This is a good one. This is the one we use when people say “how can you handle all those properties,” and I respond, “if we survived this one tenant, we know we can handle whatever gets thrown at us.” Hoarding, mice, court dates, eviction. But its not always like that. The sun shone down on us for the current tenant though, who signed a two year lease and take care of the house (like, even power washed it on their own accord). The stories below show that you need a thick skin and a smooth temperament to be a landlord. Treat this as a business.

LOAN

This house was purchased ‘as-is,’ but we still had a home inspection contingency in the contract. It was listed at $139,500; we purchased for $137,500 with $2,500 in seller subsidy. We went under contract on 8/14/2017 and closed on 9/22/2017. The appraisal came in at $141,000, so we were content with our decision.

We refinanced the loan in May 2020. Our original loan had a balance of $105,800 at the time of the refinance. We rolled closing costs into the new loan and cashed out $2,000, making our new loan amount be $111,000. The refinance reduced our interest rate from 4..875% to 3.625%, shaving $104.25 off our monthly payment. I went into detail about the refinance in my Refinancing Investment Properties post.

Following the 1% Rule, we would be looking for $1,340 in rent (net of seller subsidy), but we haven’t received that yet. The first tenant’s rent was $1,150 and the second at $1,250. For the third potential tenants, we listed at $1,300, but the new tenants negotiated to $1,280 for a 2-year lease.

TENANT #1: OUR WORST

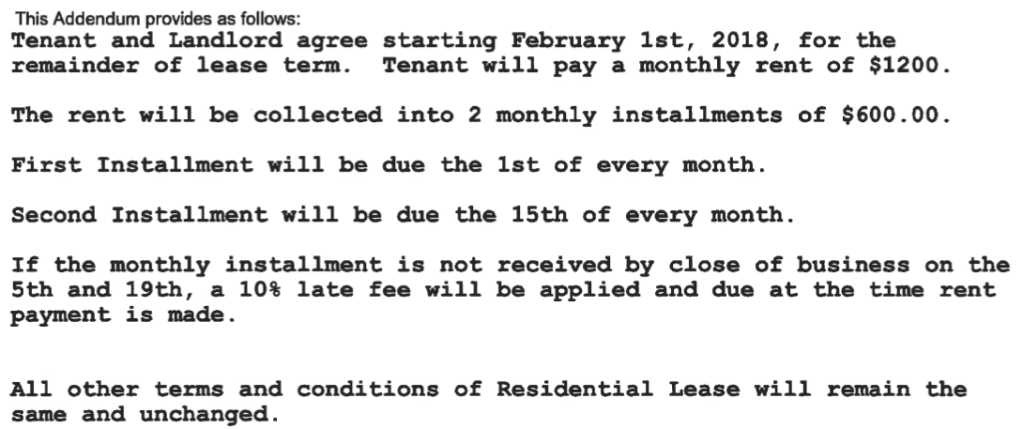

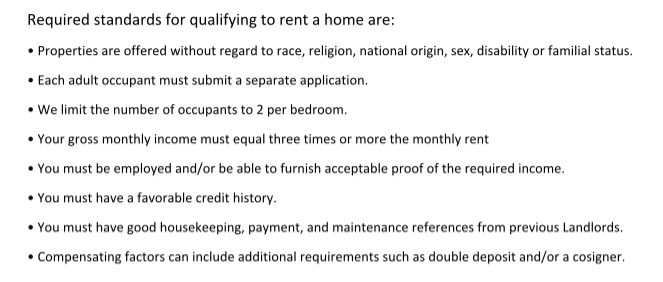

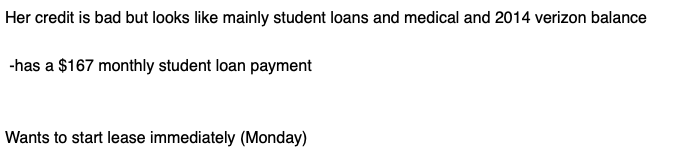

The application. It’s hard to not give someone a chance when their application is borderline, but I suggest letting the information on the screen speak to their character. Before the official application was run (which includes a background check), she admitted to a felony that she served 2.5 years for, and she filed bankruptcy due to a stolen identity while she was incarcerated. It seemed like she paid her dues and was building a new life. We got her application about two weeks after closing, so it wasn’t like we were desperate to rent it at that point. But she was quick to fill out an application and provide necessary documentation, so we decided to give her a chance. She moved in on 10/1/2017 with her 3 children, one of which was born days after she moved in. Her rent was $1,150.

We didn’t have any unreasonable situations with her in the first year. We did have a maintenance call for a leak under the kitchen sink, and we noted that the house wasn’t tidy. It seemed like she was a coupon-er, where she stocked up on a few items and probably resold them, which supported how she kept wanting to pay us in cash. The house wasn’t to my standard, but I didn’t look close enough to notice that it was dirty in addition to cluttered. I wanted to say something, but didn’t know my place at that point. Hindsight: I should have told my property manager and had her issue a written notice. This won’t matter down the road for legal proceedings, but perhaps we could have saved ourselves some headaches if she took the notice to heart; I was just afraid of offending her. But, other than that small concern at the time, we had no issue renewing her lease for another year.

The tenant complained about seeing a mouse around February 2018. We informed her at that time that pest control was up to her because of her living style that was attracting the pests. She claimed to have a quarterly treatment through Terminex. She complained further of mice in November 2018, but I wasn’t part of that conversation. It appeared to be that she was upset that there were still pest issues while she was paying Terminex. Well, that’s an issue to take up with the pest control company, not us. Our property manager gave her the information to our pest control company and shared that it would be a bit cheaper for the quarterly plan too. We heard nothing more until all hell broke loose in April 2019.

She sent pictures of mice poop all over the house on April 9, claiming that she had been out of the house from March 31 through April 8 and came back to this sudden mouse infestation and would be leaving the house. Well, that’s not how it works. She claims that was her ‘prompt’ notification, as if mice set up camp in a lived-in house that’s well maintained out of nowhere (news flash: it wasn’t well maintained and clean). She claimed that because of the living conditions (that she perpetuated), this would be her last month in the house. We knew we had the lease to fall back on, so we continued to remind her that this wasn’t on us and she couldn’t leave us with the financial burden and walk away. We had our pest control company go to the house as soon as possible, and we received their report on April 12.

But wait! While complaining about the condition of the house (that she caused), she wanted to know if she could buy the house!!!! Logic always seems to abound in these situations; it’s hysterical. We offered her to purchase the house from us at $148,000. She ignored it after that offer.

Both the pest company and our HVAC person noted a dog on the premises, which was in violation of the lease. HVAC was called out to fix a wire on the outdoor HVAC unit that the dog had chewed through. She also wasn’t taking care of the yard, and the City of Richmond was fining houses that violated their weed and grass clauses, which we notified her of on May 9.

She didn’t pay April or May rent, so we had a court date set for May 10. We had told her that she had to pay all overdue rent and late fees for us to cancel the May 10 court date. She didn’t pay, so our property manager went to court. The judge awarded us possession of the property, but since there was such outstanding rent and damages, another court date was set for July 1 to award us the money owed. In front of the judge, the tenant handed the keys over to our property manager, saying she was moved out. Immediately after leaving the court house, the property manager arrived at the house to do a walk through, only to find several people inside. She called the police.

The officer assessed the situation. He said that since they’re still moving things out (and there was a lot to move out), that it was a benefit to us that they were still working on it. He suggested asking their input on when they thought they would be done. One guy said at 3 pm. We agreed to let them stay, and I would go by after work to change the locks.

I showed up at 4 pm to change the locks, only to find people still coming in and out of the house. I called the non-emergency police line and waited for the cops to show up. It’s officially trespassing, and we were prepared to press charges. The officers knocked on the door and asked the people inside (none of whom were the tenant on the lease) to leave. One woman started a whole spiel about how she’s on probation and everything that she’s been arrested for, so she didn’t want to be arrested. The officer was funny to watch, and he just kept saying, “I’m not arresting you. I just want you to leave.”

After they drove away, the officers let me walk the property to ensure everyone was out. The place was destroyed!

By Virginia law, we are required as landlords to make every attempt possible to get the unit re-rented and let the old tenant “off the hook” for unpaid rent. Meaning, we can’t hold them to the entire term of the lease and have a vacant house. Regardless of this, we wanted to get everything fixed and replaced in the house so that we had an exact amount to claim during the July 1 court date.

The linoleum replacement was the critical path. She had destroyed it (looked like some chemical ate through it) beyond repair and it had to be replaced before we could re-rent the house. Home Depot’s timeline was really behind, and they weren’t able to get us scheduled for installation until June 20th (after she had “vacated” May 10th).

I compiled a list of lease violations with my documentation to support the claims in which she violated the lease on top of the obvious (e.g., dog on premises, smoking in the house). We had invoices from the pest company, the HVAC company, the trash removal company (over 40 cubic yards of garbage was left in the house when they finally vacated), and the “hazmat” cleaning company, all corroborating an unclean and unkempt living condition.

We went into court with a claim of $9,250. This was unpaid rent for 3 months, late fees, junk removal, pest control, HVAC fixes, professional cleaning that included a ‘hazmat’ charge, and all our paint and flooring charges.

We won the first judgement in court, simply because the defendant didn’t show up. We were awarded $9,250 plus the court fee and 6% interest. Well, somehow the court accepted her plea of needing another court date after not showing up to this one, and that was on July 10th. The judge that day reduced our rent and late payment owed by one month, and reduced our reimbursement total by a bit more than the security deposit we had already kept, bringing the judgement to about $6,600 plus the court fee and 6% interest.

Per the court process, we were required to work with the ex-tenant to develop a payment plan. We offered her a payment plan via email that was never responded to. From there, the next step is to retain an attorney for wage garnishment.

I contacted the attorney we use to help with wage garnishment, but he wasn’t experienced. He referred me to someone, who let me know that he’s already representing someone who has a claim against her. He said that he could still represent me, but I’d be second in line to any money they get from her. He offered me another attorney’s name to see if that one could help me instead, but that attorney said he couldn’t represent me because he already has another client looking for money from this woman. Interesting that two attorneys had different answers, but we went with that first. We haven’t seen a dime. Once the money was spent and we paid off the credit cards, it wasn’t on our radar anymore. Anything we get from this woman will be a bonus at this point.

TENANT #2: BLISSFULLY UNAWARE OF HOW LIFE WORKS

Two kids just out of college were our tenants that came in after that mess. They were great tenants, but a bit unaware of how the world works. They didn’t get the utilities into their name timely, so we charged them for the bills that came to us. After that, they paid their rent on time, and even when their restaurant jobs shut down at the beginning of the pandemic, they prioritized paying rent over other things they could have spent their limited income on; I was impressed. At the end of their lease, they were a bit lost too. Our lease requires 60 days notice of your intentions – either leave, or renew. Our property manager reached out to them at the 60 day mark, and they said they weren’t sure what they wanted to do, but were looking for other places. Since, realistically, we weren’t going to list the house for rent at 45 or 60 days, we told them that was fine. They came back after a week and said they were going to move out.

We moved forward with listing the house for rent and vetting new tenants. We had our property manager show the house on June 10 for what would be a July 1 lease. About a week later, the current tenants asked if they could stay longer because they didn’t get the place they were looking for. Sorry, but that’s not how it works and it’s already rented. The new tenants were OK with moving in July 15, so we allowed the college guys to stay until July 10. Then we hustled to get the house put back together before the new tenants. Specifically, one of the tenants was an artist, and he hung a huge canvas on one of the bedroom walls to paint on. Well, the paint bled through.

They also didn’t tell us that the range wasn’t working. When we asked about it, they said something to the effect of, “oh yea, we smelled gas, so we just cut it off. That was back in March.” Goodness!! So we quickly ordered a new range. We also had to have the carpets professionally cleaned, which was especially frustrating since they were only a year old. Luckily, the ladies who came to clean the carpets worked their magic, and they came out looking good as new. The microwave handle was broken off, and when we looked to buy a replacement, it was essentially the same cost as a new microwave, so we installed a new one.

While we were working in the house, we noticed that the air conditioner wasn’t keeping the house cool. We had an HVAC tech come out to the house, and it was either $1,400 to repair (after we had already previously put money into the HVAC unit), or $5,000 to replace it. We decided to replace it after it died shortly after the third tenants moved in.

TENANT #3: SOME OF THE BEST

These tenants have been wonderful. They’re both pharmacists at the local college and have been very self-sufficient. They’re great about alerting us of issues, but not in a way that it seems like they’re nitpicking. For instance, they wanted to store their lawn mower and other things in the shed out back, but the handle was broken off it. We told them that if they wanted to purchase a replacement, we would reimburse for the cost. Then they noted that the closet dowel was broken and they replaced it. I told them I would pay for that, so just take it off the next month’s rent. When they sent me the receipt, they had only taken the rod itself off the rent, but not the brackets to hang the rod. I immediately sent them the rest of the cost!

They’re one year into a two-year lease, and we’re very happy with them. They always pay their rent on time, they communicate regularly, and they’re taking care of the house.

MAINTENANCE AND REPAIRS

Since I’ve covered a great deal of the repairs we’ve managed in this house through each of the tenant stories, here’s a quick summary of other items.

Shortly after the third tenants moved in, they politely let us know that their dishwasher wasn’t cleaning the dishes. They very clearly identified the problem and the steps they had already taken to attempt to fix it, but it wasn’t working. We purchased a new dishwasher the day after they let us know. So in the matter of a month, we replaced the built in microwave, range, dishwasher, and HVAC. The only appliance we haven’t replaced in this house now is the refrigerator.

There was an electrical issue that we had sort of noticed before, but hadn’t pinpointed it without having things to plug into all the outlets. We had an electrician go out and fix the switches and outlets that weren’t working in master bedroom.

AN OVERALL LOOK AT THIS HOUSE AS AN INVESTMENT

Remember how real estate investing provides multiple avenues for wealth building? Here’s how they’re looking for this property.

Cash Flow – As we have had to replace nearly all appliances, including HVAC, and all the flooring among several other smaller issues, our total cash flow on this property is nearly nothing. But, like mentioned before, we shouldn’t have any big purchases coming and will start to be able to pocket the profits on this house once again.

Mortgage pay-down – The tenants have paid our mortgage for us, but due to closing costs of refinancing and choosing to take $2,000 cash back from that refi, our principal is actually higher than when we bought it.

Tax Advantages – We always depreciate the cost of the structure for paper losses that help offset profit on properties for tax purposes. All those repairs and appliance replacement expenses that eat into the profit margins are written off. So come April 15, the silver linings of those expenses are realized.

Appreciation – This one is good for us. This house is in a developing neighborhood and the area around it is being revitalized. Coupled with standard appreciation and the *hot* real estate market we’re in now, the value of the house is 150% of what it was when we bought, in less than 4 years.

SUMMARY

We’ve put about $10,000 into this house at this point. But that means we have a lot of brand new things in it. Now isn’t the time to give up on the house, since we should be in a position to not deal with many maintenance requests. Rent continues to climb, increasing our cash flow, while we just brought our mortgage payment quite low with the refi, and the property will continue to appreciate in value.

We learned a lot about the eviction process, even dealing with local police officers in the process. The court system and law enforcement are fairly simple to work with, as long as you are a fair and respectful landlord, keep documentation, and follow landlord-tenant laws. When the tenant doesn’t live up to their end of the bargain, justice will be served.