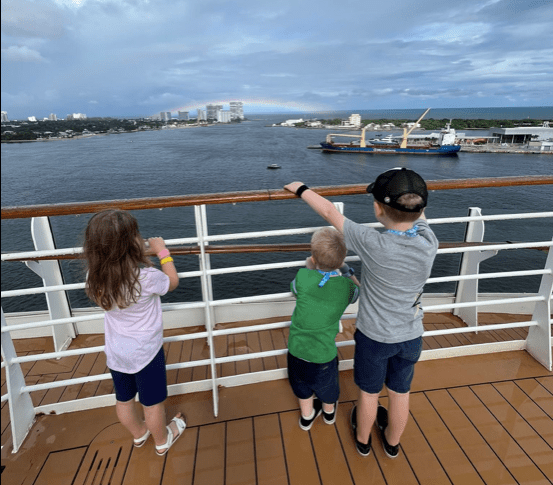

After each trip, I typically summarize how much it cost us. I like talking about money, mostly to work towards eliminating the stigma about talking about money. The more information you have, the better informed you are when it comes to decisions, so here’s a reference point to file away. We sailed Royal Caribbean’s Oasis of the Seas. I loved it!

COST BREAKDOWN

Flights – 25,000 miles + $273

We looked at several different flight options now that we’re a family of 5 flying and that adds up quickly. The first night we were looking to book the cruise, there was a group of 5 tickets for just under $700, which we thought was a great deal, but once we were ready to book, it wasn’t there anymore. We ended up going with Frontier for one direction and using American Airline miles for the other direction. When booking with miles, you only need to pay the taxes on it, so that’s what we did.

The flight options were very limited for the way home. We ended up just sucking it up and picking a 9 pm departure. Not long after the booking, we received an email saying our itinerary was changed and now the departure is 12 pm. While that seemed concerning at first – to get off the cruise, through the airport, and to our gate before noon – I had hoped it would be just fine, and it was. We got off the ship around 8:30, took an Uber to the airport, and arrived too early to check in for our flight. They built the airport expecting this isssue, so they sent us to the waiting room. We sat there for about 45 minutes and then checked our bags and got to our gate. We sat at our gate for a couple of hours and got home on time.

On the way down, we each got a checked bag because of our American credit card. However, we still needed to prepare for “carry on” status on the way home with Frontier. Then, once we were already packed, Frontier offered us to upgrade all our bags to checked bags. Had I trusted that they wouldn’t have said “no, you have to check a carry on size,” I would have happily changed our 3 carry on bags to one big bag to make traveling through places with 3 kids easier. So while some parts were harder because we had 3 rolling suitcases to account for, it was nicer through the airport to not have suitcases to manage.

Hotel – 34,000 points

If you’ve ever had to fly into a cruise port, you know it’s less stress-inducing to fly in the day before. I went on a cruise a year and a half ago, and we were flying out during a snow storm that was affecting travel all over the area. We ended up arriving at our hotel near midnight, so we were happy to know we were there for the cruise boarding time and not stressing about delays that morning. That means there’s a cost for a hotel one night.

The hotel was booked with points, so it wasn’t a literal cost to us. We stayed at the Tru in Dania Beach. They had a shuttle from the airport to the hotel, so when we arrived, Mr. ODA called the hotel to come pick us up, and it worked out well. We had to wait 20 minutes for a crib to arrive, even though it was on our reservation as a request. This isn’t a huge deal, but when it’s 10 pm and I’m just setting up a crib to get over tired kids to sleep, I’m not thrilled. Otherwise, the hotel was nice and it provided a good breakfast.

Uber – $58; Airport Parking – $70; Dog – $289

The hotel provided a shuttle from the airport to the hotel, so we didn’t have to pay for that part. Then we needed an Uber from the hotel to the port, and then from the port to the airport. We requested a car seat in the Uber on the way to the port, so that limited our options. Then she was 23 minutes late to our pick up time, didn’t get out of the car to greet us or help set up the car (pick up the 3rd row to fit our 5th passenger we disclosed ahead of time), didn’t acknowledge being late, and generally didn’t speak to us except to say get our IDs out for the port. That’s not an Uber issue, it’s a specific driver issue, but that was not a great experience. On our way from the port to the airport after our cruise, we got charged a wait fee, even though the wait was because security was stopping our Uber from getting to us. Uber removed that charge though.

The CVG airport parking is $10/day for economy. That’s my first economy experience instead of the ValuPark lot, which is $12/day. I didn’t really think anything of it, but it wasn’t a great experience. I always thought it odd that the ValuPark lot has shuttles that pick you up at exactly your car, but the economy lot has the shelters. I didn’t properly account for the time to wait for the shuttle and then to have the shuttle drive through all the shelters.

Food – $44

Obviously most of the food was part of our cruise fare. We had McDonalds on the way to the airport, Burger King during our layover, and then McDonalds on the way home.

Cruise – $3,099

The big one! We did not prepay gratuities, so that was billed as we left the ship. Gratuities are $18.50, per person, per day. We had $50 on board credit. Ironically, and just coincidentally, we spent $50.40 between drinks and child care (the babies room (0-3 years old) is $6 per house before 7 pm and $8 per hour after). Royal Caribbean only requires $100 per person as the deposit, and then the balance is due a few months before the cruise departure. We booked right at that threshold, so we paid our deposit and then a few days later paid the balance.

LOGISTICS

The booking of the cruise could have been a bit more forward. Cruises are not family-of-5-friendly. There’s an option on Royal Caribbean to book a “guarantee” or GTY room. You get a discount for allowing them to assign you in an open room (of the category you picked (e.g., interior, ocean view balcony)) about a week before the departure. I did this for a cruise I took in January 2024, and it worked out perfectly fine. So we see these prices quoted online for GTY rooms, but they always make you call to book for more than 4 people. We’re expecting the cost to be just the taxes and port fees for the 5th person, but when we call, the difference is over $500.

We tried to explain how that feels like a bait and switch and that there’s no indication of that on the website, and they basically said “well, that’s the way it goes.” They can’t guarantee a 5+ room available at the time of sailing. This makes sense, but it also eliminates our ability to use that cheaper booking option. We asked if there was something they could do to help make us feel whole since we were being forced to spend $500 more than if we could be put into the guarantee-pool, and they gave us $50 on board credit.

Mr. ODA’s parents book Celebrity (same parent company) all the time, and if they book their next cruise while on their current cruise, they are given OBC. Turns out Royal Caribbean doesn’t have the same philosophy, and they hardly give OBC. We tried to see if there was a special deal for a cruise if we book on the ship and they had nothing to offer.

Our departure experience was horrific, and I’m not even sure how we timed everything so poorly. At CVG, the kiosk jammed printing our tags, so we had to wait in line to get to the counter for the last luggage tag. Well, the line took forever because there was a large group in front of us that couldn’t speak English, so the workers couldn’t get everyone checked in quickly. Then we were too late for her to print checked bag tags because it was 30 minutes before the flight. So now we’re stressed trying to get through her attitude, us being late, and having to get through security and run through an airport with 3 little kids. This is the first time I’ve ran to my initial flight (ran for connections countless times!). I’ve never had this issue before, but everything along the way took just a few more minutes than I had planned for, and the luggage tag issue stole about 15 minutes of time from us (plus, our flight was delayed by 20 minutes and then 45 minutes before the original flight time, they said it was on time… we hadn’t delayed our departure from home, but it was wiggle room we thought we had and then suddenly didn’t). After the attitude from the ticket counter, then we encountered two more attitudes from the gate agents. It was a rough start, but the flight attendants were nice, and we had plenty of time to catch our breath at our connection.

Child care is provided on the ship. They have a few hours in the morning (maybe 9-12?), then 1-5 for the afternoon, and then 7-1 am. For the kids 3-12 (split between two rooms of 3-5 year olds and 6-12 year olds), it’s free until 10 pm; then it’s $10 per hour per kid after 10 pm. For the babies (0-3 years old), you need to make a reservation for times when you arrive on the boat. We prioritized the buffet, so by the time we got to the kids area, lots of time slots were booked already. She offered me 6 hours worth of booking, which I split between 3 days. Our youngest is 7 weeks shy of being 3, but he wasn’t 100% potty trained (although we did try) so they wouldn’t let him move up. If he was potty trained, they would have let him go up to the 3-5 room. The first 2 hour block, we only used 1.5 hours worth of it based on the activities we were trying to get done. The second 2 hour block, we only used 1 hour worth. And then we didn’t use our final day worth of time because he got sick, and I didn’t want to contribute to the spread of it. We dropped the big kids off a few times and just took the baby with us to activities, which worked out fine. He’s so good when he’s alone, but the 3 kids feed off each other!

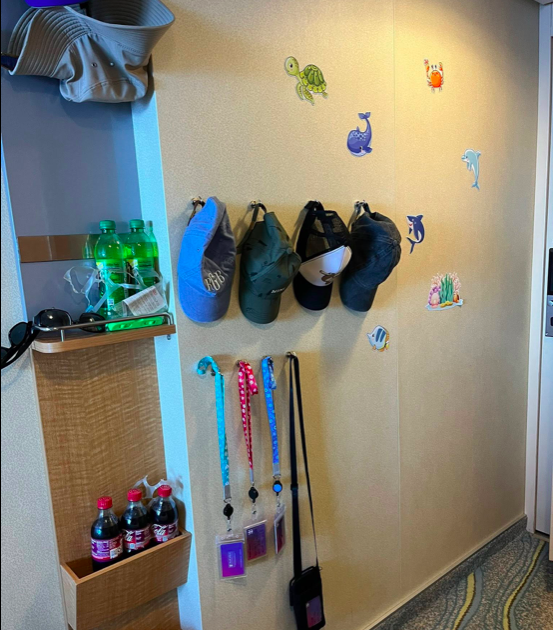

I brought lots of hook magnets. I used them to hang everyone’s lanyards with their seapass cards, hats, and to dry bathing suits. I also used them to hang from the ceiling and utilize curtains that I brought (actually, I bring these curtains everywhere we travel because a really dark room is important to getting the kids to sleep past sunrise when bed time is 2-4 hours later than usual). There were 2 hooks in the shower, 3 hooks on the bathroom door, 2 hooks in the bathroom with 2 towel bars, and 2 hooks outside the bathroom. We’re going on another cruise next year, and I’m going to bring more hooks because we could have used more space to dry out bathing suits. Having the curtains hanging to separate the kids from each other and then from us was great.

I also bought a pack of decorative magnets. This is very unlike me; I don’t like anything extra. But I put them on the stateroom door, and it helped the kids identify which one was ours. The door is textured, so they didn’t all fit. I put them inside the cabin on this big blank wall, and I actually really appreciated the decoration.

You’re allowed to bring on 12 cans/bottles that are less than 17 ounces each, so we did that for Mr. ODA’s sodas. We didn’t buy any drink packages. I don’t know what sodas cost on the ship. At the buffet, we have lemonade, iced tea, and water available. At some of the included restaurants, they have other flavored water type drinks like strawberry melon. At breakfast they had apple juice and orange juice. There are enough options for variety if you’re not looking to buy a package. I had Mr. ODA bring a non-diet/zero type drink in case I wanted some variety, but I was so full that I didn’t end up wanting any sodas and had a couple of lemonade and juice options throughout the week. The alcoholic mixed drinks are about $15 a la carte. They offer a happy hour special of margarita (and maybe one other option that’s $6-7) and have a drink of the day that’s $8. I didn’t know about the drink of the day special until day 3 and didn’t know about it at all on my last trip, so that’s a positive to know. I think the Truly/beer type option was around $8-9 each.

When buying the drink package, that’s your baseline. Are you going to drink 5 mixed drinks or 8 beers/Truly each day to make paying up front worth it? I’ve heard some people say “I just like not having to think about what I’m ordering.” But, do you enjoy paying $65 for 2 drinks? I understand it’s vacation and many people have the mentality that money is no object, but it is something to pause, have the perspective, and make an informed decision on.

The app is really good. There’s a little room for improvement, but everything you need is there. We’d like to see a search feature, where you can search “bingo” or “laser tag” and see the offerings instead of scrolling every day and hoping you catch the times. I like the daily tips they post about what’s happening that day and some good reminders. I also like how many activities are offered. I wish there were a few more things in the 6-8 timeframe for those with a 5:00 dining time, but I understand that’s not the worst problem. There is so much offered for other times, and I found myself juggling wanting to do all the things, but also not wanting to be on a schedule.

A few weeks before your cruise, the app will have most of the shows and activities available. One example that we didn’t have until we were on the ship was laser tag’s schedule. But you should get on your app a month in advance and keep checking for the show reservations to be opened. They seats go fast. We were able to reserve the ice skating show and Cats, but we weren’t able to get a seat at the aqua show. I was really bummed about that, but we went to the aqua theater at the beginning of the show and were able to get a seat.

We did not pay for a wifi package, nor did we set up our phones for an international plan. I was looking forward to being completely cut off from the world for 4.5 days. To my surprise, iMessage worked the whole trip. It wasn’t too bad, and I got to share stories as we went with some people.

LESSONS LEARNED

- Book any 0-3 year old child care slots ASAP

- Pack half the pajamas you need (our kids wear pajamas through breakfast at home, so there’s no re-wearing, but they don’t eat anything in the cabin, and they don’t leave the cabin once in pajamas, so don’t use up the space)

- Prepare accordingly for theme nights (I may have not planned well for my oldest)

- Bring as many magnets as you can hold (although you may get flagged for a bag check in security)

- Read the daily tidbits in the app each morning

- Don’t pack lots of snacks (I thought I’d be looking for breakfast faster than everyone being ready to go, so I packed granola bars. I also thought we’d want more snacks, but we’re so full from eating bigger meals and being on a different type of meal schedule that eating in the room was never a thought)

- If you’re on the cusp of 52″, 48″, age 3, or age 6, I may wait until those milestones are hit. While it’s not the end of the world and doesn’t kill your cruise, we had kids disappointed they couldn’t do some things based on height (water slides) or age (rock climbing).

- Drink the happy hour or daily special beverages if you don’t have the drink package

THE CRUISE

We took a 5-night cruise. It was more time than I had planned for originally. I didn’t want to be stuck on a boat in case the kids didn’t take to sailing well, but the price was $1000 less than the 3-4 night offerings, so we went for it. It worked out well. Everyone’s first question seems to be, “were you afraid of them going overboard?” Turns out, there are very limited options for that to even occur. We were in an ocean view balcony, but the glass goes higher than the littlest ones, so that wasn’t an issue. Most decks have the staterooms on the outside, so the only real place they could attempt to get overboard is on decks 15 and 16, and a little spot by rock climbing on deck 7. It was barely a thought of mine the whole week.

The biggest hurdle of the week was getting the kids through crowds. There’s a lot of people on the boat, and people tend to congregate in certain areas. Keeping 3 little ducklings together in a crowd could have been worse, but it wasn’t the easiest either. The cruise ship gives you bracelets for your kid to wear with their muster station on it. I wish there was more information on it, so I put their names and room number on the back. The youngest didn’t have a yellow bracelet, and I wasn’t happy about that. Luckily, I had packed a bracelet that I could put his information on. I used a regular sharpie and the lettering was legible until about the last day. I could have rewrote the information, but by then I was feeling more comfortable.

We did not push too hard to get to all the activities. We made a concerted effort for a few activities, but I didn’t want to be tied to an agenda all week. We generally started the day with breakfast. We ate in the main dining room twice, which was quieter and calmer, but also slower. One morning, I ordered a small breakfast, and the waiter pushed me to get the “express” breakfast. It came with 2 things I didn’t want, and I was frustrated that he pushed me to waste food. We usually then went to the pool or splash area (the splash pad is pretty cool with slides and activities within it for the kids). Ice cream opened at 11:30, so that worked well as a way to get out of the pool and start drying off for lunch. We ate lunch in the buffet (Windjammer). I personally liked the variety of options with the kids, but it wasn’t the easiest process. Apparently kids really struggle holding plates flat. We only lost one apple once, but it was stressful every time trying to make sure they kept the food on the plate while walking. Our afternoon was spent either with the kids in the kids club area (Adventure Ocean) while we did trivia, or they came to trivia with us. We rode the carousel, the big slide (Abyss), and participated in some random activities (family festival, scavenger hunt). We would get back to the room at about 4:55, rush to change, and then run to the main dining room for our 5:00 dinner. On my last cruise, there were only 2 dinner times, so being on time seemed less of a priority. This sailing had a 5:00, 6:45, and 8:00, so I felt the push to be as close to 5:00 as possible so we didn’t delay a 6:45 sitting. We ate all our dinners in the main dining room. I truly appreciated the themes, but perhaps only 50-60% actually participated.

At Cozumel, we got off the boat, had a beer at a tourist trap, and got back on the boat. I don’t think we were off the boat a full hour. There was swimming available in some pretty water just next to the cruise ships. There are shops for trinkets and a few places to eat or drink. It was an area that clearly catered to cruise ships and I felt perfectly safe.

Our second stop was Royal Caribbean’s island, CocoCay. I can’t sing enough praises about this concept. All your food is available. There are servers just like on the boat if you want a drink. It’s clean. There were some concerns about jellyfish while we were there, but we didn’t have any problems. My youngest was struggling with the sand concept (and not touching the sand and then rubbing his eyes or sucking his thumb), so we eventually moved over to the pool. The pool was packed, and I almost said lets just go, but we got in. Once you were in, it wasn’t uncomfortable at all, and there was plenty of room. There’s a 0 entry area with water fountains, which kept the kids entertained well. There are life vests on the island for your little swimmers. I did hear that snorkeling was sold out when we arrived around 10, so you could keep that timing in mind. The ship staff give you towels as you get off the boat (you sign them out with your seapass card), and there are towel stands on the island if you want to swap out your wet, sandy towel for a new one.

I will note that we had a medical emergency just hours into the cruise. It didn’t affect us at all. We heard the “alpha alpha alpha” call while we were at dinner, and about an hour later, the captain came on the loud speakers and announced the plan. We departed Ft. Lauderdale, but we were going to return to Miami to get this patient off the ship. They were making a plan on whether we’d have to fully dock or if the coast guard could come out to us. They announced a bit of time later that they decided the coast guard could come out. Then about a half hour after that, they said that the swells from the tropical storm we were near were too rough and the coast guard couldn’t get close to our ship to safely transport the patient between the two boats. So then they decided to send out a helicopter, and that happened just as the sky opened up on us at the aqua theater and we gave up and went to bed. So even though the course changed, it really didn’t affect anything we were doing on the ship. The patient actually got off and received emergency coronary bypass surgery that night and was recovering, so that was a blessing. There was also supposedly a death in another cabin, which I knew nothing about until after I got back home. I share this just to say – things happen, and there’s so many people, so it’s not surprising, and it didn’t affect the rest of the trip.

Getting on the ship and off the ship on the bookends of our cruise was extremely easy. I had a similarly easy experience at Cape Canaveral (actually probably easier). On the way there, we went through the security check points. I was flagged for my magnets, and in the process, they found my extension cord. Honestly, it wasn’t clear what the rules were about the extension cords. I wasn’t worried about the number of plugs as much as I was the extension to an outlet. They’re quick to say “there are plenty of outlets,” but they don’t address the fact that 3 outlets are on one end of the room and there’s only 1 at the bed. It didn’t matter though. We plugged in a phone overnight by the bed, and the sound machine was over by the kids with that 3 outlet option on the desk. They confiscated my extension cord, but they tagged it, and I got it back at the end of the cruise. After that, we went upstairs to a huge waiting room. We were told to sit in order as we entered. The place was packed; I expected this to take a while. It was less than 2 minutes. We scanned our boarding passes and walked right on. On the way off, everyone just left when they were ready. We walked right into the main dining room, scanned our seapass cards, and left the ship. There was luggage areas to pick up any luggage you had carried off the ship overnight, but we hadn’t done that. Then you go through the immigration check where they take your picture and approve you to continue. And that’s it. There was no queuing through either process except for the 2 minutes we sat in the waiting area at the port on the way on the ship. It’s incredible to me.

SUMMARY

I was a reasonable level of nervous taking 3 young kids on a cruise for 5 nights, but it went significantly better than I expected. Our next cruise isn’t until this time next year, but I wish it were sooner! I highly recommend cruising, especially with Royal Caribbean.