Every once in a while, I like to share what I’ve been doing to manage the properties. There was a lot of activity needed over the last two months.

RENT INCOME

One of our usual suspects for late rent payments was late again. We seem to only have a one-month streak for on-time payments with them. She at least communicates with us that they’ll be late and gives a projection on when we’ll see it. She ended up paying rent on the 14th, and said she needed to pay the late fee on the 21st.

Two other houses haven’t paid rent, but they’ve applied for rental assistance.

RENT RELIEF PROGRAM

House2 applied for rent assistance in September, and we still haven’t received that from the State. I did finally get a tracking number on the 19th that it’s on its way. She paid $400 worth of January’s rent on a Friday and said she’d have the rest on Monday. Well, as she has a history of not communicating and not upholding her word, I wasn’t taking a chance with her. I served her the default notice on Saturday to indicate that she didn’t pay rent in full and had 14 days to remedy that. She remedied that by applying for rental assistance again. She said that she only applied for January assistance, so hopefully we’ll have February rent on time. I wish I could dig into her finances and find out how she didn’t have to pay any rent for September, October, or November, only had to pay $600 towards December because she had a credit from a payment plan previously in place, and then can’t pay January rent in full.

House3 had to apply for rent assistance. They’re great tenants and have been with us since we purchased the house. In November, she applied for December, January, and February assistance. The application expires 45 days after it’s sent, as a means to protect the landlord from floating the expenses on the property indefinitely. This tenant ended up paying December’s rent, but hasn’t paid anything towards January. Luckily, we did receive approval for their application on January 11. Hopefully we’ll receive that money in less than 3 months time like the last time this program was involved. What she paid in December will be counted as March’s rent (2021 income for tax purposes, but she won’t pay March rent because she has that credit now).

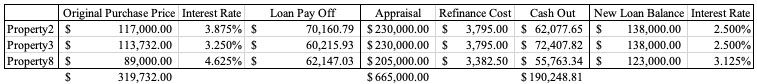

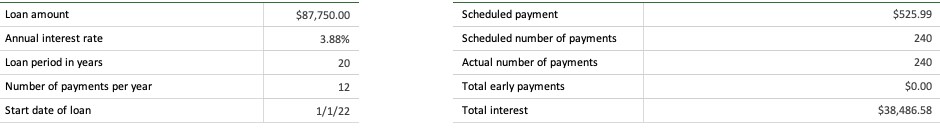

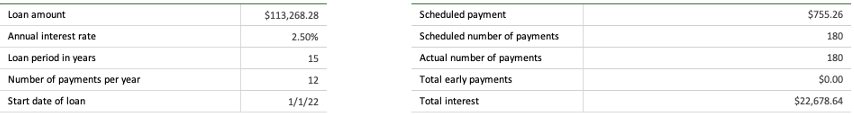

REFINANCES & MORTGAGES

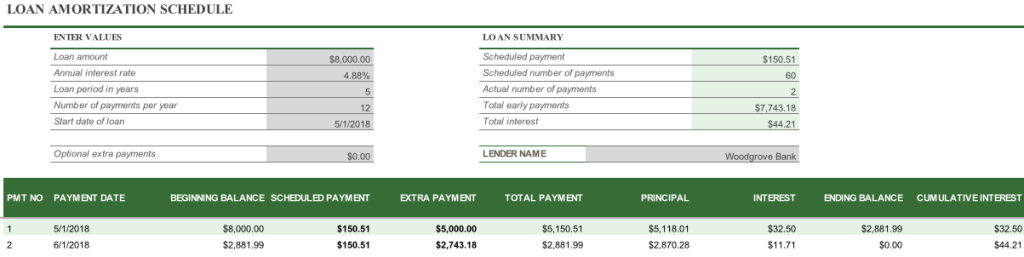

We had to provide several post-closing documents on the refinances. It was horrendous. They asked for new types of documentation. Clearly, whoever is purchasing our loans didn’t like the lack of due diligence done pre-closing. Except for the new request, everything else they requested could have been ascertained by looking at the documentation already on hand, so we didn’t appreciate that. Then the new request was to explain how we paid off a mortgage, which was paid off 4 months prior to us establishing a relationship with this company to refinance the other loans. I had to provide proof that it was paid off, and then I had to provide the funds used to pay it off. The balance was $3,100. Paying a $3k bill hardly touches our finances. I want to become an underwriter so I can understand how they need so much detail and are sticklers for the type of detail, but they don’t need to know how to read the details they request.

We had an escrow analysis done on House7. It said that our mortgage was going to increase by $183 each month, but the increase should have been just about $60. I’ll explain details in another post, but that took some time. Mr. ODA called and walked the representative through the error. He said it took a while for her to get there, and we’re awaiting an update.

Since our refinances occurred at the end of the year, and all our city tax payments are due in January, I was nervous about the right amounts getting paid. The initial closing disclosures had the old tax payment amounts on it, but every one had increased. I was able to catch it and request that they be updated before our closing, but it was a day or two before closing. I was afraid it wouldn’t catch correctly. I had to stay on top of the payments and make sure they were all paid in full, and I had to pay the property taxes for those that aren’t escrowed. I was most worried about the three properties that were being refinanced, but then the issue ended up being one of our other houses. The escrow check was sent on 12/21, and it still hadn’t processed as of the tax due date of 1/14. I sent an email to the finance office hopefully showing that I had done my due diligence timely. Luckily, when I checked on 1/20, the taxes were processed by then.

LEASE MANAGEMENT

We require action from the tenant no later than 60 days from the end of their lease. There are 3 properties that have an April 30 lease term expiration. One tenant already reached out and asked to renew their lease. They’ve already been there for two years, and their rent has remained steady at $1300. We have precedent of increasing long-term tenant rent every 2 years by $50 (but we also have precedent of not actively managing houses and not increasing the rent at all.. oops). I explained to this tenant how there have been several increases in our expenses over the last two years. They’re really great tenants, and they hardly ever ask for anything from us. I felt guilty, but we’re trying to run a business, so we need to take care of that side too. Plus, if we didn’t increase slightly this coming year, it’ll be hard to manage future increases. It’s a lot harder to keep a good tenant if you don’t raise their rent and then hit them with $100-$200 increase down the road, so it’s best to keep with inflation. I did the cash-on-cash analysis for this property and discovered that the $50 increase falls slightly short of our expenses and keeping our rate of return the same.

I have to work with two other houses (via a property manager on those) to determine their new rent amount. One house negotiated a lower rent for a longer lease term at their lease initiation, which was October 1, 2019. This property in particular has had the highest jump in taxes. We grieved them to no avail. They’re claiming our neighborhood is part of a more affluent neighborhood and refuse to see how their district lines aren’t accurate for the type of house and street it’s on. I plan to push for an increase of $75 on that one, since their original lease amount is based on a discounted rate. One the other house, the tenants wield a lot of power to our property manager. We tried to increase rent last year, and the tenant flipped out on us about it. We’re already below what we thought market value was on the house, so 2.5 years without an increase is insult to injury. I’m going to request an increase from $875 to $950 on the house and see what the property manager says. If she agrees to a $50 increase, that’d be acceptable, but it’d be nice to recoup some of the other expenses too.

EXPENSES

We have a tenant in one of our houses that is amazing. He treats the house as if he’s the owner. He’s quick to take care of problems, and only seems to let us know when it gets to be a certain level of problem. This house has always had a mice problem. One tenant, who we evicted, created a really big problem that involved several mice making this house their home. She refused to do her part in cleaning up food messes, be it old food sitting on the counter or in the sink, grease splattered all over, or just general mess left behind. We got it under control, but the occasional mouse still rears its head. He sent us an email saying he’s been having an issue, and he’s tried really hard to address each individual mouse appearance. He said it has gotten to the point where he wants to do something more drastic, but wanted our permission. I said that it was absolutely at the point where it’s our issue to deal with, not his, but we thank him for his efforts. I called our pest control company, and we’ll see if that helps. One or two mice is one thing, but for him to say he’s caught 9 in a year, that’s a bit much. The pest control was $165.

One of our KY houses has a bunch of little and weird expenses pop up. This month’s explanation on my report from the property manager simply said “Repaired door by adjusting door to fit opening and resetting stuck plates.” I don’t know what door or how the plates got stuck, but I threw in the towel on that $60.

We were also informed that a toilet at another property stopped flushing. When asked for more detail, we were told that she presses the handle and nothing happens. My response? “Please don’t tell me I’m going to have to spend $125 for someone to reconnect a chain.” Our property manager’s husband said he’ll go look at it, for $80. That’s a downside to not living near the property and being able to check on the issue yourself. We got a text later saying that he talked the tenant through the issue, and it turned out that the flapper was just stuck. So luckily it’s nothing at the moment, but it could be an expense down the road.

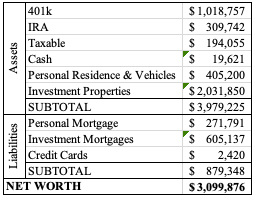

SUMMARY

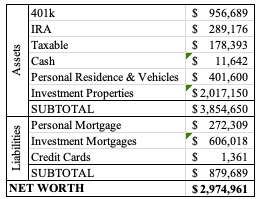

So that was a lot for one month. Luckily, our expenses themselves were low (225), even though we’re missing some rental income ($1,900 and $145 worth of a late fee) and we had to do more management than usual. By having 12 properties, late rent payments or non-existent payments don’t create a strain on our finances. For example, if we only had House2, who paid $1550 worth of 5 months of rent because of the rent relief assistance program, then we’d be floating those mortgages each month. By having more houses, those other rents are covering the expenses on the one house.

In 4 weeks time, a ‘full time job’ would be 160 hours of work. I estimate that all the action that I took this month (and the phone call Mr. ODA had to make to our bank on the escrow issue) comes out to about 6 hours. There’s the perspective. Even when it seems like a lot, because it’s more than nothing, it’s still hardly anything.