We have been surprisingly busy around here. I’ve been juggling a few rental issues, staying on top of some billing issues, and trying to make it through a commercial loan process.

At one point, most of our loans were held by one company. That was a more simple life. Even though we’re down to 6 mortgages under our name, it’s through 5 different companies. I’m really struggling keeping up with them and getting in a groove after our most recent refinance. I’ve mis-paid things 3 times now. I’m always on top of our payments, but something just isn’t clicking right now for me. I just paid one of our mortgages due April 1 instead of changing the date to be an April pay date. At the moment, we have a buffer in our account because we’re getting to this closing next week, but we usually don’t, so hopefully I have this figured out now that I’ve made so many mistakes.

RENTAL PROPERTIES

LEASE RENEWALS

We had 3 properties process their renewals this past month. Each of them had cost increases to their lease renewal (875 to 950 effective 5/1, 850 to 900 effective 8/1, and 1025 to 1100 effective 5/1). We have another property that will have a renewal offer go out this week. Then we have 3 that will need action by the end of April because the leases expire 6/30, and one that will need action by the end of May because it expires 7/31.

MAINTENANCE

We had a tenant reach out to us that they found bugs in their bathroom tub. She sent pictures and, sure enough, they were termite swarmers. I have way too much experience with termites. I called our pest company, and they sent someone out for an inspection to confirm they were termites. Then I got a call that because we didn’t pay the annual fee to keep our warranty current for the last 3 years (we had the house treated for termites in February 2019 when we bought it because there were active termites and extensive damage by the front door that needed repaired), they could charge us $650 again. However, since we’re considered a business account, she’d be happy to let us back pay the termite warranty and they’re treat it. So I paid $294 for the treatment instead (split with a partner on this house). She also informed me that they had cut off the hot water to the kitchen sink because there was a leak. I don’t know why tenants don’t tell us these things right away! I had my plumber out there the same day, and he replaced the whole faucet. That was $378. That’s one of those charges that’s frustrating because we could have replaced the faucet on our own, but we don’t live there anymore. Oh well; it’s also a cost split with our partner, so that helps.

We had another tenant reach out saying that her kitchen sink drained slowly. She’s been with us since we bought the house and never asks for anything. She’s on top of communication and was super appreciative each time we agreed to renew her lease. We had done a huge sewer line replacement project at this house, so I was skeptical of the issue. It turns out there was a plastic fork lodged down there, but I just let it go (meaning, she’s then technically responsible for the cost). Our property manager let her know that if it happens again, she’s financially responsible, but we’ll cover the cost ($200) this time.

RENT COLLECTION

We FINALLY got the check for one of our tenants that had an approved rent relief application. They submitted an application in November to cover December, January, and February rent. By mid-December, they ended up paying December rent because they hadn’t heard (and the application expires, meaning their protection from eviction expires (not that I would have pursued eviction for this group because they’ve been great tenants for several years)). They received approval for 3 months worth of rent and 2 late fees on January 11. We received the check on March 4th. So frustrating in that process, but still better than an October approval and us getting those 3 months paid at the end of January.

We had our usual suspects not pay rent. On the one house, they didn’t tell us they weren’t paying rent for the longest time. Now, they tell us they’ll pay us on a later date. I let it go this month, but with them paying on the 23rd, that means we’re in a perpetual cycle of not getting rent on the 1st. We have a partner on this house, so I plan to address it next month if they claim another 3+ week delay in getting us the rent. On the other house, she let us know in February that she’d struggle to pay rent and she gave us random amounts throughout the month. I let her know she was still $106 short from February and that she was now in default of March’s rent, and I got no response. Then Mr. ODA had $1000 show up in his account on Friday. She still owes $371 between the two months, but at least we have the mortgage payments covered. She’s also the tenant that we plan on not renewing her lease because she’s caused issues throughout her tenure.

BUYING A NEW PROPERTY

We’re still in the process of getting through closing on a new rental property. We’re expecting to close not he 24th, so we’ll see how that goes. It’s a commercial loan, and it operates different from residential mortgage underwriting, so we’re in the dark. Communication has been next-to-nothing. We’re currently waiting on the appraisal to come back. That was our one hurdle to getting into the house. I said once the appraisal clears, then we (as the buyer) shouldn’t have any risk in getting to closing. Therefore, we were hoping to have the house painted before we close (I would do the painting), then we could refinish the floor and get the rest of the cleaning done the weekend after closing, and get it listed for rent for April 1. I suppose I wouldn’t be trying to get to the house before Friday, so I guess I can be patient and wait to see what happens with the appraisal for a few more days (even though the appraiser was on site last Tuesday, and I’ve never had it take more than a day or two to get the paperwork).

REFINANCE FOLLOW UP, STILL

We still have an issue with the mortgage that I ended up paying 3 times for the 2/1 due date. Our refinance was difficult, and the communication continued to be difficult after closing. I asked on 2/1 whether our loans had been sold yet because I was surprised I hadn’t heard. Usually, I see a note saying to pay the new company before the first payment, thereby not paying the first payment to that “first payment notice” place that comes with the closing documents. The company’s contact said to keep paying them because they hadn’t sold the loans yet. I didn’t open the attachments in his email because I assumed he was reiterating what he said in the email. Turns out, one of the loans was already sold, and I should have paid the new company. Well, I processed a paper check to go to a completely different company (started with a C, and I didn’t catch that I selected the wrong one in bill pay). Luckily, that company sent us our check back, saying they think our loan is closed with them and they can’t process the payment (thank goodness we once had a loan with the address I put in the memo line so they could clearly make a connection and say “we don’t want this!”). When I noticed my mistake on the 14th, I sent a handwritten check that I rushed to the post office at 4:55 to get post marked. In the meantime, I found out that I was able to set up an online account with the new company even though I didn’t have the loan number yet (they gave it to me over the phone). I paid the new company online to make sure I didn’t have anything on my record claiming I didn’t pay by the 15th and it was late. I figured I’d rather manage 3 payments being made than fight the credit companies to change my credit report. Well, the initial company cashed my handwritten check, but they still haven’t sent the money to the new mortgage company. They just kept telling me they have 60 days to get it to them, and I said that’s unacceptable that they’re holding my money. That was a week ago that I was told I’d get a call back, and I haven’t heard from them.

PERSONAL EXPENSES

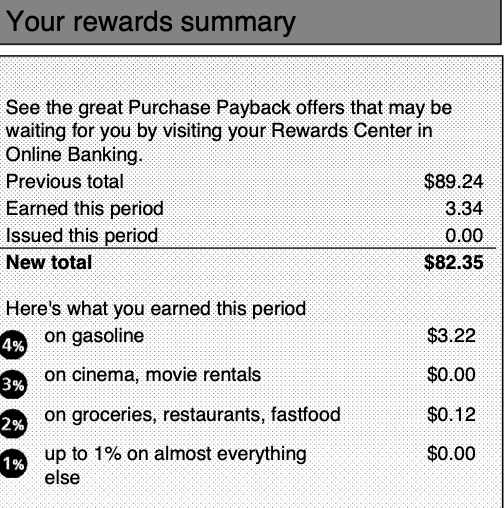

Now that the basement is done, I had a strong urge to finish projects. There were several things that were starting but not completed. Those final punch list items always seem to take forever. I was impressed that Mr. ODA pushed to get some of the things in the basement done right away, even though they weren’t on a critical path. However, I didn’t uphold my end of the project by painting those things, so I got back to that. I mentioned several of the projects in a recent post, and I’ve done a whole lot more since that post. But all that to say, I’ve spent a lot of money in the last month. I bought a lot of supplies to finish off these open projects. I also had big purchases of cabinet hardware, a dining room table, a desk, and a wood. We haven’t done very much out of the house, so we don’t have a lot of other expenses than these projects, which means our credit cards are actually have the usual balances. We did book an AirBnB for a trip at the end of the summer with friends of ours. That was a big hit on the credit card for a week at the beach, but they reimbursed us for their half.

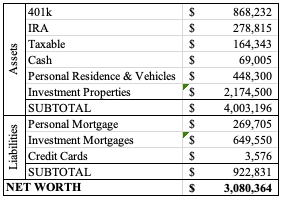

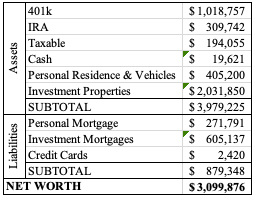

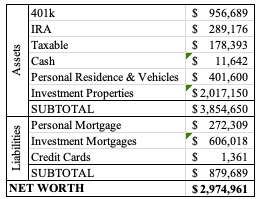

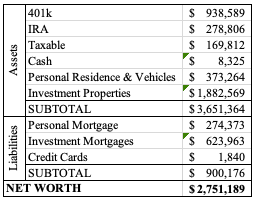

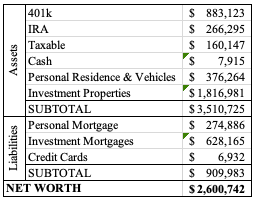

SUMMARY

It feels like I just keep lowering the balance in our investment accounts each month, but I went to look at February 2021 to see the total. Even though some balances have decreased, we’ve still contributed to the accounts, so overall they’re $21k higher than last year, which is encouraging. I guess I should also focus on the property values raising significantly. We’re over $500k higher than last year in our assets, and our liabilities (i.e., mortgages) are about 13k less than February 2021. We’re also still over $3M on net worth, even if we’re hovering right around that. We’ll add about $50k to our net worth by the end of the month, as long as we close on the new property on time.