I was going to include this in a financial update post, but it was too long and complicated to include there. I really want this to be a lesson for anyone reading this – mostly on the renter end, but perhaps for a budding landlord as well. We tried really hard to work with the tenant, but we can’t work with someone who doesn’t communicate up front and doesn’t keep her word constantly. When using statements like “I need to keep the water and electricity on for my kids,” understand that the roof over their head isn’t a given. I’m a private landlord and be lenient, but an apartment complex type situation isn’t going to allow you to not pay for months on end; they’re going to file for eviction on the first day 6.

THE DETAILS

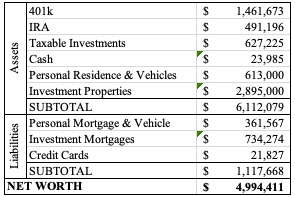

After this house was flooded by a tenant, we got it fixed up and on the market. The options at the time were limited; plenty of people were interested, but they weren’t qualified. The area called for $2,200, but I wanted it to move quickly, so we listed at $1600. The previous tenant was paying $1200, so this felt like a huge jump. No one qualified for the property. We had two options that were close enough to our requirements.

We chose a single mom who worked two jobs herself to be able to afford this place. Honestly, kudos to her for her effort. She lost both those jobs (we knew about one, but not both) and ran into some other troubles. She has worked hard to get herself back on track. I commend all that. She’s wonderful like that. Her communication (or lack thereof) was infuriating.

At the beginning of October, she said she’s back on track now with a steady income (replacing both jobs), but with all the outstanding bills, she’s going to need time to catch up. I’m a very understanding person and work with my tenants as long as they work with me. Instead of telling me WHEN I should expect to see payments, she left it open ended with “sometime in October.” I gave her the benefit of doubt. Then two Fridays passed with $0 paid. I asked for an update through our property manager.

On the 16th, she sent over $300 (after we had to ask for payment), and wrote, “I will be sending another payment this upcoming Friday and typically Fridays going forward.” Typically. She reiterated that October would be paid before the end of the month, and then she’d need about two weeks to pay November’s after that. She did pay $500 that following Friday, and then missed the next Friday.

My property manager had to follow up with her 3 times before she actually received an answer. The tenant claimed she had been too busy to respond. Excuse me, but keeping a roof over your head should be a priority in your life (this will be a theme). I asked for a payment plan instead of this open-ended concept of payment. On November 1st, she finally responded that she was going to pay $400-700 every Friday, going forward, unless she needed to pay other bills. Again. “I’ll pay you when I pay you, unless I don’t pay you.” This isn’t appropriate.

She paid $700, as goods and services, on November 3rd. All fees are the tenant’s responsibility, so now she owed another $15. She ended up sending $50 over that same day. At this point, it’s November 3rd, and she’s still $60+ short on October’s rent and $0 towards November. As expected, Friday November 10th came and went with no communication and no payment. She ended up sending an email in the early morning hours of the 11th stating she’s waiting on a deposit to clear, so she’ll pay something on Monday. She did pay that Monday. However, she had said she’d pay every Friday, and the 17th came and went with no payment. Again.

On the morning of the November 18th, I sent the notice of default. It said she had 5 days to pay the entire balance or we’d file for eviction. She threw a little tantrum, claiming she wanted to end her lease. It doesn’t work like that. My property manager had a good idea and was able to articulate our frustration sternly, yet professionally. The property manager said that “forgetting” and “life” getting in the way were not acceptable responses, and it was time to be responsible for herself and her bills, perhaps by setting alarms or utilizing her calendar for reminders. The offer included our waiving of December and January late fees ($160 each) if the tenant continued to pay every Friday without us having to follow up. I thought the incentive was great. The tenant then paid $700 on the 24th and $600 on 12/1. At that point, she was caught up on October and November (sans late fees though), while paying into December’s rent owed.

She paid the first two Fridays in December, missed the 22nd, and paid on the 29th. At the end of December, she had a balance owed of just over $500, which included all late fees, so that was a decent position. Then things went downhill again. She paid nothing until January 17th, and it was only $100 that day. She claimed an issue with the amount she was able to send over, but stopped trying. When we asked why she mentioned $400 in $50 increments, but only sent over $100, she acted like we did something wrong. Over the next week, she ended up sending $300. At the end of January, she owed $1,863.40.

TENANT VACATES THE PROPERTY

In mid-January, seeing that communication was getting worse, and payments weren’t even being made, we asked her to leave. I was really trying to get through February so that we’d have a more favorable market time to list it. She said she didn’t want to leave. That’s a bold statement from someone who owes a lot. On January 25th, we sent her the 5 day notice until eviction document, which showed her balance due. We offered her the ability to leave the house by the end of the month with minimal damages, and we’d just keep her security deposit. Her initial response was that she wants to finish interviews she has scheduled, and she didn’t want to leave.

Within 24 hours, she decided she did want to leave. For the first time in all of this, she fully explained her situation. She gave good reason to have until February 4th to leave (instead of the end of January). We allowed it, but she’d be responsible for those days of rent in February.

As a final goodbye, she told us she would be able “to make another payment that first week of February.” As I suspected, she meant the week of February 5th, and not the 1st or 2nd. She didn’t pay. On February 9th, she “kindly” asked for an extension for the final payment, since she was expecting her tax refund in the next two weeks.

I don’t need to tell you at this point – two weeks came and went. She did end up paying over $500 on 2/29 though. That was more than I ever expected. I don’t know how she arrived at her number (she did email an explanation, but the numbers didn’t add up), but I’m accepting it.

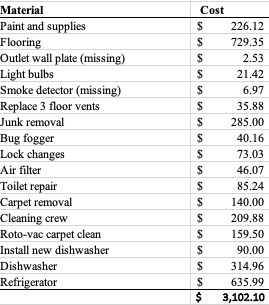

TURNOVER

She actually left the house in great condition. She had sticking LED light strips in a bedroom that said they were easily removed. However, when she removed them, paint came with it. I had to have someone touch that up. She bought blinds, but didn’t hang them, for ones that were damaged (she had asked us to pay for them when she first moved in, so that was a nice gesture to uphold the integrity of the request), so I had to have someone do that. Then I paid someone to clean the house, which is normal. Overall, she was difficult to communicate with, but I do believe she meant well.

BACKGROUND & EXPECTATIONS

I have a track record of being very lenient and very understanding. I promise. I can provide lots of examples where I’ve let people know to take their time, prioritize back to school necessities, waive the late fee, etc. I can not work with you if you don’t talk to me. I don’t know what you need. I don’t know you as a person and whether you’re “good for it.” I need to know your expectations, needs, and plan. Talk to me without me hunting you down for information. I don’t know where I’ve said this before in this blog, but I’m positive you can find that or a very similar statement made throughout. Understand that in nearly all other scenarios, a landlord is not going to be patient for 4 full months to try to get you to pay rent owed.

She said phrases to me that were generally that she has kids so keeping the water and electricity current is her priority (isn’t keeping a roof over their heads equally important?), or that she asked for grace and patience (what have I been doing? I could have issued you the first step of the eviction process on October 6th, and I didn’t, even though you didn’t pay a penny towards rent until the 16th). It’s things like that get under my skin and make my efforts feel unappreciated, making not want to work with you going forward. Take the time to acknowledge how gracious I HAVE been, that I have bills to pay in addition to you having bills to pay, that I deserve to be given regular updates and information without having to follow up and beg for information.

My property manager says “she’s young” and “she’s learning.” There have been learning opportunities, but it’s also not my role to mentor a tenant on how to be an upstanding citizen and uphold your commitments. There were two other late rent moments this summer where my property manager said that if there’s any issues with rental payment, we need to know ASAP, without us having to make phone calls or send emails. My property manager reiterated this expectation on October 31st over the phone – don’t miss a Friday rent payment, assume we know you’re not paying anything, and leave it at that (I already played the “benefit of doubt” game through October when we received $0 for half the month).

LESSON

Communicate with the landlord. Don’t put the landlord in a position where they’re having to keep track of your financials and whether you’re paying timely. Pay regularly or communicate up front. All of my leases state that rent is due without demand. My having to regularly ask for an update or why you haven’t paid a single penny halfway through a month is not in any realm an acceptable way of doing business.

Renters need to understand that landlords have bills to pay. Those bills (that mortgage) are not as lenient as I’m trying to be with you. If I don’t pay my mortgage, there’s a late fee and it’s immediately reported on my credit. They also don’t accept partial payments. If I don’t pay for long enough, it becomes a foreclosure. As a tenant, you don’t know if I have funds to cover that payment. Assume I don’t. If I don’t pay my mortgage, the house is foreclosed, and you’re kicked out anyway. You’re getting by without any credit hits, as you’re now two to four months behind on rent. I’m floating mortgage payments on your behalf. Lucky for you, I’m on top of my credit and paying these bills even if you’re not paying me, but that isn’t an assumption you should make.

Your actions have consequences. You can mitigate those consequences by upholding your word and keeping in regular communication on what’s happening (again, up front, not after the deadline passes).