I had a couple of posts teed up to reflect on last year’s finances and activities, but having some conversations with people made me realize that things that I find basic, aren’t for others. I thought I’d share some things that I do that help me be more successful (calm) in my day. I’m not an organization expert. I’m not the “lazy genius” that gets touted (although, I don’t see people executing what they learn there). I’ve found things over the years that have helped me keep my brain straight. This particular post isn’t financial related, but part 2 will be (but next week will be the monthly financial update, so come back in week 3 this month).

Even though I broke this up, it’s still long. Skim the middle, unless it’s pertinent to you, but the summary ties it up at the end.

I have my own home’s finances, thirteen rental properties, three kids with two in school (and they go different days of the week), investments (and Mr. ODA’s constant moving of money!), and whatever other ad hoc bills show up to manage. I don’t have the ability to think in a quiet and distraction-free environment after 7:30 am. I adapted so that I don’t feel stressed because I’m trying to pay bills while the baby is nipping at my heels and the 3 and 5 year olds are asking me for endless snacks.

Please note that I’m a stay at home mom that manages our rental properties part time and works ad hoc as a substitute. I fully acknowledge that all of this isn’t relatable to someone who is out of the house from 7 am until 5 pm, but I will point out that getting systems in place will make your shorter time at home less stressful.

For a real-time, real-life example, I’m frustrated because my writing of this post has bled into Mr. ODA and two kids being awake, and so I’m trying to finish my thoughts here while Kid #1 tells me about his 14 stuffed animals he brought down from his room, Kid #2 is telling me about her puppy and two babies, and Mr. ODA is asking me to meal plan for my dad’s visit. So here’s why I wake up before anyone else. 🙂

START YOUR DAY RIGHT

I wake up around 6:15 everyday. The kids are in preschool, which starts at 9. When my oldest starts school next year, I’ll start setting an alarm to be awake around 5:15 because I think he needs to be out the door at 6:45.

I know people who even say “I’m not a morning person,” who set an alarm and agree that starting your day without distractions from what you want to achieve makes for a better day.

I start my coffee and make something small for breakfast. I’ve learned that if I don’t eat something, then suddenly it’s 9:30, I’m frustrated by being asked for second breakfast by the kids while I haven’t eaten anything for myself (because if I make any move towards food, suddenly the kids NEED food right then also, even if they just ate). I eat something small, and then around 10 I have … I guess … “second breakfast.” I also learned that if I take time to actually sit and eat a bigger breakfast first thing in the morning, then I’m anxious to get to the other things that I want to do, so it doesn’t help me feel successful to the start of the day.

I empty the dishwasher. If you have young kids, maybe you’re lucky that they don’t see something and then immediately need that thing they wouldn’t have otherwise asked for, but I’d venture to say that’s not the majority. If I’m emptying the dishwasher and laying out their cups, waiting for their matching straw or lid to also get unloaded, they suddenly need milk in that specific cup. Therefore, I unload the dishwasher before anyone is awake and there’s no distraction.

I then make each kid their own water bottle. This was a surprising step to a few people recently. Sometimes this means just filling up the same water bottle as the day before, which is probably sitting on the counter from yesterday. Sometimes their water bottle was washed, so it was just unloaded from the dishwasher. I have specific water bottles that are our “everyday use” water bottles. They’re leakproof. They have a handle. This is what gets carted around when we leave the house. Having a full water cup means that I’m not in the middle of doing something and being asked for water. I refill the water at lunch and dinner, but sometimes there’s a request for more in between.

I set their water bottle and their respective vitamin on the table. When the kids wake up, they go to the table, eat their vitamin, and put their breakfast request in. Sometimes, I’m really on top of things, and I make a breakfast before they wake up (e.g., not cereal). If there’s a plate of food in their “spot,” then they typically just sit at the table and eat it. Most mornings, I’m giving a list of a few options and letting them pick.

I prepare their snack and water for school, if it’s a school day. Again, if I start rummaging through the pantry while they’re awake, they suddenly have preferences and questions. It’s better if I just have it done. As a compromise, I offered my oldest the ability to pick out his own snack every Friday. He wakes up before anyone else, so I have him pick it out before #2 wakes up (who wants everything #1 has or is doing).

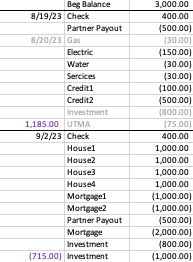

If it’s a day that I want to pay bills and/or update our financial tracking spreadsheet, then I also make time for that before anyone wakes up. I can run through our finances in about 10 minutes without distraction. Sometimes, my son wakes up before I get to it, and then for 30 minutes I’m fielding questions about stuffed animals while also trying to keep track of what I’ve already updated.

I know a lot of people lay out their kids clothes the night before. Perhaps this will become part of my routine when my oldest needs to be out the door at 6:45, but at this point, we have plenty of time in the morning to get dressed and ready.

MIDDAY RESETS

I’ve consistently used a child’s nap time to reset the house. Pick up toys that are out (not everything, but most of what hasn’t been touched for a few hours). Clean up any dishes that have been left out. This started with my first’s nap time, and was really because I couldn’t physically sit and relax while I saw toys scattered around the floor or dishes piled on the counter. It has evolved over the years as we’ve had more kids, but the general gist is the same – give it a quick reset, but not a perfect clean up. It’s going to get messed up again before bed time, but it’ll be less items to manage at that time.

Now that my kids are a little older, I task them with it too. Since tidying our house has always been something they’ve seen, they do it well. While I put the baby down for a nap, it indicates that it’s time for them to straighten up. If they put their “morning toys” away, they get to watch a couple of episodes of a show.

I’m a stickler for pieces of toys to stay with each other, so this helps manage that toys don’t have pieces go missing. It also gives everyone a fresh slate to pick out new toys to play with, and it helps no one feel overwhelmed by the state of the room.

I clean up anything left over from lunch, wipe down the table and high chair, and at least get the dishes to the sink, if not the dishwasher. I used to fight anything being left in the sink, but I’ve let go of that.

I then use the baby’s nap time and the bigger kids’ tv time to make any phone calls needed, catch up on any financial things I didn’t get to in the morning, or clean a room.

END YOUR DAY RIGHT

Reset your house.

The two big kids go to bed around 6:30. After they’re in bed, I pick up most toys and clean up after dinner. When I clean, I focus on one room at a time. I start in the living room because rarely am I going to find something in the kitchen that belongs in the living room, but I’ll have items in the living room that need to go to the kitchen.

From the living room, I put any toys away that belong in that room. If a toy is meant to be in the basement, it gets put at the top of the stairs. If there’s a bedroom-related item that got left behind, it gets put at the bottom of the stairs. In both those cases, when someone walks to that area, they’re supposed to bring that to the next floor; in reality, I’m the only one who really does that. If there’s a cup or a plate, it gets put on the kitchen table (because that’s the closest to the living room). The point here is to work in phases. Don’t exert the energy to carry one toy all the way to the basement, to then see that another toy got left under the kitchen table and needs to go to the basement. This makes the task overwhelming.

Once everything is picked up, I move to the kitchen table area. All plates and cups (including whatever I’ve added from the living room), get moved to the kitchen peninsula. The baby’s high chair gets wiped clean, the table and chairs get wiped cleaned, and the dog’s food and water bowls get filled.

In the kitchen, I clear the counters first. Everything goes where it belongs – refrigerated items go to the fridge, any spices left out are put in the cabinet, leftovers are stored away. The goal is to get all the counters cleared off, leaving the dishes in the sink for last. If the stove needs wiped down, I do that once the counters are cleared because the grates need to be placed on the counter. Then I load the dishwasher from the sink and rinse out the sink. I can either rinse the sink after I’m done clearing it, or I can scrub hardened on food in the morning. Put the effort in to do it right so that it’s not a bigger task later.

The baby goes to sleep around 8, so after his bedtime, there’s usually more toys to pick up and a few more dishes that were used.

Then the dishwasher is turned on before bed. Our dishwasher runs for 2 hours. While sometimes it’s overflowing and needs to be run mid-day, it’s more likely that we run it every other night, after we’ve cleaned up the last of our things that need to be loaded from the day.

If I don’t do these things at the end of the night, then they bleed over into my morning chore list. I usually don’t have any “extra” time for my morning chores, so I prefer to focus on my night time to-do list as often as possible.

WEEKLY TASKS

There are things that need to be done, but they’re not done daily. For one, the bathrooms need to be cleaned. I knew someone who said “Sunday is for bathrooms.” She knew that every Sunday, she’d tackle cleaning the bathrooms. I loved that there was a system. I can’t say I’m consistent in that though. I try to remember to vacuum upstairs once a week, but the first floor probably gets vacuumed every other day. One thing that I did that has helped me clean bathrooms more often is that I keep a glass cleaner, all purpose cleaner, and a roll of paper towels upstairs. This means that I’m not thinking, “I should clean this bathroom,” but having to walk downstairs to get supplies and carry them back upstairs.

I change the kids sheets every two weeks. I try to do laundry in order of how it’ll go back on the bed. If I need to wash their blankets and comforter, then I wash the sheets first (since it all doesn’t fit in one load), this way I can get that step done while the blankets are being washed. If I wash the comforter first, then I have to do the entire thing all at once when the sheets are ready (note: my daughter will take any sheets on her bed, but son only wants his Paw Patrol sheets, which is why this system is complicated).

As for laundry, I don’t have any perfect answers, except that piled of laundry do not overflow our hampers. I used to wash our clothes separate from the kids’ clothes because I’d prefer to fold our bigger clothes than theirs, but now it’s a crapshoot. One thing that I have found helpful is that I sort the clean laundry into piles per person. Then I carry the pile into the respective kids’ room, fold it in there, and put it away right then. While my laundry may sit in the dryer for a day or two, this at least gets it folded and put away a lot faster than it used to be. Sometimes I force myself to fold by putting a load of towels in behind the clothes. This means I need to clear the dryer, but it won’t be as daunting because I’ll have the “reward” of “just” towels behind it. Ha!

SUMMARY

The goal here is simple: eliminate stressors that I have control over. I get things done when I don’t have to also manage 74897 toddler questions and a crying baby. I get my house organized before I go to sleep so that I am not overwhelmed by clutter and tasks first thing in the morning.

I’ve seen multiple articles over the last few years that talk about reducing clutter in your house to make yourself feel better. That when your house is cluttered, it makes your brain feel cluttered and exhibits a physically negative reaction. There are distractions everywhere you look that are taking brain power and exhausting you. If you come up with a system that gets kids’ toys out of plain view, that gets your kitchen counter cleared off and the dishes into the dishwasher when dirty, and eliminates piles of papers that will take you an hour to go through and organize, you’ll physically feel more calm and be able to tackle more.

Additionally, just staying on top of little tasks in a “system” you create that works for you and your household makes each day feel more manageable. I do a quick 10-minute reset of the house at nap time. This means that I’m not left with all toys and dishes and mess to deal with at the end of the day when I’m tired. I clean up room-by-room, creating piles of items that need to go to a different room, rather than putting each individual item exactly where it goes as soon as I touch it.

I’ll also point out that even though I use “I” throughout this, it’s a team effort with Mr. ODA. He cooks, cleans up the kitchen, straightens up, etc.