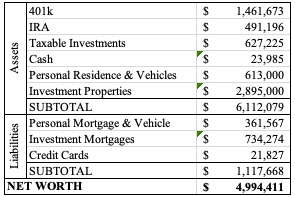

NET WORTH

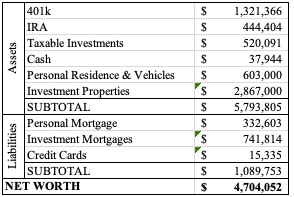

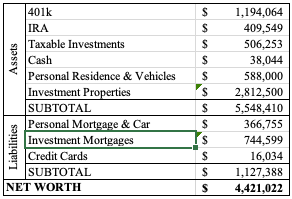

It is higher than last month, so that’s good. Credit cards are carrying $4500 worth of windows, so it’s nice how low of a balance those are outside of that 0% interest balance we’re holding onto. Our investments struggled a bit over the past month, but the payments on mortgages and loans helped offset that.