We closed on a new type of loan last week. It wasn’t a completely smooth process, but it was easier than a residential loan.

WHY COMMERCIAL?

Residential loans on second+ properties were over 4.5% on their interest rates last month. The commercial loan gave us options that were lower than that. It comes with a catch though. While the loan is amortized over 25 years (there was a 20 year option too), there’s a balloon payment after 5 years. There were also 3, 7, and 10 year options. Being that this was our most expensive investment property purchase, 3 years was too much of a risk to take on that balloon payment. The interest rates for 7 and 10 years didn’t make it worth going the commercial loan route. While the interest rate is fixed (unlike in an ARM or adjustable rate mortgage), this balloon is a risk.

By going through a credit union, our costs were also minimal. Our closing costs were just over $1,000, rather than the typical $2k-3k that we’ve seen on closings that cost less than half what this house cost us.

The only other “catch,” if you want to call it that, is that there is no escrow. I already handle the taxes and insurance payments on my own for a handful of our houses, so that’s not a big deal. I also appreciate having control over my money instead of having to check in on escrow regularly and making sure all the escrow analyses are actually done correctly (because one recently wasn’t!)

PROCESS

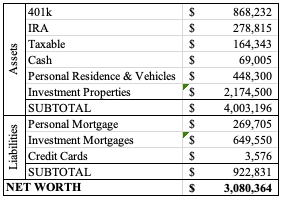

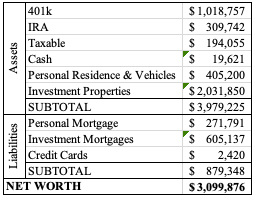

We filled out an application, which they called the “personal financial statement” and included our detailed financial status. It had me list all our account types and balances. I assume that’s what they used to compare against our credit report, because we actually didn’t send any account statements to them (glorious!). We had to provide the last 3 years of tax returns (ugh… we haven’t done 2021 yet so we had to give 2018).

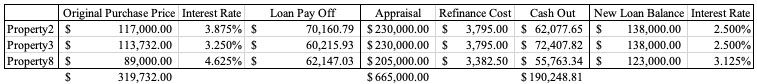

I developed a rent roll and gave that as well. It listed all real estate owned, purchase price and date, current market value, monthly rent, mortgage balance, monthly mortgage payment, and whether or not it’s occupied. I added the HOA payments on the houses where it’s applicable because that always seems to be a last minute request for documentation.

Once the application was completed and reviewed, that was it. We were asked a few follow up questions about the numbers on our forms, but we weren’t asked for anything further. Essentially, “underwriting” happened as part of the application process, versus in the middle of the application and closing dates, spanning days and maybe weeks of documentation gathering and answering of questions.

Instead of a “rate lock,” the rate given is the rate that was present at the application submission, pending any exceptions (e.g., if credit isn’t what we said it was or we have outstanding loans not disclosed). As an auditor, it was hard for me to accept that we weren’t going to be hit with a surprise somewhere along the way because we never signed anything agreeing to loan terms!

We saw no documentation until the Monday before our Thursday closing. There was no initial disclosure, and no “rate lock.” We had no idea how much the closing costs actually were going to be. The responses to our questions were slow or nonexistent. We didn’t see our appraisal until the Friday before closing. Not knowing the process or knowing when we’d find out how much this was costing us was more than we’re used to handling emotionally.

We received the HUD settlement statement on the Monday before closing. Luckily, everything was correct. Our sellers had already moved out of the area, so we had to have the statement sent to them, signed, and sent back to the Title attorney. They did that perfectly, and we had an easy closing on Thursday. We signed all the paperwork in about 20 minutes!

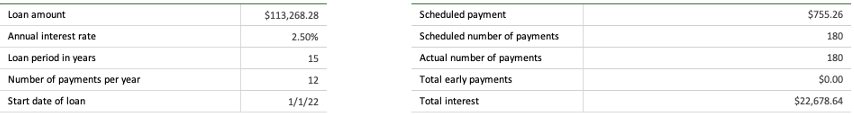

FIVE YEAR LOAN

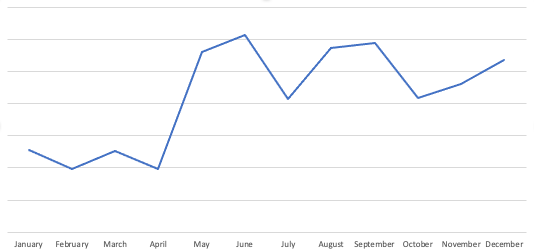

Mr. ODA ran some numbers to show me why we should go for the 5 year loan instead of the other terms.

We didn’t consider the 3 year option because we didn’t want to manage that balloon payment or refinancing so quickly.

As a reminder: the closing costs for the commercial options are the same regardless of the term, and were about $2k less than the traditional loan; all the commercial loans are amortized over 25 years, but have a balloon payment at the end of the term given; all are based on 20% down (because there was no incentive for 25% down).

The final decision to go with the 5 year loan was that we haven’t shied away from risk in the past, so take the incentives that come with the shorter term (i.e., lower monthly payment and less interest paid). Our portfolio has made drastic changes over the last 5 years. Therefore, we don’t see a reason to pay more interest, reduce less principal, and have a higher monthly payment (thereby lowering our monthly cash flow) just because a balloon of $167k is concerning.

BALLOON PAYMENT

The loan is $193,600. After 60 payments (5 years), the principal balance (with no additional payments made) will be $167,500.

Let’s face it, if we had $160k+ liquid, we wouldn’t be paying the first 5 years of interest on the account. We can make additional principal payments over the next 5 years to dwindle the balance before the balloon payment is due, and/or we can look into refinancing the balance at the end of the 5 years.

We had another private loan that had a balloon payment at 5 years. That loan was originated at about $70k and we paid it off in about 3 years. We had several issues with that lender, so we had the incentive to throw money at the loan and be rid of it, versus attempting to refinance it at the end of the 5 year term.

It’ll be interesting to see what we do on this going forward. The balloon payment would typically be an incentive to make additional principal payments. However, we have six other loans with an interest rate higher than this loan’s, and one loan with the same interest rate. We’ve been focusing on either the one with the lowest principal balance or the one with the highest interest rate. This new loan doesn’t fit either of those categories!

SUMMARY

Mr. ODA asked me if I would do this again, and I would. It was frustrating to ask someone in customer service a pointed question and not get an answer, but overall this was easy. There was minimal documentation needed, the requests didn’t drag on, and the closing costs and interest rates available were favorable. The balloon payment is something that needs to stay on your radar over the next 5 years (and mostly in that final year), but refinancing is always an option. It doesn’t mean that you have to be ready to fork over $167k on that date, but you do need to plan for closing times and ensure you keep your credit worthiness in good shape (although isn’t that always the goal?!).